The Misguided Beliefs of Financial Advisers

- Juhani T. Linnainmaa, Brian Melzer and Alessandro Previtero

- Kelley School of Business Research Paper No. 18-9

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the Research Questions?

Financial Advisers (especially those affiliated with banks and brokers) catch a lot of flack from the investing community.(1) One of the most powerful and persuasive concepts is that advisers self-deal by directing customers to funds that generally pay the adviser the most, are performance chasing and require clients to trade frequently. This paper examines whether the incentive structure in financial advice is driving advisers decisions to direct clients, or if the advisor’s belief system is driving the investment style advisors most frequently recommend.

Show me the incentives and I’ll show you the outcome.

– Charlie Munger

The paper investigates the following research question:

- How much variance is there between investing performance and trading behaviors between clients and advisors.

- Do advisors trade their own portfolio contrary to their beliefs in order to voluntarily disclose trades inline with what they advise clients?

- Is it the incentive structure of the business, or misguided beliefs of advisors, that are causing investors to underperform passive benchmarks?

What are the Academic Insights?

To investigate these questions the research team utilized 14 years of data on client investments and advisory relationships provided by two Canadian Mutual Fund Dealers consisting of 3,276 advisors who maintain a personal portfolio with their own firm, and 488,263 clients who are active during the sample period.

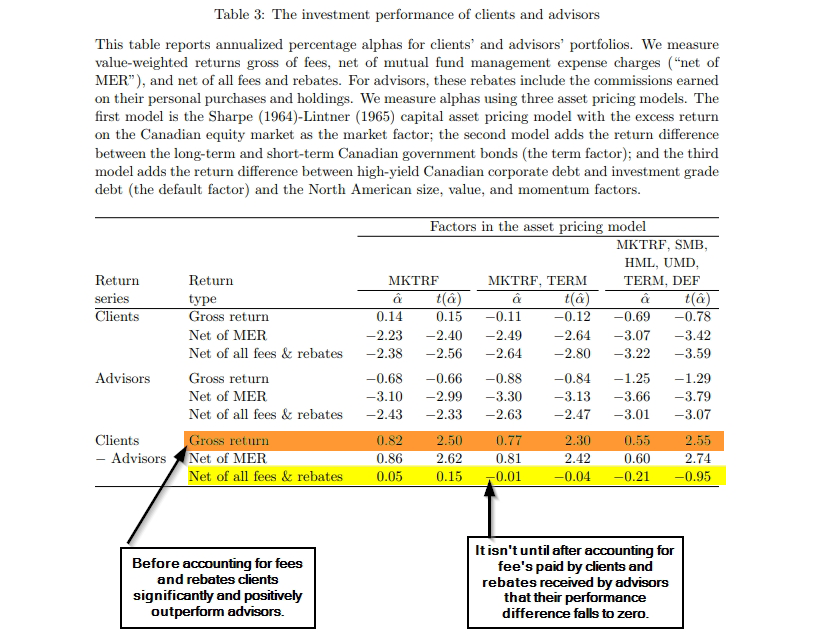

- The research team found that advisors underperform clients in 4 critical behavioral categories. Advisors buy mutual funds with great short-term past performance, lean more towards actively managed mutual funds, turn over their portfolios with higher frequency, and under diversify against the world index (and Canadian index). In addition to falling short on behavioral categories advisors as a group also tend to buy more expensive funds than their clients. So how does performance vary between clients and advisors? On gross returns clients significantly and positively outperformed advisors. It’s only after accounting for fees the investor pays and rebates the advisor receives from mutual funds that the advisor actually performs as well as, but not better than, their clients.

- To determine whether advisors were trading contrary to their beliefs as a means to display unity with their clients, the research team observed trading patterns of 400 advisors after they stopped advising clients. What they found was that advisors do not substantially change their investing behavior post-retirement. They continued to favor actively managed funds with allocations similar, but slightly more diversified than what they maintained while active in the advising clients. Which leads us to conclude that advisors are investing in accordance with their belief structure not to window dress their own portfolio to encourage clients to invest in active, expensive funds.

- The evidence the research team built suggests that it is advisors own belief structure that drives their advice.

Why does it matter?

Collectively we turn to investment advice from professionals on a fairly large scale. According to a 2015 survey done by Penn Schoen Berland (Survey) consumers use of financial advisors increased between 2010 to 2015 from 28% to 40%. This same survey found that the majority of respondents believe that financial advisors act in their companies’ best interest rather than the consumers’. These perceptions of advisors are likely linked to the incentive structure of investment advice (aka fees). Justifiably fees have been under attack on all fronts in finance. But what this paper suggests is that advisors belief structure should not be excluded from the conversation, as those beliefs may play as critical a role in the advice they disseminate as the fee structure of the products they sell.

Interestingly in my next article, I’ll be writing about how altering “beliefs” of third world investors has a greater impact on their financial future than almost any other form of financial education. In the end, Alpha Architect is so focused on investor education, as we believe that through dedicated education efforts we can change (some) investors belief structures and potentially improve results.

What are the most important charts from the paper?

Abstract

A common view of retail finance is that conflicts of interest contribute to the high cost of advice. Within a large sample of Canadian financial advisors and their clients, however, we show that advisors typically invest personally just as they advise their clients. Advisors trade frequently, chase returns, prefer expensive, actively managed funds, and underdiversify. Advisors’ net returns of −3% per year are similar to their clients’ net returns. Advisors do not strategically hold expensive portfolios only to convince clients to do the same; they continue to do so after they leave the industry.

About the Author: Rich Shaner, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.