The lack of a statistically significant size premium in the U.S. since the publication of Rolf Banz’s 1981 paper, “The Relationship Between Return and Market Value of Common Stocks,” published in the Journal of Financial Economics, led many investors to question its use in building portfolios. This conclusion is typically arrived at by considering the standalone performance of the size factor (I cover this extensively here), which ignores the potential benefits of how the size factor interacts with other factors. However, investors should be interested in how the size factor contributes to investment outcomes when used alongside other factors.

The Size Premium in Multifactor Portfolios

Mikheil Esakia, Felix Goltz, Ben Luyten, and Marcel Sibbe, authors of the study “Size Factor in Multifactor Portfolios: Does the Size Factor Still Have Its Place in Multifactor Portfolios?” published in the Winter 2019 issue of The Journal of Index Investing, sought to answer the question of whether the inclusion of the size premium in multifactor portfolios improves the portfolio’s efficiency.

They began by noting:

The size factor may be extremely useful to investors if it explains differences in returns that remain unexplained by other factors. From an investment perspective, this would suggest that considering a size tilt along with other tilts would provide benefits to investors in terms of risk and return.

Thus, their study sought to determine the cost or benefit of removing the size factor from a menu of factors investors can use in building portfolios. The seven factors they evaluated were: the market (beta), size, value, momentum, low risk, high profitability, and low investment. These factors have been widely used in both academic and practitioner research.

They first tested how measures of model fit deteriorate when each of those factors is omitted—enabling them to compare the relevance of each factor in explaining expected returns across equity portfolios. They then examined the long-term factor premia when controlling for different factors—enabling them to determine if the factor was subsumed (made redundant) by other factors. And finally, they examined the ex-post mean-variance efficient (MVE) portfolio and the weights it allocates to each of the seven factors—enabling them to determine whether a factor has contributed positively to the risk-return profile in the presence of other factors. Their data covers the period of July 1963 through 2018.

Following is a summary of their findings:

- The reduction in the explanatory power of their seven-factor model is highest when the size factor is excluded. Omitting the size factor reduces the model’s ability to explain average excess returns by an absolute 22 percent.

- Omitting the momentum or high-profitability factors also leads to deterioration in the model performance, but the magnitude is slightly lower than that of size.

- There is no meaningful impact from excluding the value factor (consistent with prior research finding that the value factor becomes redundant in the presence of the investment and profitability factors) and slight improvements when low risk and low investment factors are omitted.

Their findings led Esakia, Goltz, Luyten, and Sibbe to conclude: “We clearly see no evidence in favor of omitting the size factor.” They next evaluated how large the size premium is in the presence of other factors.

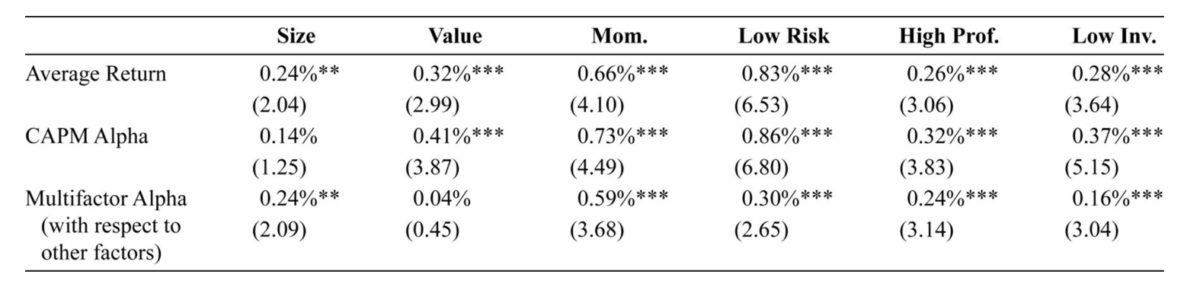

As you can see in the table below, the monthly size premium in the U.S. was not only the smallest, but it was the least significant. However, also note that the premiums for profitability and investment were just two and four basis points higher (though they were more significant). Should we only include the factor(s) with the highest premium? Not if there are diversification benefits—correlations are low to negative, which has been the case for the size premium. For example, the size factor has been negatively correlated to profitability, quality and momentum, uncorrelated to value, and has had a low correlation with market beta. With that in mind, consider the multifactor alpha (the third row in the table). As you can see, only momentum and low risk have higher multifactor alphas. And there is also a pronounced reduction in the premia for the value, low risk and low investment factors once we account for their exposures to other factors, suggesting that returns on those factors are partly explained by their exposure to some of the other factors.

Esakia, Goltz, Luyten, and Sibbe noted that “the fact that the stand-alone average return is similar to the multifactor alpha shows that the exposures of size to other factors have close to zero impact in total.” In addition, they found that the variability of returns of the size factor is mostly unrelated to other factors. These findings led them to conclude: “If one is considering excluding a factor, size does not stand out as an obvious candidate.” They added: “Our results clearly indicate that the size factor carries a positive premium after adjusting for implicit exposures to other factors. Therefore, multifactor equity investors should consider the size factor to harvest a premium that is unrelated to the other sources of performance in their portfolio.”

