Investors love to chase after the “next big thing,” as investment strategies and styles come in and go out of vogue. The latest object of investor infatuation may be a revitalized interest in merger arbitrage. Consider this bloomberg headline: “Hedge Fund Investors Have Fallen in Love with Merger Arb (Again).”

It would appear that merger arbitrage is a hot strategy once again. But while it may be hot, it is definitely not new: investors have been deploying the strategy for many years and academics researchers have studied it for decades.

Merger (Risk) Arbitrage – What is it?

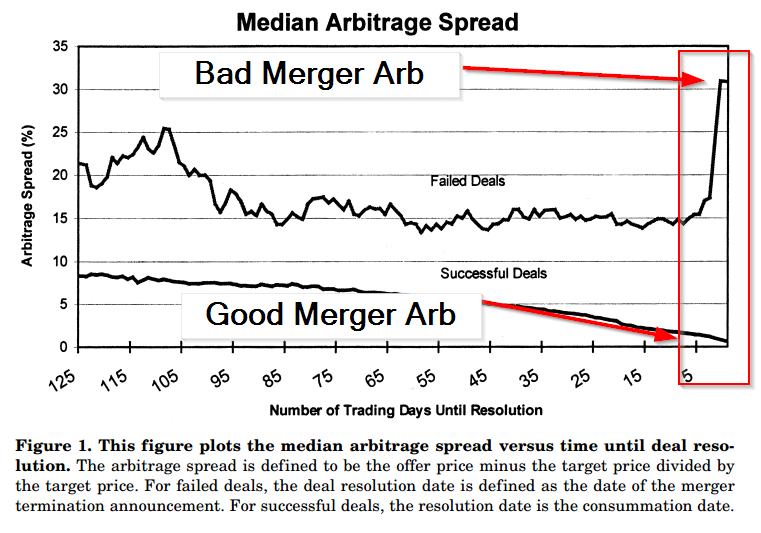

Merger arbitrage is an event-driven investment strategy that seeks to take advantage of mispricings in announced acquisitions. When an acquirer makes a bid for a target company, the acquirer offers a premium versus the target’s price. However, at the time of the announcement, the target usually continues to trade at some discount to the announced purchase price, representing the “arbitrage spread.” This discount represents the risk that the deal will not close. The chart below (from the Mitchell Pulvino paper discussed below) highlights that discontinuous nature of merger arbitrage. Deals either slowly grind to a successful close, or they blow up in your face.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Academics have generally found that merger arbitrage has generated returns in excess of market returns. That is, it appears there is some inefficiency in how targets of announced acquisitions are valued in the market. Additionally, it would seem that merger arbitrage is a great alternative exposure, in the sense that a portfolio of merger arbitrage situations will harvest positive premiums that are generally uncorrelated with a generic stock portfolio.

Merger arbitrage — A Free Lunch?

Free lunches are wonderful and the only rational thing to do when you see one is to eat (Cliff Asness quote). So should we all start eating merger arbitrage exposure? Unclear. There are a few things to consider:

- First, investors must consider the effect of transaction and frictional costs that can impact an arbitrager’s ability to achieve the promised returns from merger arbitrage.

- Second, investors must consider whether returns associated with merger arbitrage really serve as a diversifier.

How can we think about these important considerations?

Academics to the Rescue

In “Characteristics of Risk and Return in Risk Arbitrage,” by Mitchell and Pulvino, the authors attempt to measure the transaction costs and the deal risks associated with merger arbitrage.

The authors examine a sample of 4,750 mergers and acquisitions (either all cash or all stock) that occurred between 1963 and 1998, and create two merger arbitrage portfolios:

- A merger arbitrage benchmark index, consisting of calendar-time value-weighted average of returns to individual mergers, and ignoring transaction costs (“VWRA returns”)

- The same merger arbitrage index (referred to as risk arbitrage index in the paper) as above in 1, but incorporating the effects of commissions and market impact costs associated with trading less liquid securities (“RAIM returns”).

The Effect of Transaction Costs

First, let’s see how transaction costs affect theoretical merger arbitrage returns.

