In the aftermath of the financial crisis, the term “bubble” has come into wide use in the financial press.

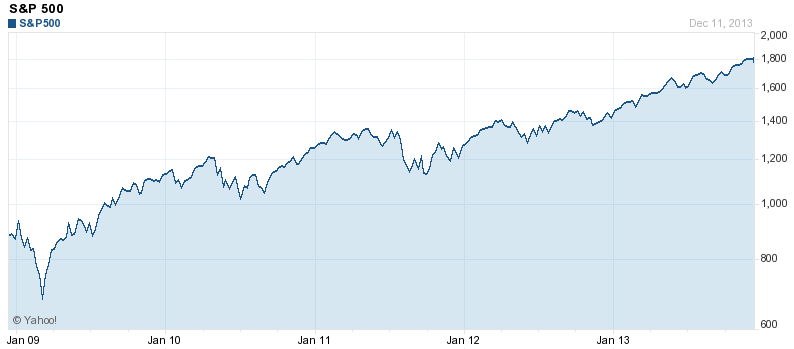

The stock market bubble:

Although everyone seems to use the term, bitter fights have erupted across academia about what a “bubble” actually is.

We took an informal web survey of conversations on the topic, and found three great financial thinkers who came up with strikingly different definitions:

- Robert Shiller: a bubble is excessive optimism

- Cliff Asness: in a bubble, no future outcome can justify prices

- Eugene Fama: a bubble must be predictable

Below are quotes that support the definitions.

Robert Shiller, American Economist and Nobel laureate:

The way it [the financial crisis] began is home prices started falling rapidly. Many people had committed themselves to mortgages and now the debt was worth more than the house was worth, they can’t come up with the money to pay off the mortgage and so it kind of led to a world financial crisis. So why did that happen? Conventional economics theory can’t seem to get at the answer, which I would say is, we had a speculative bubble driven by excessive optimism, driven by public inattention to risks of such an eventuality.

Cliff Asness, quantitative finance practitioner:

…To have content, the term bubble should indicate a price that no reasonable future outcome can justify. I believe that tech stocks in early 2000 fit this description. I don’t think there were assumptions – short of them owning the GDP of the Earth – that justified their valuations. However, in the wake of 1999-2000 and 2007-2008 and with the prevalence of the use of the word “bubble” to describe these two instances, we have dumbed the word down and now use it too much. An asset or a security is often declared to be in a bubble when it is more accurate to describe it as “expensive” or possessing a “lower than normal expected return.” The descriptions “lower than normal expected return” and “bubble” are not the same thing.

Eugene Fama, American Economist and Nobel laureate:

I don’t even know what a bubble means. These words have become popular. I don’t think they have any meaning…It’s easy to say prices went down, it must have been a bubble, after the fact. I think most bubbles are twenty-twenty hindsight. Now after the fact you always find people who said before the fact that prices are too high. People are always saying that prices are too high. When they turn out to be right, we anoint them. When they turn out to be wrong, we ignore them. They are typically right and wrong about half the time…They [bubbles] have to be predictable phenomena.

What do we think? After hacking it out in the office for a few hours, we all decided that Cliff Asness deserves the award for best description of a bubble. Shiller’s answer is correct, but too vague; Fama’s answer is more a critique. However, Asness’ answer is specific, includes an example, and is easier to empirically validate.

What is a bubble?

About the Author: David Foulke

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.