- Title: A WEALTH MANAGEMENT PERSPECTIVE ON FACTOR PREMIA AND THE VALUE OF DOWNSIDE PROTECTION

- Authors: LOUIS SCOTT AND STEFANO CAVAGLIA

- Publication: THE JOURNAL OF PORTFOLIO MANAGEMENT, SPRING 2017 (version here)

What are the research questions?

The article links two current hot topics: goal based investing and factor premia.

- Can factor premia (value, size, momentum and quality) help the aspiring retiree achieve the goal of accumulating enough to meet his retirement spending needs?

What are the Academic Insights?

By using the circular block bootstrap ( Politis and Romano (1992)), the authors study the impact of six different strategies to the terminal wealth of the retiree: the core portfolio, the core portfolio plus an overlay in one risk premium at a time and the core portfolio with an overlay of an equally weighted allocation to each factor premia. They find that positive sentiment (defined as the BULLISH percentage) on stocks is associated with positive returns

- YES- Factor premia (except for size) can enhance the distribution of terminal wealth compared to the core portfolio of global equities. The authors simulate two robustness checks where they hypothesize lower future mean returns of factor premia and skill based market timing of the global equity manager. Results of the factor premia enhancement properties seem to hold up.

The authors simulate two robustness checks where they hypothesize lower future mean returns of factor premia and skill based market timing of the global equity manager. Results of the factor premia enhancement properties seem to hold up.

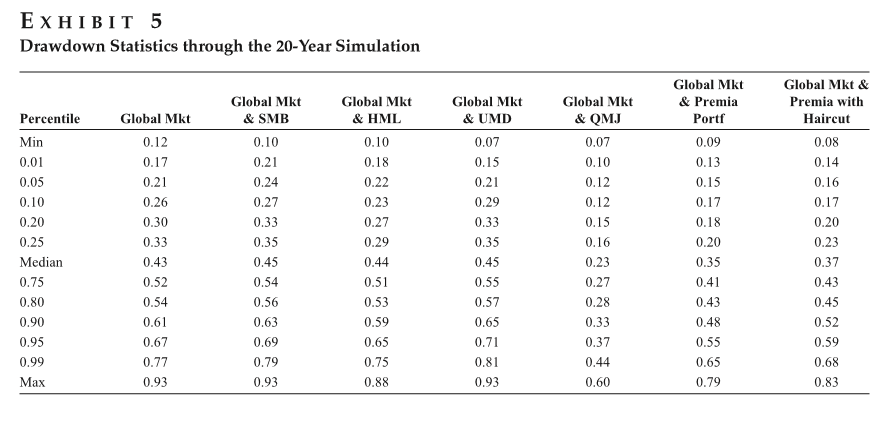

Finally, the authors analyze the drawdown properties of the stand-alone core portfolio and those of the overlays. They find that a strategy which overlays an equal weighted portfolio of factor premia on top of the global equity portfolio is superior in terms of drawdown protection.

Why does it matter?

This paper confirms the importance for investors to be exposed to certain factor premia (value, size, momentum, quality). In fact, it shows that an equal allocation to these four premia on top of a global equity portfolio: 1) enhances the probability to reach retirement goals, 2) mitigates drawdowns in the journey to retirement.

The Most Important Chart from the Paper:

Elisabetta Basilico, Ph.D., CFA, (@ebasilico) is an independent investment consultant. With co-author Tommi Johnsen, PhD, she is writing an upcoming book on research backed investing. You can learn more at http://academicinsightsoninvesting.com/

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.