Do Financial Experts Make Better Investment Decisions?

- Bodnaruk and Simonov

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category!

Abstract:

We provide direct evidence on the effect of financial expertise on investment outcomes by analyzing private portfolios of mutual fund managers. We find no evidence that financial experts make better investment decisions than peers: they do not outperform, do not diversify their risks better, and do not exhibit lower behavioral biases. Managers do much better in stocks for which they have an information advantage over other investors, i.e., stocks that are also held by their mutual funds. More experienced managers seem to be aware of the limitations to their investment skills as they increase their holdings of mutual fund-related stocks following poor performance of their portfolios. Our results suggest that there are limits to the value added by financial expertise.

Alpha Highlight:

Financial experts beat individual investors (with the same demographic profile) for the following reasons: investment expertise, financial sophistication, and experience.

Wrong.

This paper finds that “Financial experts are no better than their peers:”

They do not outperform!

They do not diversify better!

They do not exhibit lower behavioral biases!

The authors’ claims are based on investment decisions of two groups in Sweden:

- “Financial experts” group: paper chooses “mutual fund managers” as a group of “financial experts.”

- “Matched Individuals” group: the authors identify a control group of individual investors (peers) who are similar to mutual fund managers in terms of socio-economic characteristics, but do not possess known financial expertise.

The two groups are matched by wealth, labor and capital income, age, sex, family status, and educational achievement.

Key Findings:

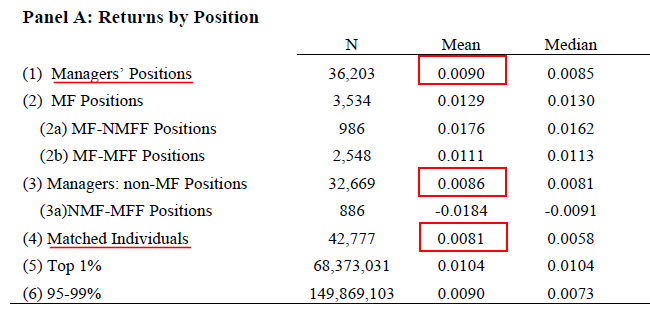

The table below shows monthly returns of different groups by position. The difference in average monthly returns for managers and matched peers [(1)-(4)] is only 9 bp — statistically insignificant from zero.

To disentangle the effect of financial expertise from that of information advantage of mutual fund managers, the paper further split portfolios of managers into two sub-groups: MF-related positions–positions that are owned by they fund they manage–and non-MF positions.

Notice that the difference between managers and peers are even smaller when their positions are non-MF related [(3)-(4)], only 5 bp.

Are you Smarter than Your Financial Expert? Maybe…

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.