What does it mean to be the “best” research? For me, this means the most influential in changing my view on the world. So the below list of “best” research represents the research that 1) changed my view of the world 2) helped sharpen my thinking.

For context, I’ve been reading source journal finance research for over 15 years. In the early days it would take me a week to grasp a paper, whereas now I can catch the drift in less than 10 minutes — read the abstract/introduction, read the tables, and dig in on details when required. I guess there really is a benefit to experience (i.e., getting old), even though this is offset by the cost of frequent hamstring pulls during my Sunday pick-up soccer game. But what can you do? You take the good with the bad. That’s life…

The evolution in my thinking about financial markets worked as follows:

- Earliest days: Value investing is everything. Ben Graham is right. Warren Buffett is right.

- Chicago PhD days: Markets are efficient, anomalies don’t exist. Eugene Fama is right.

- Current thinking: Ben Graham and Eugene Fama are both insightful, but neither are “correct.” Humans are sometimes biased, but that doesn’t imply easy profits–incentives matter. Markets are hyper-competitive, but not perfectly efficient.

Below I outline the papers that were important in shaping the above progression of how I think about the world. Even if you disagree with their implications, and follow the debates–the literature continues to debate these ideas–I still believe they do the best job of describing the world in which we live. Could new theories and ideas come about that put these ideas out of business? Sure. And I’d be the first to embrace these ideas if they get us closer to understanding the “truth” — whatever that is…

So let’s begin:

Big Idea #1: Delegated Asset Management Can Impede Market Efficiency

The Limits of Arbitrage by Shleifer and Vishny

Milton Friedman describes the logic behind market efficiency: an arbitrageur identifies a temporary mispricing, acts on the price discrepancy with all available resources, and asset prices move to fundamental value (e.g., Friedman, 1953). Case closed. Smart people like to make money and when they see an opportunity they jump on it.

Shleifer and Vishny question an implicit assumption embedded in the Friedman logic — there are no arbitrage constraints. Shleifer and Vishny, via a basic model, outline the principle-agent problem in financial markets and why this prevents various investment strategies (e.g. value investing or momentum investing) from being easily arbitraged away.

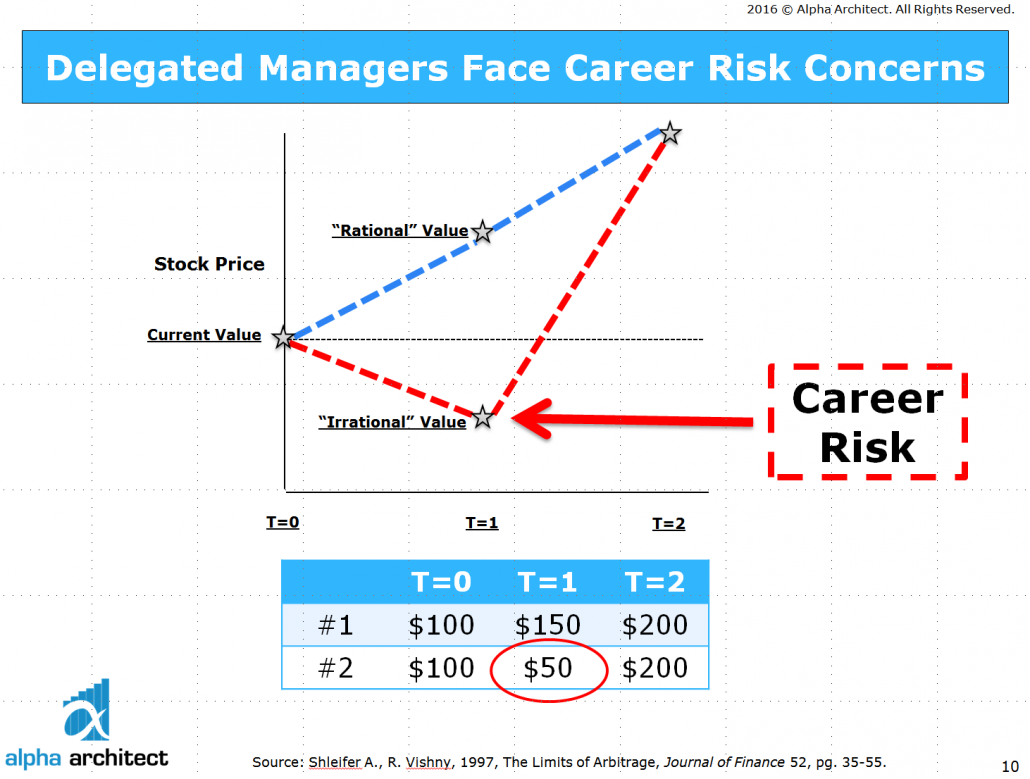

Below is a depiction of their core idea, visualized for easy consumption/understanding.

