Our epic piece on factors from a few weeks ago is still ringing in our own ears: Are factors even real? Or just data-mining?

The conclusion: who knows. We need more data.

And more data we can find. To include a recent master’s thesis on nordic country equities, which looks at Size, value, momentum, profitability and investment in a stock market that hasn’t been data-dredged as heavy as the US.

Here is the paper.

Here is the abstract:

This thesis is concerned with uncovering whether return pattern effects from some of the most well-known factor models are present in a non-US sample. In a two-part analysis, taking both the theoretical academic perspective and the practical industry perspective, equity returns on the Nordic capital market (Sweden, Denmark, Norway and Finland) are scoured for evidence of factor patterns to size, value, momentum, profitability and investment. Fama & French’s methods for constructing the factor models are utilized when taking the academic perspective to factor effects, and investigating the ability of four factor models to price equity returns. The Fama & French (1993) three-factor model, Carhart (1997) four-factor model, Fama & French (2015) five-factor model, and a combinational six-factor model are estimated using ordinary least squares. Inference about the relevance of the factor models are made based on hypothesis tests on single models in the cross section of returns, and joint tests across the estimated models. While none of the factor models provide complete descriptions of variations in the cross section,an ability to explain between below 20-32% of the dependent portfolios, provides indication that factor effects are prevalent on the Nordic equity markets. In the second part of the thesis’ analysis, the thesis takes the industry perspective and evaluates the possible factor patterns as trade proposals instead. First, the simple, individual factor portfolios are evaluated on their performance during different market conditions in the 25 years from 1991-2015. Several of the long-short factor portfolios have provided attractive risk-return proposals, indicating factor return patterns in Nordic equities. From the individual portfolios, much inspired by the value-momentum findings of Asness, Moskowitz & Pedersen (2013), combinational factor portfolios are constructed in order to uncover diversification benefits between the factor effects. Simple portfolio combinations are constructed, as well as more complex mean variance optimized portfolios. The thesis is able to uncover a superior factor investment portfolio that has provided market-insensitive alpha the 25 years in which it would have been applied.Overall, both the academic and industry perspective to factor patterns in returns presents compelling evidence towards the presence of factor effects on the Nordic markets.

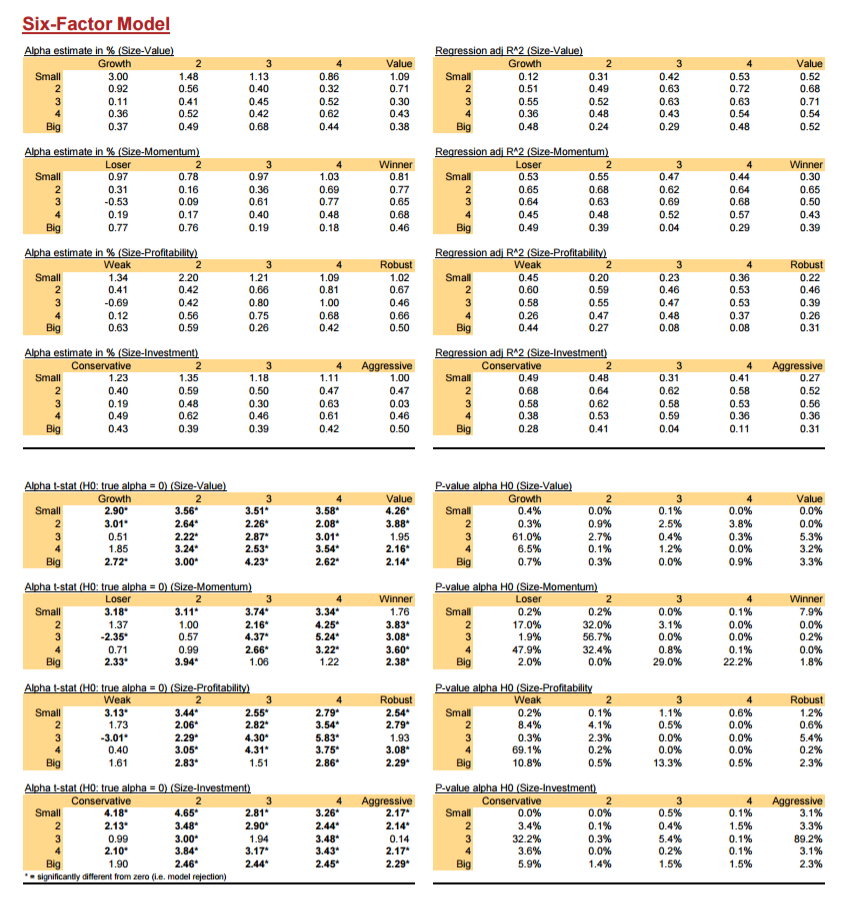

One of the charts in the paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Cliff Asness asked a good question: why are the alphas all positive? I inquired with the author and it sounds like the analysis was done correctly. Without working with the underlying data we can never confirm/deny. Here is another paper to consider on the similar subject.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.