Andrew Miller, a regulator contributor to the blog, is passionate about the intersection of academic finance research and financial planning. We obviously love the academic finance research stuff, but our financial planning advice lacks serious depth: spend less than you make.

So we rely on Andrew to help us understand how all the geeky investment research can contribute to financial planning and helping investors achieve their goals.

Andrew has a recent paper that looks at how trend-following managed futures programs can improve “safe” withdrawal rates for retirees. If you’re an advisor, and looking to understand how and why managed futures should be considered in an investment portfolio, we encourage you to dig in.

An Introduction to “Safe” Withdrawal Rates

As humans, we love heuristics, or rules of thumb. One rule of thumb that has gained quite a bit of traction in the financial planning world is the, “4% rule of thumb.“(1) This heuristic states that a recent retiree can plan on withdrawing an initial 4% of her retirement portfolio (50% US large cap stocks & 50% intermediate US government bonds) and adjust the dollar amount by inflation (up or down) every year and there is a very high likelihood that the portfolio won’t be depleted for at least a 30-year period of time.

However, this 4% rule of thumb implicitly assumes that stocks and bonds will earn their historical average real rates of return. There is some debate about whether or not one should expect historical average real rates of return from stocks going forward, but we think it is prudent to assume that one shouldn’t expect bonds to deliver their historical average 2.3% real rate of return going forward as 5-year TIPS are priced at 0.35% real return (2% below historical average) and 30-year TIPS are priced at a 0.9% real return.

What impact might low real interest rates have on “safe” withdrawal rates?

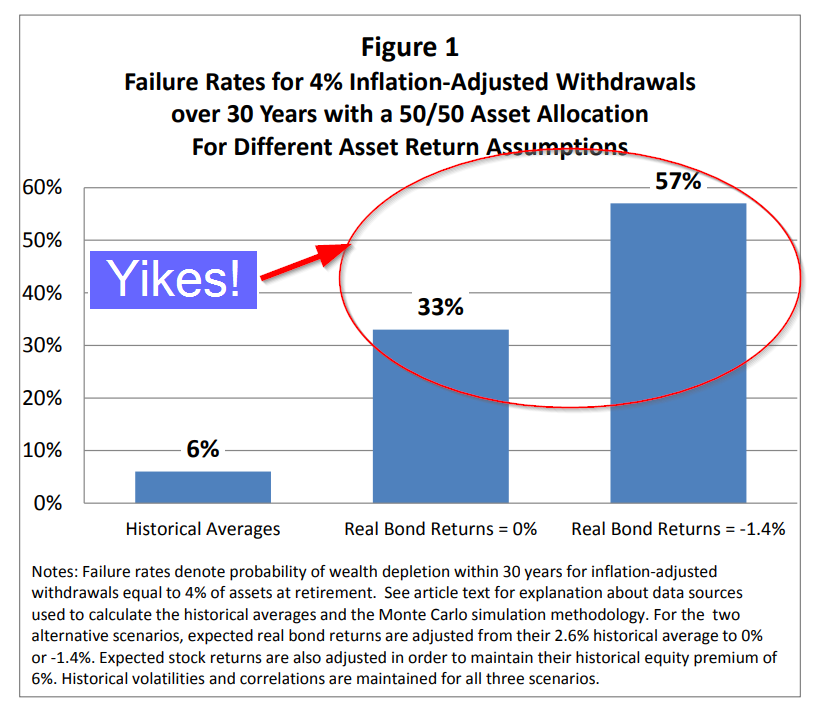

Pfau, Finke & Blancett published a couple of papers in 2013 that attempt to answer this question. Their best paper is The 4% Rule Is Not Safe in a Low-Yield World. In this paper, the authors look at a number of various scenarios in which they change expected real returns of portfolios and find that all of them require a reduced initial withdrawal rate to make it through 30 years of retirement without depleting a retirement portfolio.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Well, that result kinda sucks…is there a potential solution?

Andrew suggests this is possible with managed futures programs focused on generic trend-following algorithms.

Can Managed Futures Make Safe Withdrawal Rates Great Again?