Essentially, long duration investment opportunities, while attractive in a perfectly rational world with full information, are not necessarily attractive if they make a manager look bad in the short-run, and the investors pull all their money when the manager performs poorly relative to a benchmark in the short-run.

Big Idea #2: Prices are Determined by Supply and Demand…and Market Frictions

A survey of behavioral finance by Barberis and Thaler

Nick and Dick (yes, that is their personal conversation names, and yes that rhymes) is really a summary of ideas that emerged from the so-called “behavioral finance” movement. The biggest insight from the summary paper is simple:

- Prices are right implies no free lunch

- No free lunch does not imply prices are right

This set of statements looks silly on the surface, but goes very deep, and forced me to rethink how I thought about financial markets.

I finally realized that market prices aren’t magically determined by the efficient market gods or fundamentals. Market prices are determined by human beings that buy and sell stock certificates in the market and these humans have different incentives (some rational; some biased).

Before this paper, my understanding of markets was incomplete. The common logic among efficient market advocates, and what I was conditioned to believe, is that the evidence that mutual fund managers cannot beat the market, implied that market prices must be efficient. The false logic is that nobody can earn extra profits, so therefore prices must be right. Of course, behavioral finance helps us understand why this logic is incomplete. The behavioral theory of markets, which includes an understanding of human decision-making and arbitrage frictions/costs, can explain why markets can simultaneously be 1) wildly inefficient and 2) why mutual fund managers don’t earn excess returns. For example, a stock is undervalued by $1, but the cost to “arbitrage” this undervalued stock is $1. On net, there is $0 benefit after costs of exploiting this market opportunity. Because the manager won’t arbitrage the inefficiency, there is no “free lunch,” but prices aren’t efficient, in the sense that they perfectly reflect fundamental value (i.e., they are off by a $1).

What do these big ideas imply about market dynamics?

Real world market prices are only perfectly efficient in a competitive marketplace when the arbitrage costs are assumed to be zero. But are they? Perhaps a costless arbitrage assumption is too strong. The Barberis/Thaler highlight — arbitrage costs matter — coupled with the discussion of the principle-agent problem associated with delegated asset management from Shleifer and Vishny — an identification of arguably the largest cost of arbitrage (i.e., the fear of getting money pulled) — led me to rethink where opportunity exists in the market. There were really two avenues to pursue:

- Try to be the smartest guy in the room.

- Try to lower arbitrage costs relative to the competition.

re #1: Everyone is trying to be the smartest guy in the room. This is a red ocean.

re #2: Few smart guys focus on lower arbitrage costs — especially the one associated with delegated asset management! This is a blue ocean.

A visual depiction of this idea is below and is fully described via our sustainable active investing framework.

How can one capture the red circle of “opportunity?” As mentioned, this “opportunity” is usually a facade because the opportunity is typically worth nothing after considering the arbitrage costs. However, if an investor has lower “arbitrage costs” than the rest of the marketplace, this opportunity is real. For example, one might identify a situation where there is a $1 mispricing opportunity, but instead of the equilibrium arbitrage costs being $1, a uniquely situated investor has an arbitrage costs of only $.50, for a net profit opportunity of $.50. Now we’re talking!

But how can one lower arbitrage costs? The obvious ones like trading costs have already been exploited. But imagine if an investor could lower the costs associated with the principle-agent problem outlined in Shleifer and Vishny. What if a delegated asset manager focused less on trying to outsmart the other smart guys and instead focused on identifying and developing long-duration client capital that was agnostic to relative performance over short horizons? The risk that clients would pull capital and fire the delegated manager during bouts of underperformance would be reduced. This approach would lower the arbitrage costs associated with the Shleifer/Vishny principle-agent problem and allow this delegated manager and their investors to capitalize on the lower arbitrage costs.

