Climate Change and Asset Allocation: A Distinction That Makes a Difference

- Brian Jacobsen, Eddie Cheng, and Wai Lee

- Journal of Portfolio Management

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

This article focuses on “climate-aware” asset allocation and the associated impacts of higher temperatures on equity excess returns and risk. The objective of this research is to demonstrate how portfolios can incorporate climate change risk and rewards into the decision-making process.

The analysis proceeds in two steps:

- Determine estimates of how climate change could affect the risks and returns of equity and bond asset classes.

- Demonstrate the impact of including sustainability criteria into the asset allocation process.

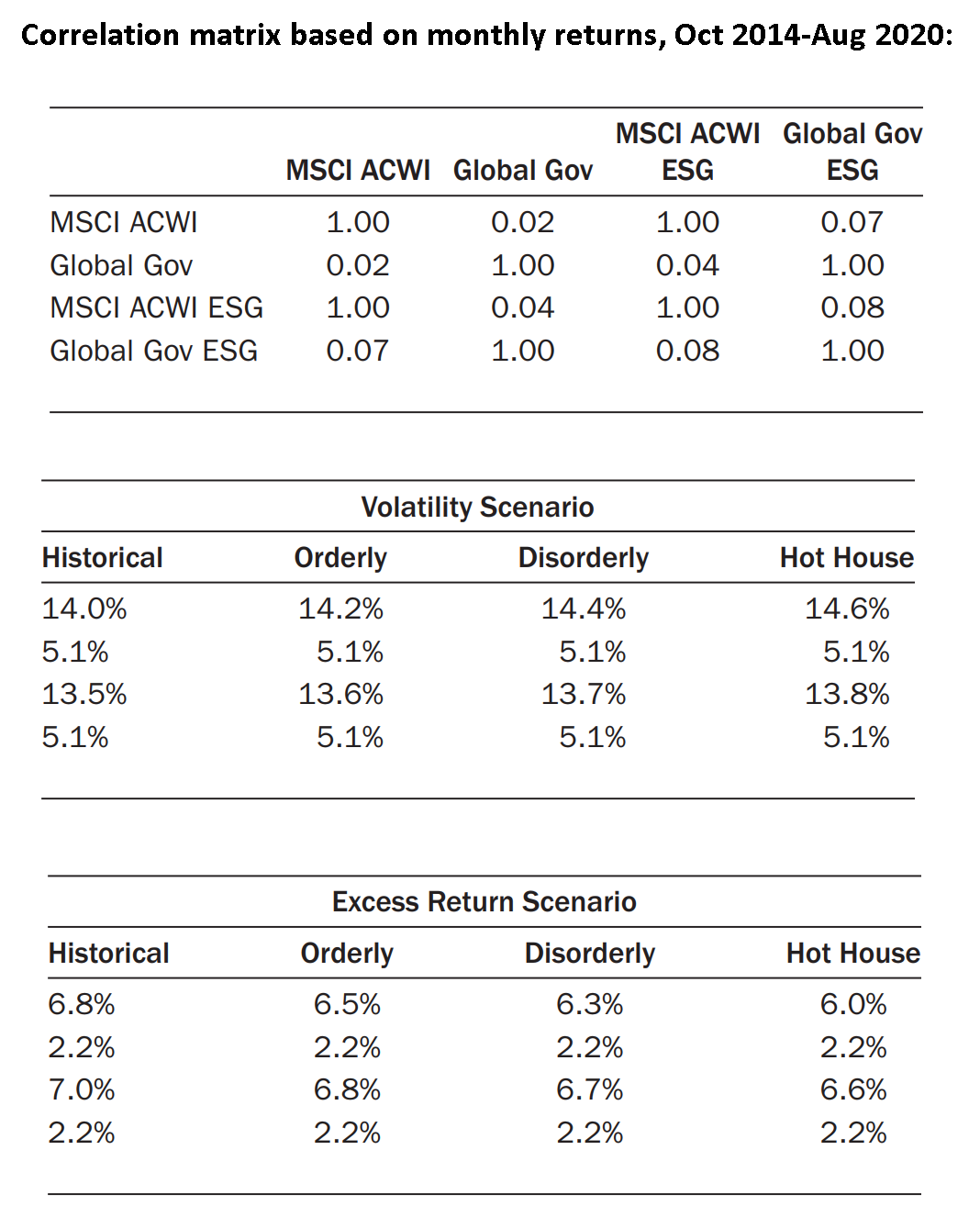

The traditional assets used in the analysis include the MSCI ACWI(1) and the J.P. Morgan Global Government Bond index(2). The ESG assets used include the MSCI ACWI ESG index(3) and the J.P. Morgan Global Government Bond ESG index (4). The cash index for excess returns is the Bloomberg Barclays Short Treasury 1–3 Month Total Return index(5). The observation period includes monthly data from October 2014 through August 2020.

Three climate change scenarios are analyzed and compared to a baseline historical scenario.

- The “orderly” scenario is the least disruptive scenario limiting global warming change to less than 2 degrees C where firms, governments, and households have sufficient time to adapt. Although the measures of risk, return, and correlation differed slightly from the historical, optimal allocations did change.

- The ”disorderly” scenario assumes a delay in which government policy changes, firm, and household adjustments do not begin to occur until 2030. Assuming higher costs associated with the later transition, the expectation is that higher risk premiums will prevail.

- The “hot house” is the third and most extreme scenario similar to the “disorderly” with the transition beginning in 2080 and a 3 degree C increase in temperature. It is characterized by extreme weather events, severe migration, and agricultural shifts.

What are the Academic Insights?

- Estimates of return and risk for climate change scenarios were based on methodology from Kahn et al. (2019) and Chudik, Pesaran, and Yang (2017). The reader is referred to the article and associated references for a detailed description of the modeling.