In a very simplistic way, one can think of your portfolio, like a baseball team:

- Stocks would be your home run hitter who strikes out a lot and play first base — they can produce some great offense, but not much with respect to defense.

- Bonds are like a great defensive shortstop: mediocre at hitting, but they are on your team to play defense.

Given, the current low-interest rate environment, bonds are now like a great defensive shortstop who hits like a pitcher…they may not do anything offensively, but they can still play defense (although that is still up for some debate).

In Andrew’s paper, he makes one minor change to the generic stock/bond investment portfolio, and changes the asset allocation mix to include managed futures. He looks at an investment portfolio comprised of 50% stocks, 40% bonds and 10% managed futures (compared to a 50% stock and 50% bond portfolio which is the portfolio used to arrive at the 4% rule of thumb).

Andrew introduces managed futures to the portfolio, as managed futures have historically been good at playing defense, but their returns (offensive) may not be (as) affected by the low-interest rate environment. In addition, the 50/40/10 allocation mix has the same risk profile (stock market beta and volatility) as a 50/50 stock bond portfolio so any results can’t be due to changes in risk profile (assuming a 10% volatility level for the managed futures investment).

WithDrawal Rates with Managed Futures: The Historical Results

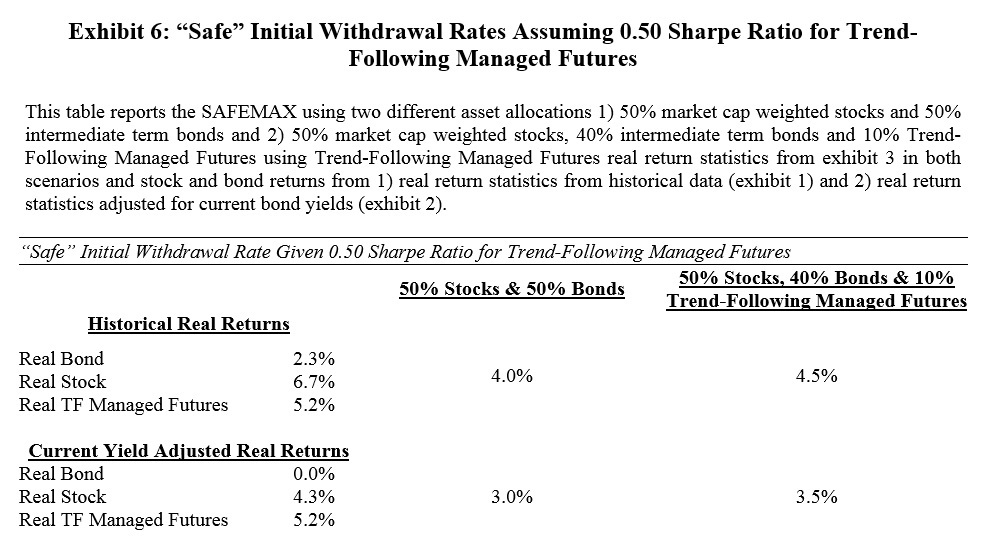

Andrew looks at several different return scenarios in the paper, but here are the most interesting:

- Historical average real returns for all asset classes

- Adjust all real returns down by 0.19% per month to make the real return on bonds 0% and keep the same risk premium of stocks over bonds

- Assume a 0.5 Sharpe Ratio for Managed Futures and stock and bond returns reduced by 0.19% per month (pessimistic scenario)

We think this results chart from the paper is the most interesting:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