A win-win, in theory. And also an explanation for why our firm mission is to empower investors through education: we don’t invest in massive education efforts and radical transparency for our health, we do this to improve your long-term expected wealth.

Here is a runner up for a paper that didn’t change my mind, but heavily influenced how I think about the value investing premium.

Value investing premiums are not fully explained by extra “risk”

Contrarian Investment, Extrapolation, and Risk by Lakonishok, Shleifer, and Vishny

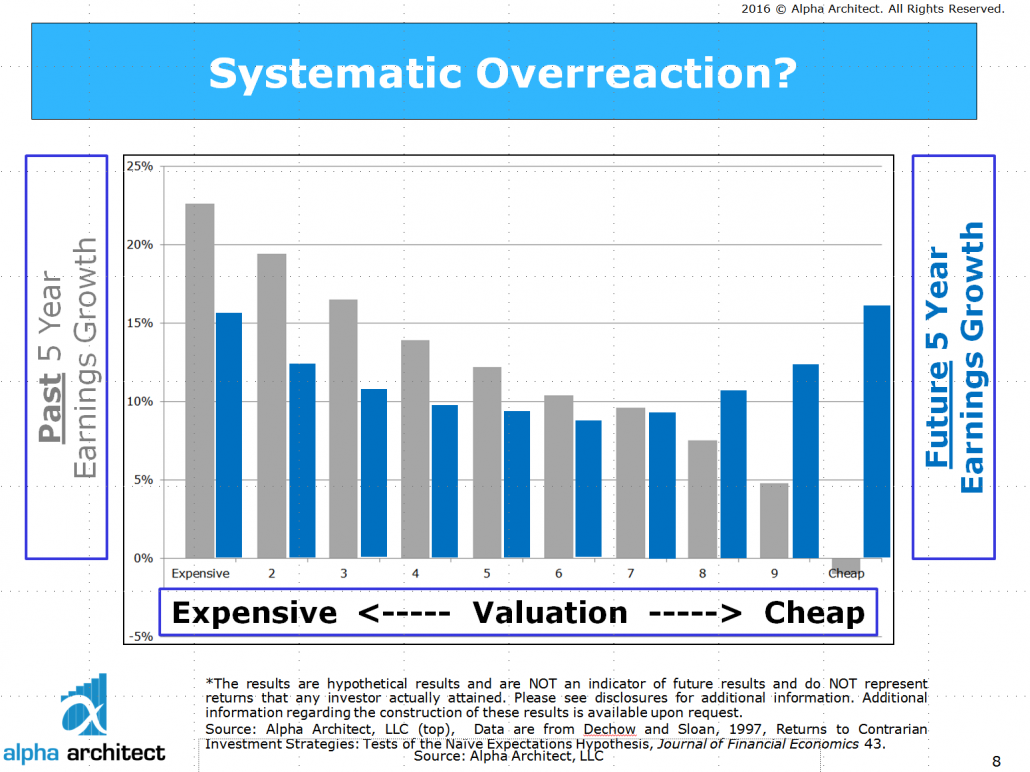

Ben Graham always argued that cheap stocks beat expensive stocks because Mr. Market is manic-depressive. On some days Mr. Market is happy and pushes stock prices too high; on other days Mr. Market is sad or scared and pushes stock prices too low. Graham is basically outlining a behavioral bias explanation for the “value premium.” Of course, this argument didn’t sit well with the efficient markets camp, which hypothesizes (in the semi-strong form) that prices always reflect fundamentals. Perhaps the value premium is driven by higher risk born by investors and not mispricing? Fama and French 1992 hint towards this conclusion and Lu Zhang later posed some interesting theoretical foundations for this argument. Regardless, this idea didn’t sit well with Lakonishok, Shleifer, and Vishny (LSV), who felt that the value anomaly was driven, in part, by a mispricing component described by Ben Graham as “Mr. Market.” The LSV paper is a rigorous attempt to show that the so-called “value investing premium” can’t be fully explained by risk, and is likely driven, in part, by an element of behavioral bias.

A visual depiction below:

The LSV research — as well as follow on research — highlight that the value premium cannot fully be explained by additional risk. We make this clear here. Something else is in the water. The degree to which value is due to risk and mispricing is a reasonable debate, but suggesting that mispricing plays no role seems unreasonable based on the evidence.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.