We investigate various methods to express a 10-Year Treasury Bond allocation.

The primary issue with Treasury Bonds is their lack of tax-efficiency. T-bond income (and CPI adjustments in the case of TIPS) are taxed as ordinary income–ouch! A 2.5% yield is pretty bad, but a 1.25% after-tax yield looks downright pitiful.

How can we deal with this tax problem? The easiest option is to invest in bonds via a qualified account, but this isn’t always possible. We need to think through tax-efficient methods to own T-Bonds.

We investigate 2 methods of Treasury ownership:

Futures on Treasury Bonds

- Futures are 1256 contracts, which are taxed at 60% long-term capital gain rates and 40% short-term capital gain rates. Futures embed elements of the capital gain and income into their return, so there might be a relative tax benefit of holding futures relative to the underlying. The downside of futures contracts is they are marked to market on December 31 each year (i.e., no deferral capability) and the cash collateral invested in T-Bills would still get taxed at ordinary rates.

Treasury Bond ETFs (e.g., IEF)

- T-Bond ETFs are interesting because the ETF sponsor can minimize/eliminate capital gain distributions and generate deferral benefits. The downside is income has to be distributed each year and it is taxed at ordinary rates. The other downside is a management fee.

Note: We avoid an investigation of structured products (e.g., ETNs), which, while uber tax-efficient, have counterparty risks. These counterparty risks are typically low; however, T-bonds are unique in that their expected payoff occurs when financial markets are in distress (i.e., when counterparty risk shoots up!). We understand the argument that you could always buy CDS on your ETN counterparty, but CDS has the same issue as a T-Bond–the insurance pays off when markets are in the most distress and your CDS counterparty is unable to pay (think AIG in 2008). Regardless, structured products can provide an interesting way to gain tax-efficient exposure to an asset class, but structured T-Bond exposures are unique, so we exclude them from our analysis.

We also avoid a discussion of direct ownership in treasury bonds, which is a fine option, but beyond the scope of this discussion.

The Performance Horserace

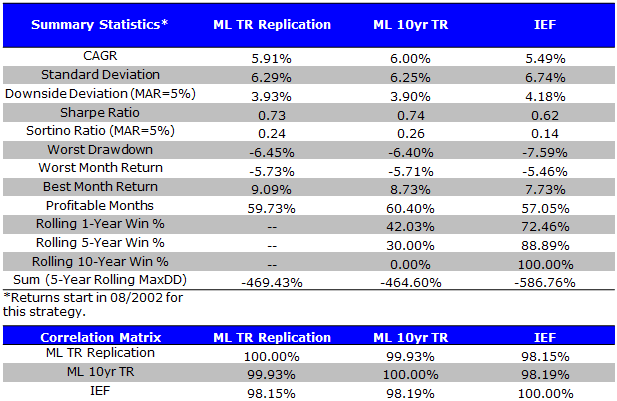

The Merrill Lynch 10-year U.S Treasury Futures Total Return Index measures the performance of a fully collateralized rolling 10-year U.S. Treasury Futures position. We choose this index to measure the performance of bond futures contracts. We also include our replication of the ML index that trades the 10-Year Treasury Futures (rolls 15 days prior to First Notice) and an investment of the cash collateral in T-Bills. We do this replication to as a data robustness check on the ML Index.

The simulated period is from 8/1/2002 to 12/31/2014. Results are gross, no fees are included. All returns are excess returns, excluding the return on T-bills. Data sources include Bloomberg.

Legend:

- ML TR Replication: Our internal replication of the ML 10yr TR Index

- ML 10yr TR: The Merrill Lynch 10-year U.S. Treasury Futures Total Return Index

- IEF: iShares 7-10 Year Treasury Bond ETF

Summary Statistics

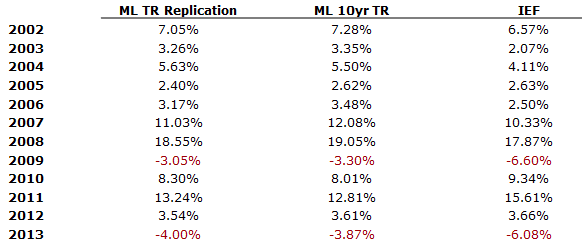

ML TR Replication generates very similar results as ML 10yr TR Index–good news for data integrity. We also identify that the 10yr Futures strategy generates similar returns to IEF. IEF is slightly lower due to embedded management fees, transaction costs, and slightly lower duration…but for all intents and purposes, they are all about the same.

