Are we in a bubble?

It depends on what asset class you’re referring to, whom you ask, and what you mean by “bubble.” We’ve posted before on how some great finance minds define bubbles, and why they disagree. It’s a subtle but fascinating topic with a lot of relevance today, in a world where headlines are dominated by negative interest rates, and quantitative easing.

The field of economics has wrestled with theoretical aspects of bubbles for many years. Much of the debate involves two camps, who disagree over how prices are set.

Efficient Markets

In one camp is Eugene Fama, who in the 1960s developed the Efficient Market Hypothesis (EMH), which states that investors are rational, and prices reflect fundamental values. Under EMH, there are two elements of rationality: 1) when investors receive new information, they update their beliefs correctly, and 2) armed with those beliefs, investors make sensible choices. Thus, prices are always right, and reflect all available information. Under a strict interpretation of EMH, bubbles should not exist.

Behavioral Finance

In the other camp are the behavioralists, represented by, among others, Robert Shiller, who wrote a book in 2000 called “Irrational Exuberance,” in which he correctly anticipated the dotcom crash. Under a Behavioralist interpretation, it is assumed that investors are sometimes not rational in the EMH sense outlined above. That is, perhaps investors sometimes: 1) do not update their beliefs correctly, and/or 2) do not make sensible choices. Behavioralists argue that investors sometimes do not update their beliefs correctly, since they suffer from systematic biases. Behavioralists also argue that humans do indeed make nonsensical, objectively wrong choices—they do so in psychology experiments all the time—even though traditional finance suggests this should not occur. In a behavioralist context, bubbles are a naturally occurring phenomenon, given how irrational we all can be. An overview of common behavioral bias is here.

So in academia, the battle rages on between these two paradigms.

Meanwhile, the real world is complex, and doesn’t provide easy answers that would resolve this debate. It may be that prices are affected by 1) fundamental value, 2) investor behavior, or 3) some combination of 1 and 2. It’s very hard to disentangle these factors.

What we need is an experiment that would disentangle these for us in some way.

Laboratory Asset Markets

In “Overreactions, Momentum, Liquidity, and Price Bubbles in Laboratory and Field Asset Markets,” by Caginalp, Porter and Smith, the authors try to isolate the effects on price of investor behavior, by eliminating the uncertainty relating to fundamental value. They examine a number of laboratory experiments, in which fundamental value is fixed, and then they see what happens to prices relative to fundamental value as it changes in known ways.

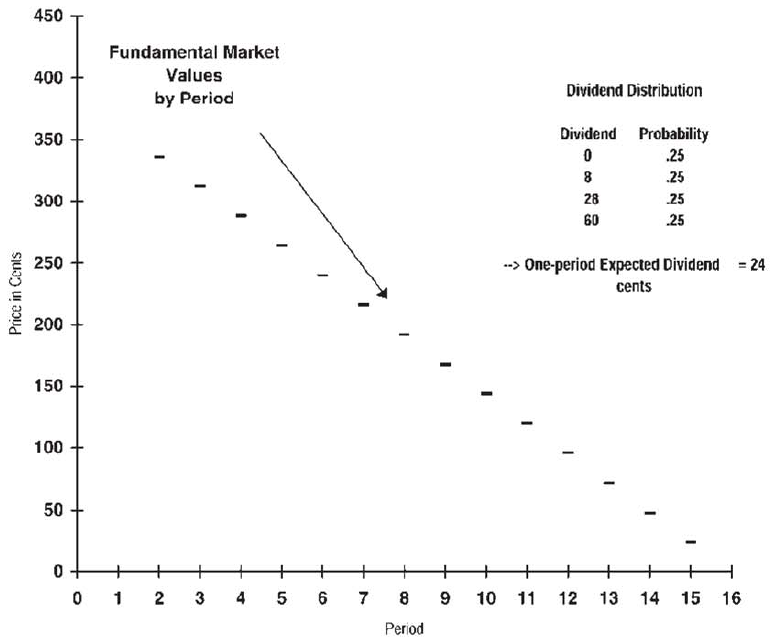

The experiments usually have a similar setup. Participants are given cash or stock they can trade over a 2 hour session, divided into 15 periods. At the beginning of the experiment, subjects are told that shares will pay a dividend each period, but the exact amount is unknown. There will be a one in four probability of the following: 60 cents, 28 cents, 8 cents, or zero. The expected dividend per period is: (60+28+8+0)/4 = 24 cents. Since there are 15 separate dividends, the starting fundamental value is: 15×24 cents = $3.60. Each period, fundamental value drops by 24 cents, and a share is worthless at the end.

A chart from the paper illustrates the parameters of the experiment:

In this setting, fundamental value is fixed, and known ahead of time for each period. Given perfectly rational traders, prices should track this linear decline in fundamental value.

