Imagine you are an alien. You land on planet earth in 1927 and are given a mission.

You are told that you need to solve a problem: compound $1,000,000.

The goal: compound your extraterrestrial face off.

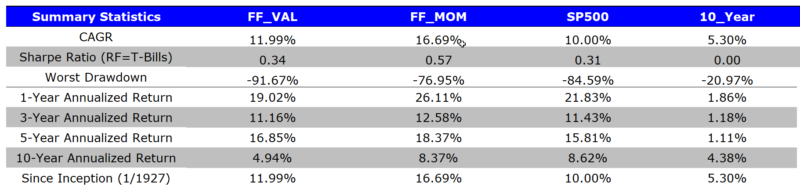

The options:

- FF_VAL: Top decile B/M, annually rebalanced, market-cap weighted.

- FF_MOM: Top decile 2-12 Momentum, monthly rebalanced, market-cap weighted.

- SP500: Own the biggest 500 stocks, market-cap weighted.

- 10_Year: 10-year Treasury bonds.

The alien’s special power: the ability to see the future with perfect foresight.

Alien Factor Investing Analysis

The alien decides to look into the future and identities that Ken French’s website has some data on one version of the world (a weird alien, I’ll admit). The alien looks at results gross of costs and no fees are included. All returns are total returns and include the reinvestment of distributions (e.g., dividends). The period is from 1927 to 2017.

The results of the analysis are summarized below:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Hrmm, the alien thinks, “These value and momentum things seem interesting.”

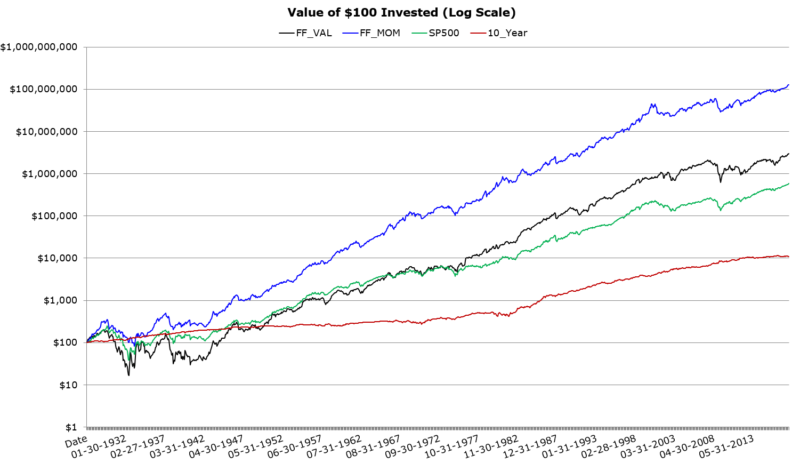

Next, the alien looks at the invested growth chart:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

“Jeez, these value and momentum things sure seem like pretty interesting options!”

Alien conclusion: Momentum looks like the best option.(1)

Asset Managers are Not Aliens. A Different Look at the Data.

Now…imagine you are an asset manager. You are living on Earth in 1927 and you have an incentive to keep your job.

This asset manager is unique because she has an amazing power: the ability to see the future with perfect foresight.

The asset manager is told to solve a problem: compound $1,000,000 for her client.

The goal: compound your face off. Don’t get fired.

Unfortunately, the asset manager lacks the most amazing power of all: the ability to distract her clients from focusing on short-term relative performance. Which means the asset manager needs to 1) make her client’s money, but 2) she also needs to not lose her job along the way.

The options for investment:

- FF_VAL: Top decile B/M, annually rebalanced, market-cap weighted.

- FF_MOM: Top decile 2-12 Momentum, monthly rebalanced, market-cap weighted.

- SP500: Own the biggest 500 stocks, market-cap weighted.

- 10_Year: 10-year Treasury bonds.

The asset manager has her analysts conduct the same research as the alien. The asset manager comes to similar conclusions: value and momentum are the most interesting from a compounding perspective.