The merger arbitrage benchmark strategy, VWRA, looks great, generating significant alpha of 74 basis points per month, or 9.25% annually.

However, when we examine RAIM, which considers the effect of transaction costs, the alpha falls to 29 basis points per month, or 3.54% annually, and with a market beta of only 0.12. This low market beta seems to suggest that merger arbitrage might serve well as a diversification tool.

Okay, so transaction costs cut into our alpha, but even so , a merger arbitrage investor still gets some alpha–and with low correlation with the market! Let’s dive in and invest…but wait, there’s more to the story…

Is Merger Arbitrage basically akin to selling put-options on the stock market?

Academic studies covering merger arbitrage have generally assumed that returns to merger arbitrage are linearly related to stock market returns, consistent with linear asset pricing models, such as CAPM. Put another way, the general state of the market doesn’t affect the relationship between merger arb returns and market returns.

But what if merger arbitrage returns are related to market returns in a nonlinear way? If this is true, then linear asset pricing models, such as CAPM, will fail to capture the risk associated with merger arbitrage and traditional “alpha” estimates are bogus.

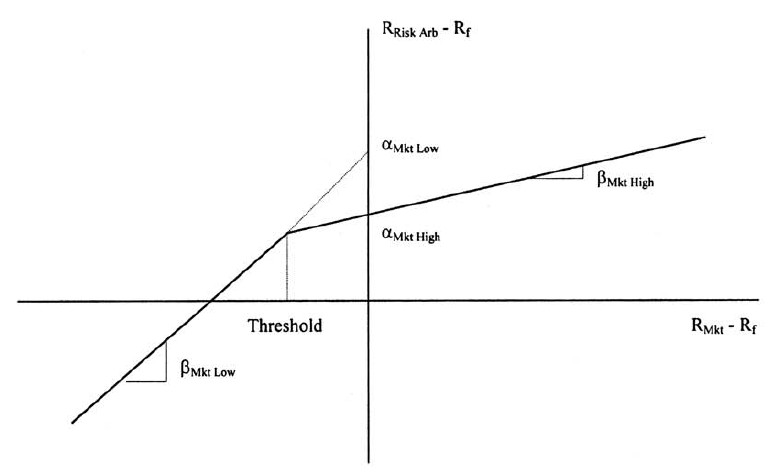

The authors find that merger arb market exposure is dynamic. In “normal” markets, excess returns to a merger arbitrage portfolio are 50 bps per month, with a market beta of 0. However, in down markets, the market beta for a merger arbitrage portfolio increases to 0.50!

In other words, merger arb portfolios grind a small premium in normal equity markets, but blow up in extremely negative equity markets. The reason for this dynamic exposure related to the fact that merger arbitrage is dependent on deals being completed, but when the equity markets are getting crushed, deals get pulled and announced acquisitions are more likely to fail.

Let’s summarize: In normal markets the payoff to merger arbitrage is a small positive premium, but in down markets, the payoff is extremely negative. This payoff structure is similar to writing uncovered index put options.

The graph below, taken from the original paper, shows how the slope coefficient of the risk arbitrage portfolio changes when market returns are below a threshold.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

The authors go on to examine the returns of professional merger arbitragers, and find that their returns tend to resemble the option payoff diagram above.

Marcus Brunnermeier has a great slide deck that summarizes the tricky nature of merger arbitrage:

A more in-depth treatment of the subject of hedge fund strategies (like merger arbitrage) and their equivalence to put-selling strategies is here.

Where does that leave us?

Merger arbitrage is really just a put-selling exposure wrapped in a cloak and dagger mystique. This reality doesn’t mean merger arbitrage is a good investment or a bad investment, it just means that now an investor can understand what they are actually buying when they purchase merger arbitrage related investments. Merger arbitrage return premiums don’t represent alpha and they don’t represent diversification–they represents a risk premium associated with a large tail risk component that is systematically tied to extreme market blowups.

Notes:

The title was inspired by the AQR papers on value and momentum investing.

Mitchell and Pulvino launched a diversified merger arb fund (now it has more stuff in it) that essentially delivers the exposure outlined in their paper.

About the Author: David Foulke

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.