The CFA Institute Magazine recently published an interview (a copy is here) with C. Thomas Howard, CEO of Athena Investment Services. Howard has some pretty explicit views on why investors should allocate all of their assets to U.S. stocks:

The primary driver of long-horizon wealth is expected returns. Why would you invest in anything but stocks? Why isn’t your portfolio 100% stocks? Do you believe stocks are going to have the highest return? By the way, stocks have averaged 10% a year for a long period of time. Bonds have averaged about 6%. The difference between a portfolio that’s 100% stocks and one that is a mixture of stocks and one that is a mixture of stocks and bonds over long periods of time is huge, possibly millions of dollars. Why would I want to buy anything but the highest expected return, asset-wise?

U.S. stocks have offered the best returns for a long time, and therefore the U.S. stock market is where you want to be invested. This is an interesting argument. Certainly, Howard is right that that the U.S. stock market has been the best place to be invested.

For instance, Mehra and Prescott in their 1985 paper, “The Equity Premium Puzzle” (a copy can be found here), demonstrated how the risk premium on U.S. Equities from 1889-1978 averaged roughly 6%. The paper was notable in that it suggested that existing general equilibrium models were unable to explain the size of this premium, which was dramatically higher than for other economies. Academics struggled to explain the persistently strong U.S. stock market. This is the “puzzle” to which the paper’s title refers.

In 1998, Reitz proposed that investors in U.S. markets might be more risk averse due to the potential occurrence of large drawdowns, or “crashes.” In a risky market that could crash dramatically, risk averse investors might expect high equity returns as compensation for bearing the risk of such crashes.

Perhaps this explained high returns in the U.S.?

As academics pondered the effect of possible crashes on risk premia, they increasingly questioned that it was risk aversion to crashes that was driving returns. Some thought these unexplainable returns might something to do with whether a market simply survived, which by definition meant that it consistently recovered from periodic drawdowns over long time frames. Was their some bias introduced to a market’s returns that was associated with the mere fact of its survival?

In their paper, “Global Stock Markets in the Twentieth Century” (a copy can be found here), the authors Jorion and Goetzmann explored this question. They examined 39 global stock markets from 1921 through 1996 and, as before, saw evidence of the outperformance of the U.S. stock market, which provided a real return of 4.32% over the period, the highest of all countries.

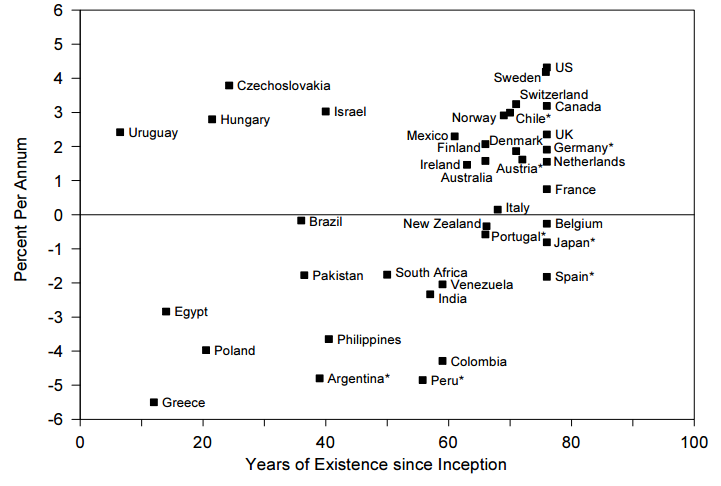

During this period, however, several of these 39 markets experienced interruptions to their functioning, caused by forces such as war, political instability, hyperinflation, and so forth. The authors compared what happened when they considered both “loser” markets, and how long they were viable, in addition to the survivors, like the U.S. and others, who were “winners” over long periods. The figure below plots annual returns against the length of the history of each market:

There appears to be a clear relationship between returns and longevity of markets, with longer lived markets generating higher returns. Over the period, the median return for all 39 countries was 0.75%, representing the return earned by holding a globally diversified portfolio since 1921. Notably, there were 11 “winner” countries which had continuous returns going back to 1921. For this group, the median return was dramatically higher, at 2.35%. Also note that the U.S. appears at the upper right of the figure. These results suggest that returns for the U.S. 1) are uncommon at 4.3% versus 0.8% for all other countries, and 2) could be explained by survival, as could higher returns for the other survivors. If you happened to invest in a country that survived, you would have earn higher returns.

The paper also examined Reitz’s hypothesis. Recall that Reitz had suggested that investors demanded a higher return as compensation for the risk of a crash. If this were true, then you would expect to see the “losers” exhibit higher equity premia. As the figure above illustrates, the opposite appears to be the case. A regression of these points would slope upward to the right.

The returns of the winners may thus be conditional on their survival. If you think about investing in a particular country as like drawing a ball from an urn, then how meaningful is it to say that we can expect future returns to resemble past returns in that country, if those past returns are a result of survivor bias?

Survivor bias refers to how we can focus on survivors in a data set, and ignore failures, which provide additional information about risk. Hindsight may be 20/20, but predicting the future is not, and if we condition on only the surviving winners, we ignore the possibility that we may be investing in a previous winner that may turn into a loser in the future.

In a PBS interview (a copy is here) Jack Bogle stated the following:

Good markets turn to bad markets, bad markets turn to good markets. So the system is almost rigged against human psychology that says if something has done well in the past, it will do well in the future. That is not true. And it’s categorically false. And the high likelihood is when you get to somebody at his peak, he’s about to go down to the valley. The last shall be first and the first shall be last.

Indeed, why should it be easy to predict which markets will survive? As Bogle points out, it may be precisely the past winners who are about to fail. Or as Jeremy Siegel stated in his paper, “The Equity Premium: Stock and Bond Returns since 1802”:

Certainly investors in…1872…did not universally expect the United States to become the greatest economic power in the next century. This was not the case in many other countries. What if one had owned stock in Japanese or German firms before World War II? Or consider Argentina, which, at the turn of the century, was one of the great economic powers.

It’s probably likely that Argentinian investors predicted continued economic dominance at the turn of the century. They were wrong. The outcome of World War II, which today looks obvious, could have played out in many different ways, and the U.S. might very well have turned into a loser. The Japanese certainly thought they would emerge as the dominant power after the war, or they wouldn’t have fought the war. Same for Germany. If the outcome of WW II had been different, we might today be studying the stock markets of Japan, Germany or other European countries, instead of the U.S.

Who is to say the U.S. will not enter a hyperinflationary period or a sustained major war? Such an outcome for the U.S. is obviously not without precedent elsewhere. When we look at past U.S. returns, we are looking at a market that did not fail, but does it follow that it cannot fail in the future?

Conditioning on past survival can subject investors to risks which they are not accounting for. Even with strong past returns, we need to consider survivor bias, and that we are necessarily betting on a winner.

Interestingly enough, Warren Buffett and Jack Bogle offer investors puzzling investment advice in the face of the results presented by Jorion and Goetzmann and a simple knowledge of survivor bias.

First, Warren’s advice:

Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.)

Next, Jack Bogle’s advice:

I wouldn’t invest outside the U.S. If someone wants to invest 20 percent or less of their portfolio outside the U.S., that’s fine. I wouldn’t do it, but if you want to, that’s fine.

We have to question whether the advice from Buffett/Bogle considers the reality of survivor bias or their own personal bias.

About the Author: David Foulke

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.