Hi Readers/Fans:

We are happy to announce that our second book, DIY Financial Advisor, is finally available.

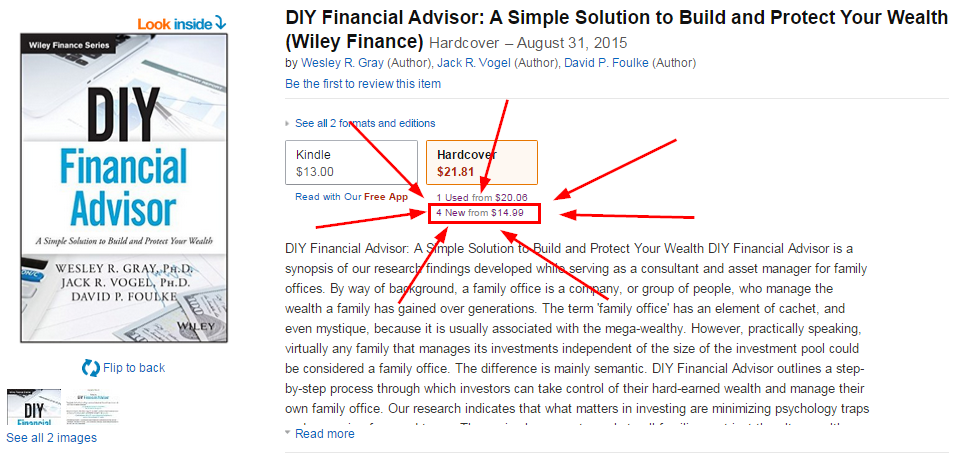

For a limited time (and while supplies last) we are selling the book direct for $14.99!

To get this deal you need to buy from the link below the main Amazon link.

The first part of the book is dedicated to making better investment decisions and the second half is dedicated to a practical application of the principles we outline in the first part.

For DIY types, we have a tool available on our tools site:

If DIY is too much to handle, we’re also launching a robo-advisor based on the philosophy outlined in the book:

Editorial Reviews

From the Inside Flap

DIY Financial Advisor gives individual investors the information and tools they need to take control of their hard-earned money and manage their own wealth—no matter how much or how little they have. The key advantage any individual investor has over so-called “institutional” investors is the ability to make long-term investment decisions that maximize after-tax, after-fee, and risk-adjusted performance, without fear of a misalignment of incentives. Those who own the money are the best stewards of the money.In this essential resource, Wesley R. Gray, Jack R. Vogel, and David P. Foulke show what it takes to stop relying on so-called experts and become a savvy investor. The authors outline an investment strategy that reduces fees, banishes psychological fears and traps, and shows how to minimize taxes by limiting trading activity, engaging in smart planning, and by following some simple rules.

DIY Financial Advisor empowers investors to maintain direct control of their portfolios and shows how to implement simple quantitative models that can beat the experts. In easy-to-understand terms, they explain the vital importance of sticking to the FACTS (fees, access, complexity, taxes, and search). This proven framework outlines straightforward concepts that apply to everyone, from the middle-class to the mega-rich.

DIY Financial Advisor is as timely as it is informative. The investment industry is undergoing a significant shift due in part to the use of automated investment strategies that do not require a financial advisor’s involvement. Let DIY Financial Advisor be your hands-on guide for making your money work for you—not for someone else!

From the Back Cover

Praise for DIY Financial Advisor

“Surprisingly simple advice: Avoid these common mistakes, make these small improvements, and voilà! Better investing performance!”

—Barry Ritholtz, Chief Investment Officer, Ritholtz Wealth Management

“Sophisticated yet sensible advice is typically afforded to only the wealthiest individuals and institutions. Now it is accessible to all in DIY Financial Advisor. A must read.”

—Eric Balchunas, Senior ETF Analyst, Bloomberg Intelligence and author of The Institutional ETF Toolbox

“DIY Financial Advisor is a great read for investors who want to take their retirement into their own hands. Wes Gray & co. bring a ton of enthusiasm to the topic while arming their readers to the teeth with useful information.”

—Joshua M. Brown, author of the bestselling book Backstage Wall Street, founder of The Reformed Broker blog, and star of CNBC’s The Halftime Report

“Wall Street’s so-called experts are overconfident, biased, and out to sell you a story. That is why DIY Financial Advisor is such a valuable resource.”

—Tadas Viskanta, Founder and Editor of Abnormal Returns, author of Abnormal Returns: Winning Strategies from the Frontlines of the Investment Blogosphere

“Investors are told their success relies on complex strategies and expert forecasts about the future. Using an evidence-based approach, Gray, Vogel, and Foulke prove why this isn’t the case. A great read!”

—Ben Carlson, author of A Wealth of Common Sense: Why Simplicity Trumps Complexity in Any Investment Plan

Again, for a limited time we are selling the book direct for $14.99!

To get this deal you need to buy from the link below the main Amazon link.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.