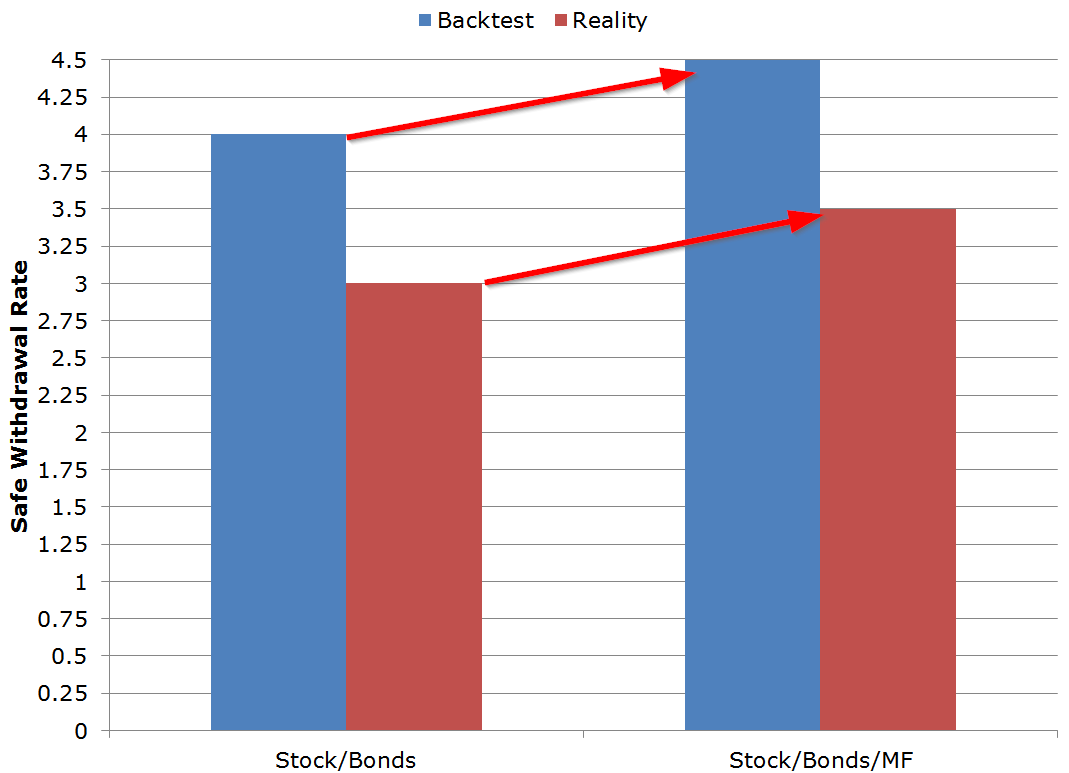

What these results show is that a 50/50 portfolio using historical average rates of return has a “safe” initial withdrawal rate of 4% (hence the rule of thumb), but if we reduce returns to match current real yields on bonds (0.19% return reduction per month) the “safe” initial withdrawal rate declines to 3%.

Here is a picture of the core result for those who are quantitatively challenged (Backtest = historical real returns; Reality = Expected real returns):

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

A 10% allocation to managed futures goes a long way to improving safe withdrawal rates.

For comparison, the 50/40/10 portfolio assuming that trend-following managed futures only have a 0.5 Sharpe ratio (which is a meaningful reduction versus their history) has a 4.5% “safe” initial withdrawal rate assuming historical average return for stocks and bonds. If we reduce the returns on stocks and bonds by 0.19% per month (and keep trend-following managed future returns unchanged at a 0.5 Sharpe ratio) the “safe” initial withdrawal rate declines to 3.5%…but it still shows a 0.5% increase over a traditional 50/50 portfolio.

The results indicate that making a minor change to the investment portfolio (reducing the bond allocation by 10% and adding a trend-following managed futures allocation of 10%) can have a material improvement on the “safe” initial withdrawal rate.

Using Trend-Following Managed Futures to Increase Expected Withdrawal Rates

- Andrew Miller

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category.

Abstract

Decreased bond yields substantially increase the probability of portfolio depletion for investors using an initial 4% withdrawal rate. One way to increase the safe withdrawal rate of a portfolio is alter the composition of the portfolio without changing the portfolio’s overall risk level. I propose a portfolio construction solution that incorporates trend-following managed futures into portfolios. The resulting portfolio, consisting of 50% stocks, 40% bonds and 10% trend-following managed futures, allows an investor to increase “safe” initial withdrawal rates while still maintaining a similar risk profile to a traditional 50% stock and 50% bond portfolio.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.