Most of the literature on the momentum factor has focused on behavioral explanations, generally either investor underreaction or overreaction. For example, in his paper “Explanations for the Momentum Premium,” Yale University professor Tobias Moskowitz points out:

Underreaction results from information traveling slowly into prices. That causes momentum. For example, there is ample evidence that investors underreact to corporate earnings and dividend announcements. Delayed overreaction results from investors who chase returns providing a feedback mechanism that drives prices further away from fundamentals, causing momentum in the short term that is eventually reversed when prices correct themselves in the long-term.

More recently, research has identified some risk-based explanations for momentum, in particular that, while investors have an aversion to tail risks, momentum strategies display large negative skewness and excess kurtosis. In addition, momentum strategies can experience large but infrequent crashes. Another intuitive risk-based explanation was provided by Cliff Asness in his 1997 study, “The Interaction of Value and Momentum Strategies,” which continued his doctoral research on momentum. Asness found that momentum is stronger among stocks with large growth opportunities and risky cash flows. These stocks would then run the risk that actual growth does not materialize and cash flows disappoint.

Other papers have found that liquidity risk can explain at least part of the momentum phenomenon. Recent winners have greater exposure to liquidity risk than recent losers, and therefore command a return premium going forward. Another explanation related to liquidity risk that might explain at least part of the momentum premium is that mutual funds experiencing large outflows engage in distressed selling of their stock portfolios, and mutual funds experiencing inflows might engage in “window dressing” (buying recent winners).

Is Momentum Driven by Risk?

Stefan Ruenzi and Florian Weigert contribute to the literature with their December 2017 study, “Momentum and Crash Sensitivity.” This study built on their prior work, “Crash Sensitivity and the Cross-Section of Expected Stock Returns,” co-authored with Fousseni Chabi-Yo, which found that stocks with strong tail risk have higher average future returns than stocks with weak tail risk, and that this effect cannot be explained by traditional risk factors and is different from the impact of beta, downside beta, coskewness (a measure of how much two random variables change together; if two random variables exhibit positive coskewness, they will tend to undergo extreme positive deviations at the same time, and if they exhibit negative coskewness, they will tend to undergo extreme negative deviations at the same time) or cokurtosis (a measure of how much two random variables change together; if two random variables exhibit a high level of cokurtosis, they will tend to undergo extreme positive and negative deviations at the same time). This finding is intuitive, as assets that exhibit particularly bad returns during market crashes are unattractive assets for risk-averse investors because their value deteriorates most at exactly the moment when investors’ wealth is particularly low and they should thus bear a return premium.

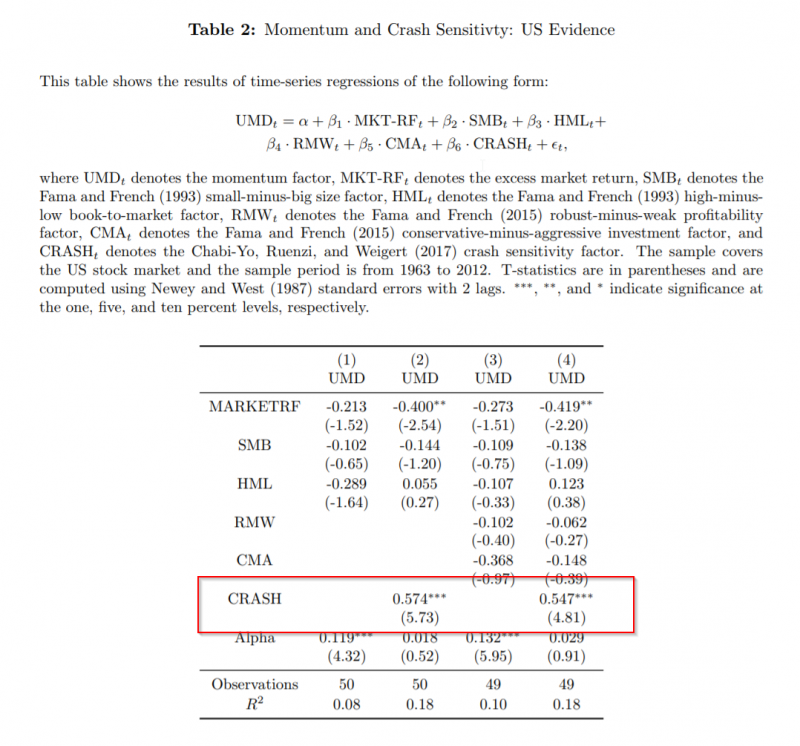

Ruenzi and Weigert use this finding to propose a risk-based explanation for the momentum anomaly in equity markets. They regressed the momentum strategy return on the return of a self-financing portfolio going long (short) in stocks with high (low) crash sensitivity in the U.S. from 1963 to 2012.

