- Title: PORTFOLIO CONCENTRATION AND PERFORMANCE OF INSTITUTIONAL INVESTORS WORLDWIDE

- Authors: NICOLE CHOI, MARK FEDEINA, HILLA SKIBA, TATYANA SOKOLYK

- Publication: JOURNAL OF FINANCIAL ECONOMICS, 2017 (version here)

What are the research questions?

Portfolios in international markets tend to be more concentrated (due to home bias). There is an unresolved puzzle in the literature: Does this concentration come from 1) behavioral bias or from 2) a rational portfolio optimization implied by the information advantage theory? The authors ask whether there supporting evidence for the information advantage theory (e.g., Van Nieuwerburgh and Veldkamp, 2009). Specifically,

- Is portfolio concentration linked to higher risk-adjusted returns?

- Do skilled investors build more concentrated portfolios?

- Is the degree of home bias related to the level of home market uncertainty

What are the Academic Insights?

By studying a data set with security holdings of 10,771 institutional investor portfolios (mutual funds, hedge funds, investment advisors) domiciled in 72 countries, the authors find:

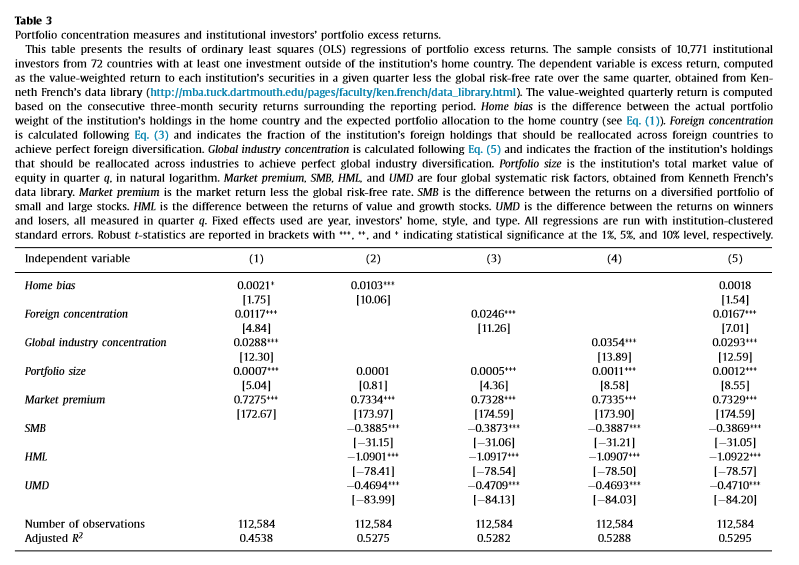

- YES- Portfolio concentration in foreign and home markets, as well as portfolio industry concentration, are positively related to risk-adjusted returns. The authors study five different measures of concentration and perform risk adjustment tests to ensure that the relation is not driven by higher risk characteristics

- YES- Institutional investors with higher learning capacity ( i.e more skilled investors) build more concentrated portfolios in foreign markets and industries

- YES-The degree of home bias is positively related to the level of home market uncertainty

Why does it matter?

Traditional asset pricing theory states that optimal portfolios should be diversified in international markets and securities. But this paper shows that concentrated investment strategies in home markets can be optimal.It appears that, if investors use an information advantage in building the portfolio, the “diversification is king” rule may not be applicable. By deviating from the well-diversified world market portfolio, investors can enhance risk-adjusted returns!

The Most Important Chart From the Paper:

Elisabetta Basilico, Ph.D., CFA, (@ebasilico) is an independent investment consultant. With co-author Tommi Johnsen, PhD, she is writing an upcoming book on research backed investing. You can learn more at http://academicinsightsoninvesting.com/

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.