In a recent letter to its investors, Crispin Odey commented as follows:(1)

Money managers specializing in picking stocks and bonds are being driven out by mindless passive investing.

Odey is a London based hedge fund manager, whose flagship fund lost almost 50% in 2016.(2)

Are Active Managers Being Treated Unfairly? Or Are They Failing to Adapt?

Blaming the disappointing performance of active management on the exponential growth of passive indexing (defined here) is not a new idea. However, a recently published paper in the Journal of Financial Economics,(3) provides a new and notable take on the continuing debate. In a surprising turnabout to Mr. Odey’s comment, the authors of the article find that actively managed funds are more “active”, charge lower fees, and produce higher alpha, when faced with more competitive pressure from low-cost passive index funds.

A summary of the main questions and insights include the following:

- What is the relation between explicit indexing and product differentiation (active share)?

- Active funds are more active (have a higher active share) in countries where explicitly indexed funds have a higher market share and lower costs.

- What is the relation between explicit indexing and price that investors pay for active management (total shareholder costs)?

- Active funds’ total shareholder costs decrease with market share and costs of the index funds. For instance, a decline in the average cost of index funds of 50 basis points is associated with lower fees (16 basis points) charged by active funds.

- What is the impact of regulation such as Pension Acts (that are designed to increase market completion by providing investors with easy access to low cost index funds) to the product differentiation and price of active funds?

- The passage of pension legislation is associated with an increase in active share (on average by 1.6%) and a decrease of total shareholder costs of active funds (on average by 3 to 5 bps).

- Does the performance of truly active funds improve in markets where competition from index funds is higher?

- Active funds perform better in countries where there is a higher presence of explicitly indexed low cost funds.

One of the reasons why we like this article is the expanded universe of their analysis. Almost all of the many articles discussing active investing focus solely on the universe of US equity securities. A significant feature of the Cremers et al. (2016) article is that it included active and passive equity mutual funds in 32 countries. To our knowledge, this represents the most robust and comprehensive analysis within the fund management literature detailing the relationship between actively and passively managed funds.

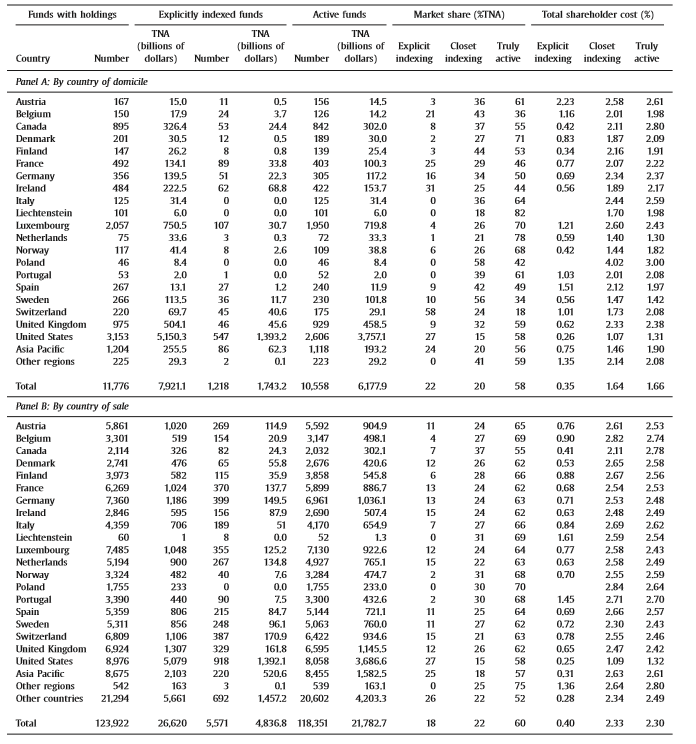

One can find the first informative statistics in Table 1 of the paper, where the authors tabulate the extent of explicit indexing, closet fund indexing(4), and active management in the different countries.

Table 1: Extract from Cremers et al. (2016)

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

It appears that on average, of the 11,776 funds in the sample, 22% are explicit indexers, 20% are closet indexers and 58% are true active managers. As the table shows, there is some differentiation at the country level where some countries have no explicit indexers (Italy, Liechtenstein, Poland, and Portugal), a few countries have a high number of closet indexers (Poland, Sweden, Belgium, Finland, Spain) and even fewer countries have a low number of truly active managers (Switzerland).

Conclusion

Overall we think these results are great news for investors, but also for active fund managers. Investors should look to find “truly” active funds (those with higher active share) in countries where the market share of explicit passive index funds is high. From these competitive environments, they are more likely to experience higher alpha and lower costs. Perhaps, active funds managers should welcome the spread of true indexers as they progressively drive away competition from closet indexers, who seem to be the main culprit behind the negative press on active investing.

Indexing and Active Fund Management: International Evidence

- Martijn Cremers

- Miguel Ferreira

- Pedro Matos

- Laura Starks

- link

Abstract

We examine the relation between indexing and active management in the mutual fund industry worldwide. Explicit indexing and closet indexing by active funds are associated with countries’ regulatory and financial market environments. We find that actively managed funds are more active and charge lower fees when they face more competitive pressure from low-cost explicitly indexed funds. A quasi-natural experiment using the exogenous variation in indexed funds generated by the passage of pension laws supports a causal interpretation of the results. Moreover, the average alpha generated by active management is higher in countries with more explicit indexing and lower in countries with more closet indexing. Overall, our evidence suggests that explicit indexing improves competition in the mutual fund industry.

References[+]

| ↑1 | http://www.independent.ie/business/world/mindless-passive-investing-killing-markets-says-odey-35315725.html |

|---|---|

| ↑2 | http://www.evidenceinvestor.co.uk/who-are-you-calling-mindless/ |

| ↑3 | Cremers, M., Ferreira, A., Matos, P. and L. Starks, 2016, Indexing and Active Fund Management: International Evidence |

| ↑4 | the authors use the active share by Cremers and Petajusto (2009) to distinguish between active management and closet indexing. They also check their results with alternative measures of active share |

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.