For many people, navigating the road to long-term family wealth creation can be a challenging process. This is because families, especially young ones, may be thinking more about minivans and mortgages than about asset allocation and retirement planning.

Into this yawning breach comes a new book by Douglas P. McCormick, “Family Inc.: Using Business Principles to Maximize Your Family’s Wealth,” which attempts to provide a framework for thinking about long-term financial prosperity.

Family Inc.’s message is that we should view family wealth creation from an integrated portfolio perspective, balancing employment, investment, consumption and long-run objectives in much the same way as we might think about owning a business.

- Douglas P. McCormick

- The book can be found here.

- Want to see all our book reviews?

Rather than a simple question of managing an investment portfolio, effective family wealth creation requires a holistic view of family finances, and how basic financial principles can be applied to them. Doug McCormick’s background as a sophisticated private equity investor becomes rapidly apparent, and he shares superb financial insights throughout the book.

What I like about the book

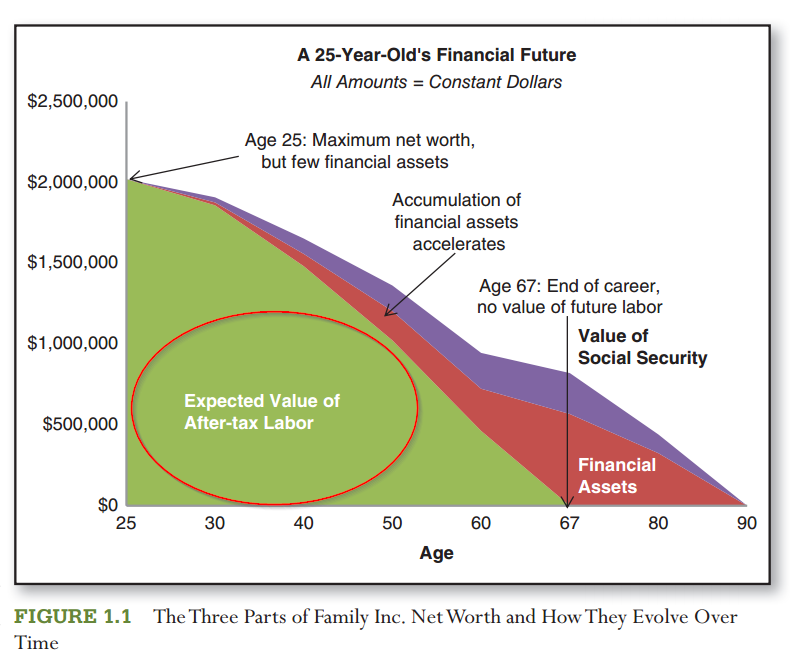

This is much more than a typical asset allocation book. Most asset allocation frameworks involve a pie chart showing allocations across a few familiar asset classes: Equities, commodities, real estate, bonds, etc. Family Inc. argues this approach ignores important components of future wealth, most notably the value of one’s lifetime income, and how a strategic view of one’s labor should considered in combination with other assets. McCormick counsels us to evaluate one’s labor as part of one’s overall family “business.” The image below, taken from the book, shows that the largest asset held by most people is their human capital, or earnings from their labor.

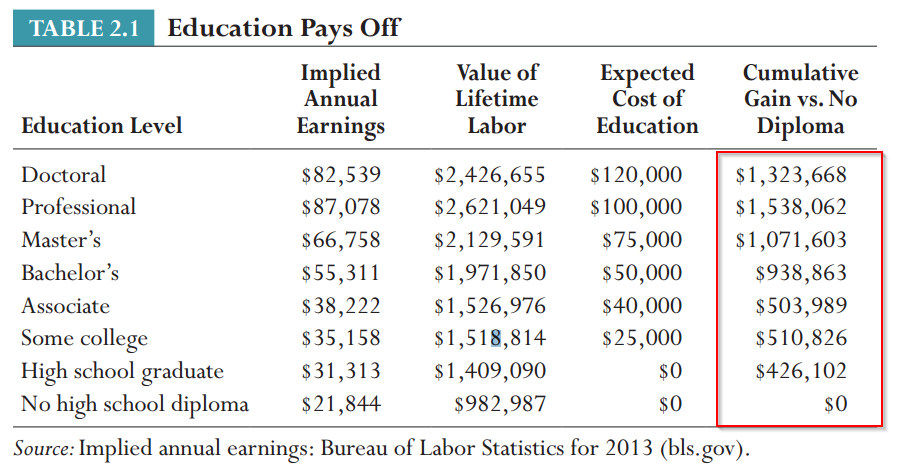

Once an investor understands that their largest asset isn’t their investment portfolio, but their brain, the calculus of investing changes. Through the human capital lens, Doug covers how we can make “capex” investments in education, optimize career choices to maximize the value of our labor, assess the quality of the business where we choose to work, and evaluate the overall risk/return tradeoff. An example of this analysis is captured in the following figure from the book:

Another asset that can be viewed in a broader business/financing context is Social Security, which is “the mandatory purchase of an inflation-indexed annuity that is guaranteed by the government.” There are also thoughts on retirement benefits and insurance that are unique and interesting.

Next up is a discussion of the ongoing role of financial or investment assets, including as a liquidity buffer, wealth compounder, source of financing for retirement consumption and seed capital for future generations. This discussion falls more in line with other investment books, covering topics like diversification, goals and assumptions for the long run, the danger of inflation, strategic borrowing, and thoughts on the role of indexing and on the active/passive management question. There is also a section about behavioral biases and how they can influence us to do the wrong thing.

McCormick also includes a helpful section on how to create a dashboard of analytical tools that can help monitor and measure Family, Inc., including an income statement and balance sheet, and how to conduct sensitivity analysis to ensure you are properly positioned for the future.

The next section deals with retirement, including your retirement “number,” and withdrawal rate. There are thoughts on preparing heirs, estate planning, and charitable giving. A lot of these elements of investing are covered in other books, but the treatment of these topics was clear and concise, which made for easy reading.

Constructive Criticism

Overall, this is a solid book, although there were some points in the book where I struggled to reconcile different ideas presented. For instance, McCormick points out, “Today’s workplace is too dynamic and your expected career is far too long to attempt to make good job choices based on future prospects for a specific company…” Yet 11 pages later, he argues the opposite, “Equity investments with high growth and high valuation can produce volatile outcomes…But over a longer horizon, like that of an employee, initial valuation becomes less relevant and long-term growth becomes the dominant factor driving value…”

So which is it? Should we make job choices based on a company’s long-term growth prospects or not?

There were several points in the book where I found myself flipping back and forth between sections trying to understand the ultimate message that was being conveyed. This led to some confusion at times, but nits aside, the book is well written, clear, and concise.

Summary

Regardless of quibbles mentioned above, Family, Inc. does an excellent job of suggesting a reasonable path, by applying shrewd financial thinking and principles to family wealth and long-term goals, and in a novel way. The emphasis Doug puts on thinking about human capital as a large part of one’s portfolio was unique and is often overlooked by many investing books. The discussion and analysis on this particular subject is excellent and thought-provoking. Unfortunately, I’m approaching my 50th birthday so my human capital asset is becoming a less important aspect of my own personal portfolio, but if I had read this book 30 years ago, and understood the importance of my human capital asset at an earlier age, I would have been surely been better off.

Overall, if you have an established degree of financial sophistication, and are looking for ways to enhance your thinking about managing your family wealth, this book will provide the big picture perspective and deliver the tools required to be successful in managing your wealth.

About the Author: David Foulke

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.