What Does the Evidence Say?

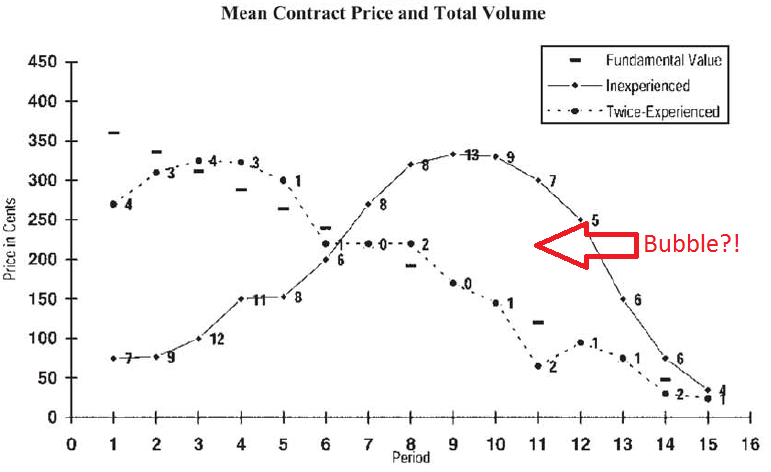

The experiment is run with two separate groups: experienced traders and inexperienced traders. Below is the outcome:

Note how prices as traded by the experienced traders track fundamental value pretty well. But what about the inexperienced traders?

Inexperienced Traders: Bubble-and-Crash Behavior

Inexperienced traders transacted at prices that started below fundamental value, and then at fundamental value, and then in excess of fundamental value, before crashing and returning to fundamental value. This is a classic bubble.

In this case, seems reasonable to believe that inexperienced traders can create bubbles, but that experience can mitigate this effect. It also seems reasonable to conclude that it is some aspect of behavior that drives the creation of the bubble, since fundamental value is fixed.

The authors go on to review a number of additional experiments that explore how such price bubbles form in different settings.

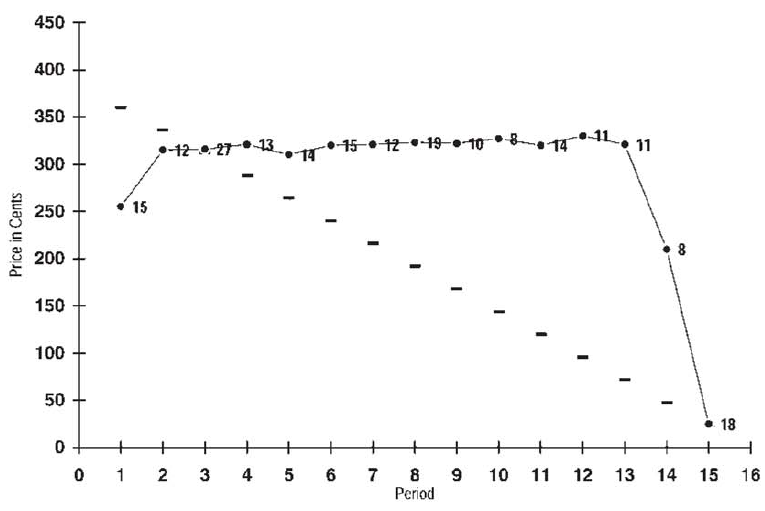

For instance, they hypothesize that in the above example, it is perhaps the uncertainty around the dividend rate that drives formation of a bubble. To address this question, another similarly arranged experiment pays a fixed dividend at each period.

Below is the mean contract price (and volume) given this certain dividend, as traded by inexperienced traders:

Once again, we can observe a clear bubble, which crashes in periods 13 and 14.

The authors also explore low liquidity, which tend to dampen bubbles, margin buying and limit price rules, which tend to exacerbate bubbles, and a number of others. Also, bubbles seem to be reduced when traders have more experience.

This perhaps begs a question. Every year experienced traders leave the market, and new, inexperienced traders enter the market. Moreover, it has been 8 years since the financial crisis. Does this suggest that the participation in the market of these inexperienced traders, who have little or no experience with bubbles, may some day have some effect on the market?

The authors explore a lot more questions and we encourage readers to sit down with a cup of tea and read this paper in full. Truly fascinating.

Regardless of the answer to that question, the research seems to suggest that the behavioralist view of the world is worth considering. This work offers tantalizing clues that the behavioralists may be onto something. The authors also highlight an experimental fact: momentum is a natural component of markets. Initially investors underreact to fundamental information and eventually they overreact.

If you’re interested in learning more about how bubbles are formed, you should check out the paper!

About the Author: David Foulke

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.