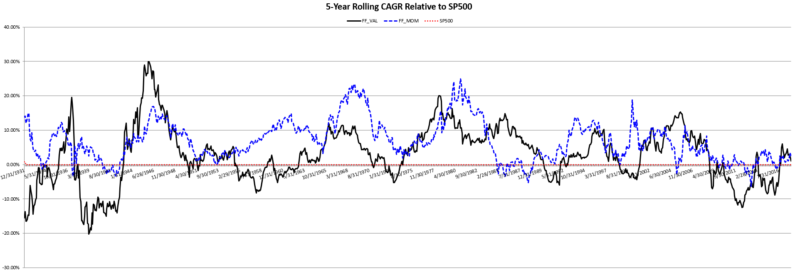

However, the asset manager recognizes that her investors are anchored on the S&P 500 as a benchmark. She knows if she underperforms for a 5-year period she will be fired. By year five of underperformance, there are always 100 other competing asset managers lined up telling her client it’s unacceptable to underperform for 5 years and all their clients have done much better.

The asset manager has her research analyst do some additional analysis on relative performance. She looks at the rolling 5-year relative compound annual growth rates of the various strategies against the SP500.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Hrmm. There are multiple 5-year periods when value and momentum drag on the SP500, in effect guaranteeing a pink slip!

- The generic value strategy outperforms the SP500 over 5-year periods only 65% of the time, leaving a 35% chance that the asset manager loses her job.

- Momentum looks significantly better over 5-year stretches, winning around 90% of the time. She focuses on the momentum approach and digs a bit deeper.

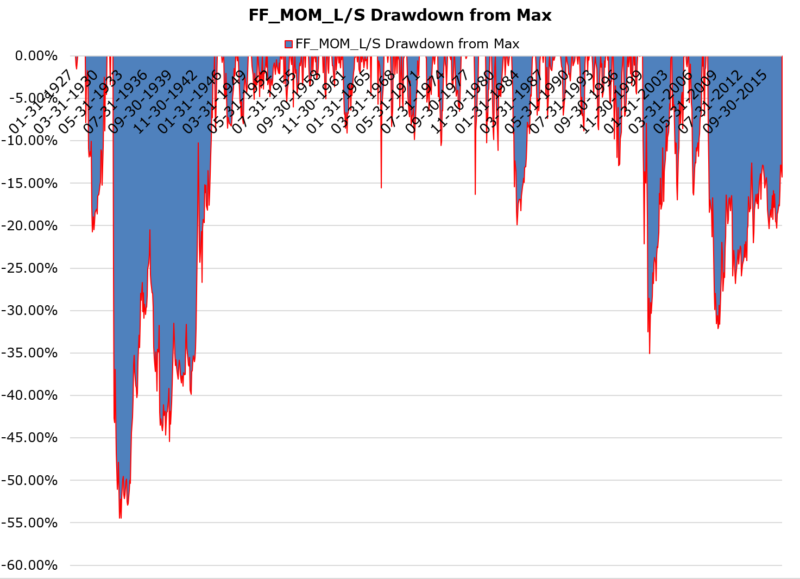

The asset manager wants to examine a hypothetical portfolio that invests $1 in the FF_MOM portfolio and shorts $1 of the SP500. The proceeds on the short sale are assumed to earn the risk-free rate and the portfolio is monthly rebalanced. The experiment is set up to better understand the dynamics of the relative performance over time. The drawdowns of the strategy, which essentially map out the relative performance against the SP500, are shown below.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Aye Karumba! While the 5-year rolling hit rate for momentum is high, there are plenty of short-term opportunities to get fired!