That said, it’s also important to note that the negative exposure of the size factor to the profitability, quality and momentum factors translates into a reduction in the (standalone) size premium. Adjusting for this exposure (which is what is done in a multifactor portfolio), the remaining premium will tend to be higher.

International Evidence

As a test of pervasiveness, Esakia, Goltz, Luyten, and Sibbe ran the same tests in developed and emerging markets.

They concluded:

“Consistent to our findings in US data, accounting for cross-factor interactions on top of the market factor increases the size premium. The multifactor alpha is higher than the CAPM alpha in both developed and emerging markets.”

They added:

“Our main finding that the size premium is not lower than that of other factors, once we properly account for multiple exposures, holds across developed and emerging markets.”

Having found that the size factor carries a premium unexplained by other commonly used equity factors, we should expect that investors can improve their risk/return profile by including the size factor in their portfolio because it carries a premium not captured by other factors. They tested this in an ex-post MVE U.S. portfolio that maximizes the Sharpe ratio over the full sample.

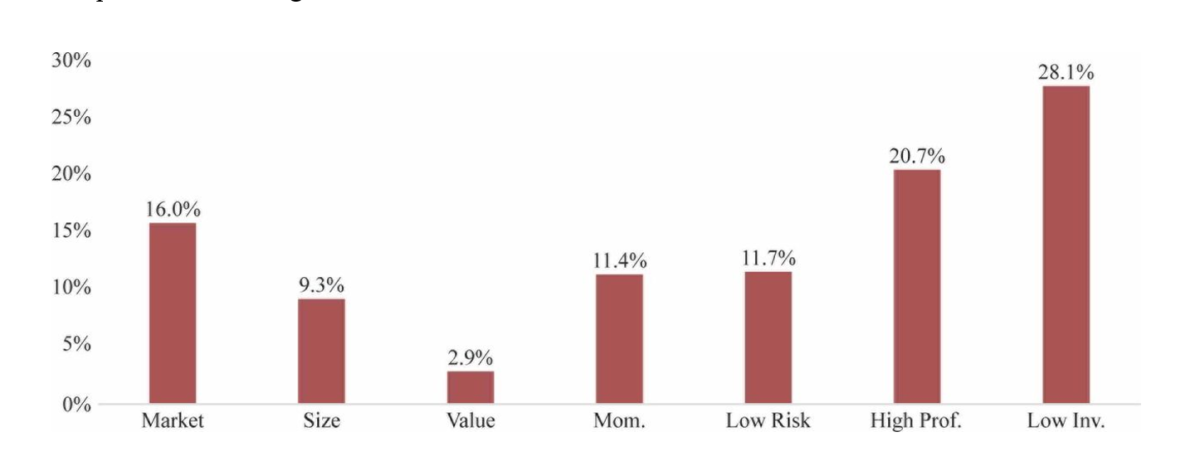

The following chart shows the results.

As you can see, despite the size factor having the lowest return among the factors in the menu, the size factor plays a far greater role than the value factor and similar roles to the momentum and low-risk factors. Their tests also revealed that “the exclusion of the size factor would lead to about a 3% reduction in Sharpe ratio.” They also found that “one should have an expected zero return for the size factor to consider excluding it.” They noted this demonstrates that “some factors can stomach a sizable reduction in their premium.”

In another test related to macroeconomic conditions, they found that:

“size turns out to be the only factor that tends to perform well when the dividend yield is unexpectedly rising. Hence, we predict that size has an important role for investors who wish to reduce their exposure to interest rate shocks or dividend yield shocks.”

In general, they found that,

“the analysis of macroeconomic risk and multi-asset class portfolios confirms that the size factor offers substantial diversification benefits. Omitting size would be costly for an investor who is exposed not only to the equity factors but also to other sources of risk, such as interest rates and other macroeconomic risks.”

Summary

Esakia, Goltz, Luyten, and Sibbe’s results demonstrate the importance of not considering just the standalone factor premium but also its volatility and its correlation to the other factors in the portfolio. Their test results provide no evidence suggesting that one should exclude the size factor when constructing multifactor portfolios. Their findings are consistent with those of prior research, which I presented in detail in my Advisor Perspectives article of October 16, 2019, “The Size Premium is Alive and Well.”

Following is a summary of that piece:

- The size premium has been “polluted” by the very poor performance of small growth stocks, especially those with high investment and low profitability.

- Once you control for other factors (quality, profitability and low volatility), the size premium is persistent and pervasive around the globe and is no longer concentrated in the tiniest stocks. For example, small quality stocks outperform large quality stocks, and small junk stocks outperform large junk stocks, but the standard size effect suffers from a size-quality composition effect. In other words, controlling for quality restores the size premium.

The bottom line is that the research demonstrates that not only is there a size premium when we control for other factors but including the size premium adds value in multifactor portfolios.(1)

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.