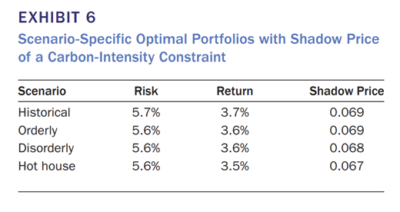

2. The authors use the traditional mean-variance optimization framework which allows the incorporation of constraints and information contained in each of the climate-change scenarios. They include an estimate of the cost of the ESG constraint by adding a shadow price. The shadow price represents the extent to which a relaxation of the constraint will improve the optimization objective of maximizing the Sharpe ratio. In other words, how much of the Sharpe ratio the investor will forgo (cost) if the climate constraint is imposed (benefit of achieving the ESG goal).

For the three climate-change scenarios, the optimized portfolios contained 46% in the Government Bond Index and 0% in the MSCI ACWI equity index. Traversing the historical to the hot house scenario, as shown in Exhibit 6, the allocation to ESG equity index dropped to 30% from 32%, and the allocation to the ESG bond index increased from 22% to 25%. The change in basis points of risk and return is a clear indication of the shadow price of imposing the constraints. Whether or not the costs are “worth it” is a matter of preference.

Why does it matter?

Although markets are generally thought to be efficient, longer-term risks take a backseat to salient short-term concerns. Climate change is the type of risk/reward opportunity that markets are less likely to price efficiently. In this article and other research, the climate-induced downward pressure on returns and upward pressure on volatility is documented. The authors demonstrate that portfolios constructed without such considerations produce portfolios that are very different from those constrained by climate and temperature change considerations. Adopting a methodology and process that incorporates various scenarios on temperature change possibilities provides an opportunity for investors to assess and balance the consequent patterns of risk and returns.

The most important chart from the paper

Abstract

It has become generally accepted that climate change affects economic variables such as growth and inflation. Via these economic channels, it is likely that climate change will also affect asset returns and risks. The authors provide evidence-based estimates of what these effects are and discuss how to incorporate climate change to build portfolios that are robust to a variety of climate change scenarios.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.