The crash sensitivity of individual stocks is measured based on the lower-tail dependence of their return time series with the market return time series. The crash sensitivity factor is then constructed as the equally weighted average return of the quintile of stocks with the highest crash sensitivity minus the average return of the quintile of stocks with the lowest crash sensitivity. The following is a summary of their findings. The tables are from Ruenzi and Weigert’s 2017 paper.

- The momentum strategy loads significantly positive on the crash sensitivity factor.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

- Controlling for the three Fama-French-factors (1993) of beta, size and value, including the crash factor reduces the momentum effect from a highly statistically significant 11.94 perfect to an insignificant 1.84 percent, a reduction of almost 85 percent. Controlling for the five Fama-French factors (2015) of beta, size, value, investment and profitability reduces the momentum strategy return from a highly significant 13.2 percent to an insignificant 2.9 percent per year, a reduction of 78 percent.

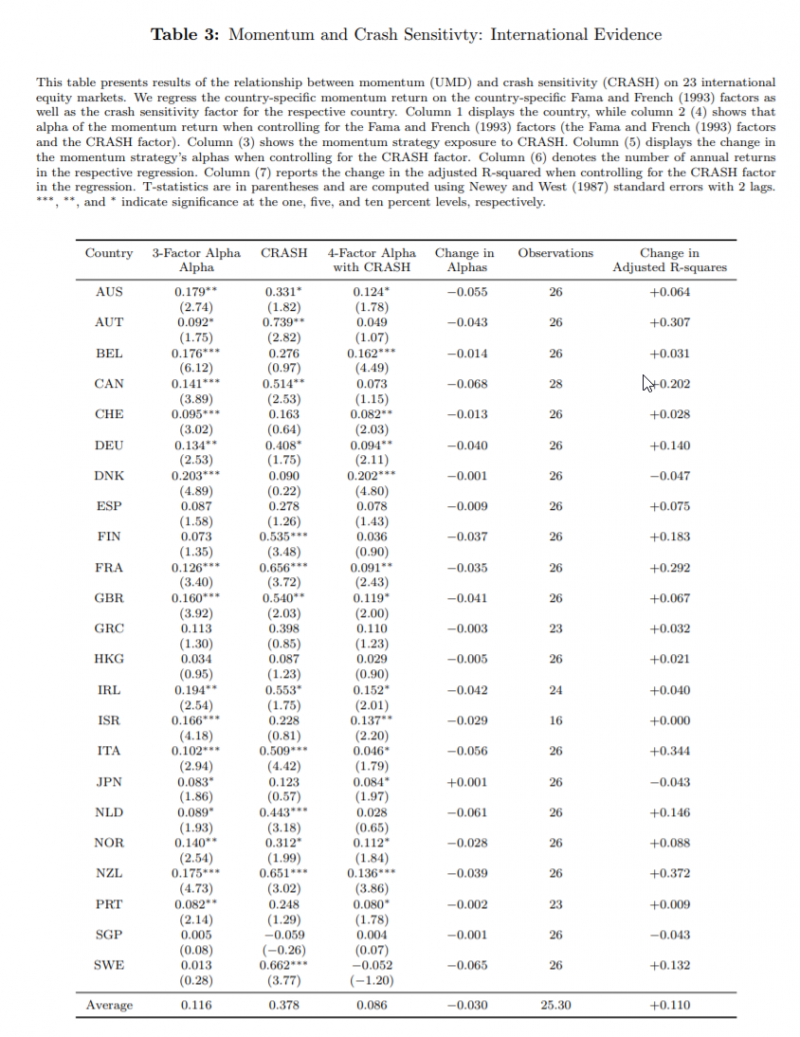

- There is supporting evidence for a risk-based momentum explanation in a sample of 23 international equity markets. Specifically, momentum and the crash factor are positive in every country in the sample and also statistically significantly different from zero in the majority of them.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Conclusion

Ruenzi and Weigert concluded:

Our findings show that at least a substantial part of U.S. and international momentum profits represents a risk premium for the exposure of the strategy to systematic crash risk…. This finding does of course not preclude that alternative behavioral explanations also drive a part of the momentum strategy returns.

The finding of risk-based explanations for the momentum premium (at least in equities) is good news for investors who include exposure to the factor in their portfolios because, while it’s possible that arbitrageurs can act to correct mispricing, risk cannot be arbitraged away and is therefore expected to earn a reliable premium over time.

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.