Annual Returns

Taxation Discussion

The futures strategy is going to pay a blended 60/40 LT/ST rate on the annual gains each year. Assuming a 23.8% LT rate and a 43.40% ST rate we get a blended rate of 31.64%/year.

On the ETF, you have deferred capital gain liability and distributed income, taxed at 43.40% (plus state, city, etc.).

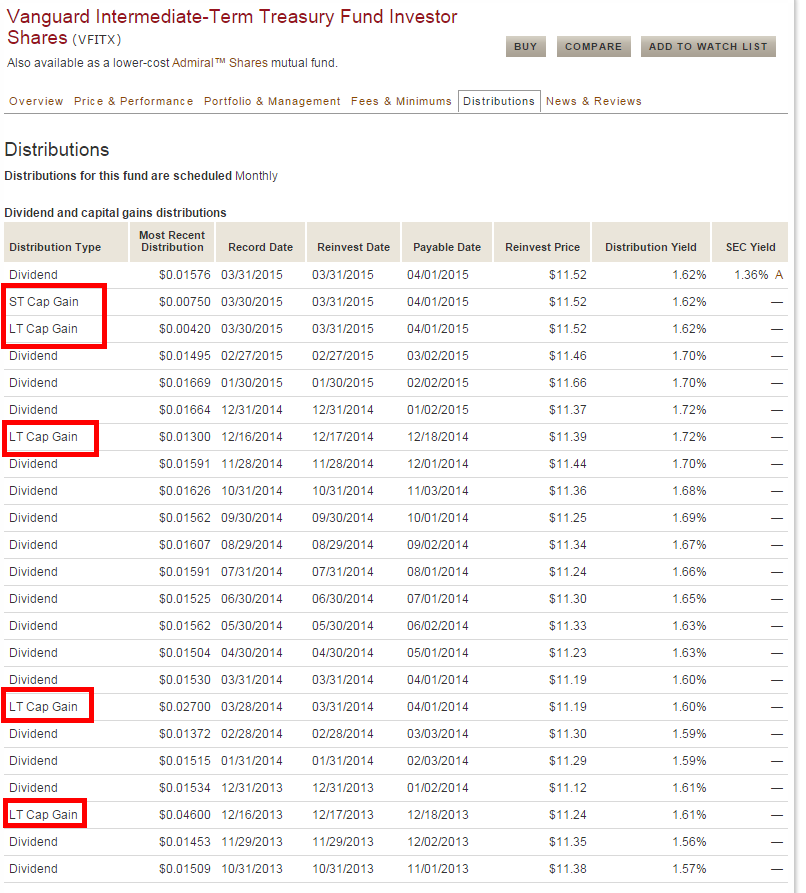

As a point of differentiation, notice that a low-cost mutual fund equivalent of the same basic strategy pays capital gain distributions–killing after-tax returns in the process. For example, consider the Vanguard Intermediate-Term Treasury Fund Index Shares:

Who wins on an after-tax basis–Futures or ETFs?

Probably the ETF because of the large capital gain in bonds over the past 10 years. But if income yields were much higher, futures might have been the more tax-efficient option? Who knows…

The real question is who will win the after-tax return race in the future?

This determination probably depends on your expectation for the breakdown of the total return generated by 10-Year Bonds. Consistent duration ~10-Year Bonds will generate both a capital gain component and an income component. If one believes that the income component will be a large part of the total return, then owning T-Bonds via futures may make more sense. However, if one believes that capital gains (movement in underlying bond prices) will play a larger role in the 10-Year return, ETF vehicles make more sense (they can defer capital gains, whereas 1256 contracts are marked to market each year). A lot to digest, I know, but this is why you hire a financial advisor. The only thing we know for sure is that owning T-Bonds via a mutual fund doesn’t make any sense at all (at least in a taxable account)!

Of course, the “easy” option is to simply own high-income producing assets in qualified accounts and keep tax-efficient exposures in taxable accounts. But sometimes tax-efficient financial planning does not operate in a vacuum and the situation may dictate a need to keep tax-inefficient assets in a taxable account.

As always, good luck!

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.