Is Investor Attention for Sale? The Role of Advertising in Financial Markets

- Madsen and Niessner

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category.

Abstract (from SSRN):

Using detailed data on daily firm advertising activity, we find that print advertisements increase attention to firm’s financial information. Advertisements for products and services are unlikely to target investors, yet are associated with a 3% increase in Google searches for the firm’s ticker. This increase is concentrated on weekends and is larger for ads placed in business publications. We further find that firms temporarily increase daily advertising by 5% in the three weeks around earnings announcements if the earnings surprise is positive, but temporarily decrease daily advertising by 5% if the earnings surprise is negative. These results are consistent with managers undertaking strategic actions to exploit the fact that advertising can attract investors’ attention. Finally, we find that the increased attention has short-lived stock market implications. In contrast to prior research, we do not find evidence that advertisements increase stock prices. Rather, for companies that recently experienced a decline in stock price, the increased attention due to advertisements causes a further temporary decrease in price.

Alpha Highlight:

Investors attention is limited, and advertisements are meant to catch our attention.

This paper shows that advertising traditionally targeted towards consumers, also attracts investors’ attention. Interestingly enough, a company’s customers are also more likely to invest in that company’s stock. (KKL 2012)

This paper examines three main questions:

- Do product market advertisements attract investors’ attention to financial markets?

- Do managers manipulate advertising activity around earnings announcement dates?

- Does product market advertising influences stock returns?

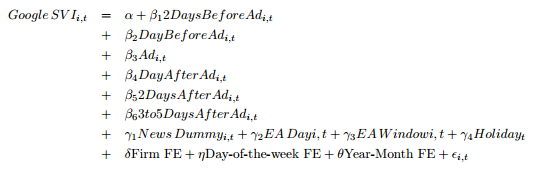

To address these question, the authors develop an empirical approach to identify the relationship between two key factors: “advertising” and “investor attention”.

- Measure of advertising: novel data set of daily firm print advertisements.

- Data source: Media Radar, which scans over 4,000 daily and weekly print publications and also includes detailed information of each advertisement. Sample include 569,957 ads in 39 daily and 419 weekly publications.

- Measure of investor attention: log daily Google Search Volume Index (SVI) for company tickers.

- Data source: Google Trends, which provides a daily SVI for search volumes. The index measures the popularity of the term relative to other search terms during the same time period. Sample include 535,392 firm-day observations for 489 firms.

- Previous posts about Google Trend: (1) News and Google Hits: A Path to 20% Alpha? (2) Googling for Profits?

- Data source: Google Trends, which provides a daily SVI for search volumes. The index measures the popularity of the term relative to other search terms during the same time period. Sample include 535,392 firm-day observations for 489 firms.

Key Findings:

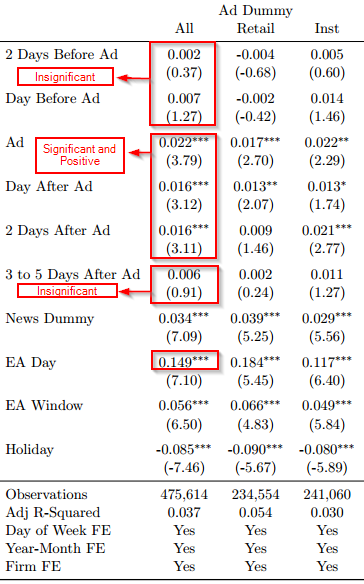

Finding 1: Advertisements attribute to a 3% increase in Google searches for a firm’s ticker (as a proxy of investors’ attention to company’s financial information), and this increase in search volume persists for two days. As a comparison, earnings announcements generate a 15% increase.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Finding 2: Managers take advantage of the fact that advertising attracts investors’ attention around earnings announcement dates.

- A temporary 5% increase in daily advertising activity around positive-news announcements and a temporary 5% decrease around poor financial announcements.

Finding 3: Increased advertising on earnings announcement dates is associated with larger announcement returns relative to firms with similar earnings.

I’ll admit it, Jean-Claude Van Damme’s bada$$ split commercial enticed me to see if Volvo had a stock ticker.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.