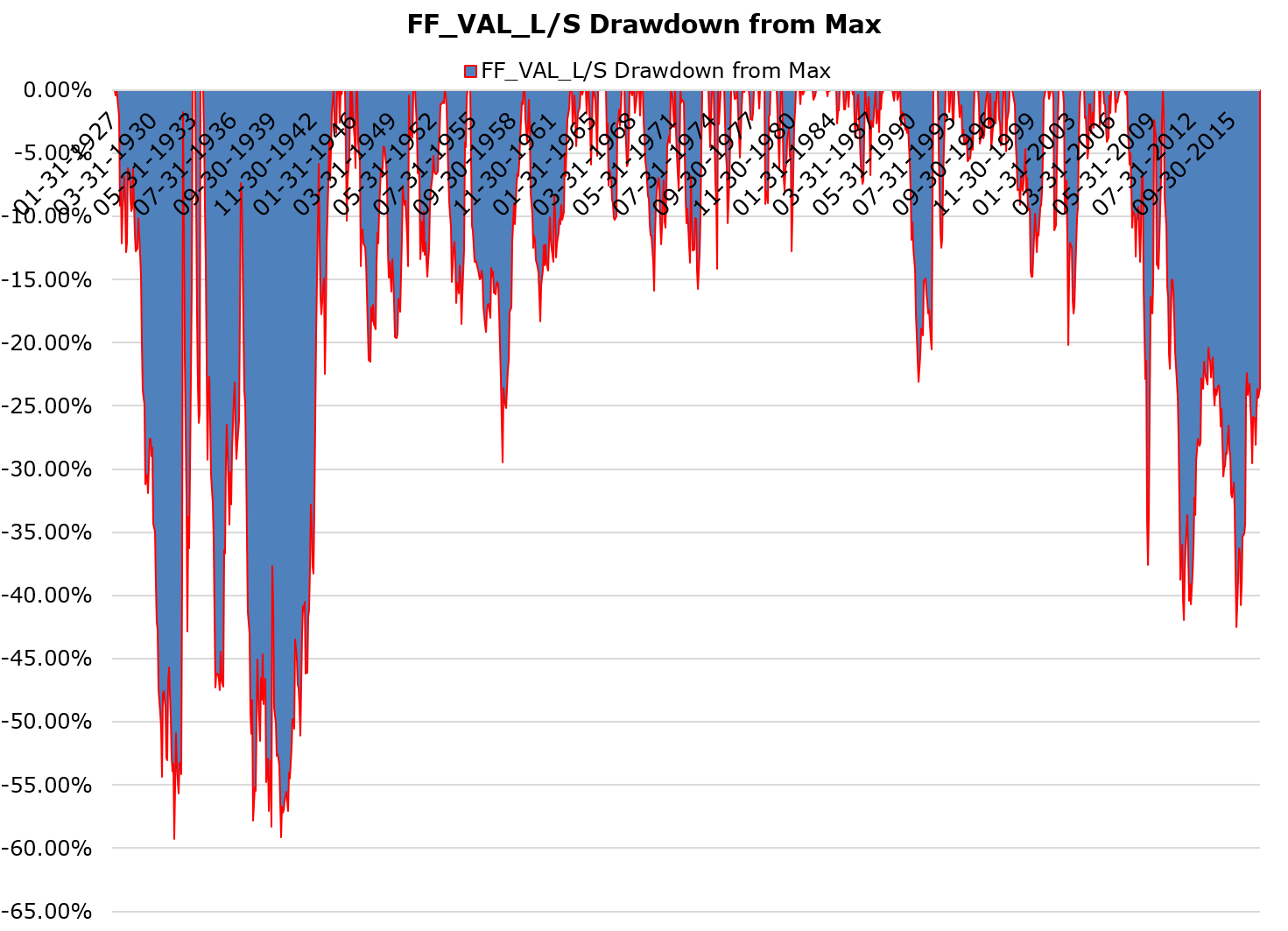

Perhaps the equivalent analysis on value is less intense? She conducts the same analysis on the value strategy and looks at the performance of a strategy that is long the value portfolio and short the SP500.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Not looking good! The portfolio manager quickly refers back to the junior analysts to confirm the results.

How Do Career Risk Incentives Play out in the Asset Management Industry?

In the simple portrayal above, an alien is well equipped to make an investment decision with limited baggage. Short-term relative performance isn’t really a consideration because it doesn’t help the alien solve its problem. The alien just wants to compound it’s extraterrestrial face off.

For the non-alien, relative performance might matter a lot. (Would you do a job that you knew, with your perfect foresight, you’d be fired from 35% of the time?) But, how much does it matter? How is this career risk premium priced? Can so-called “anomalies,” such as value and momentum factor strategies, be easily wiped away by machine learning algorithms, instant data access, and commission-free trading? Perhaps, but Shleifer and Vishny didn’t think so over 20 years ago, and my guess is they don’t think it is possible today.

Perhaps the alien’s biggest superpower isn’t perfect foresight, but the ability to invest in strategies that no normal investor can reasonably deploy…

Also, as was pointed out on twitter, I would be remiss if I did not point out that advisors who have a passion for client education can possibly help their clients capture this career risk premium. Our hope at Alpha Architect — and our firm mission — is we can play a small part in helping advisors (and solo investors) achieve this goal.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.