The Role of Factors in Asset Allocation

- Mark Kritzman

- Journal of Portfolio Management

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

What is the role of factor investing and asset allocation? Should investors substitute factor exposures for asset classes in constructing strategic portfolios? Or should factors be used as an instrument to enhance the performance of asset class-based allocation schemes? There are still quite a few questions surrounding the implementation of asset allocation strategies even though they have permeated investment practice over decades.

In this piece, Mark Kritzman, comes down on the side of using factor exposures only as enhancers in the standard asset class allocation strategy. Using a structured framework for evaluation, he argues the advantages and disadvantages of using asset classes as building blocks and discusses how factors can act as portfolio enhancers.

- What types of factors are used in factor allocation strategies?

- What are the advantages and disadvantages of factors vs. asset classes in allocation?

- Can factors and asset classes be used in combination?

What are the Academic Insights?

- THREE TYPES: STATISTICAL, ECONOMIC, ATTRIBUTE.

- Statistical factors are estimated by principal components analysis. Remember eigenvectors? Ugh. The returns from securities are essentially separated into a multi-dimensional scatterplot in a systematic fashion. The first dimension is the linear combination that explains the largest amount of variability of the returns. The second, independent of the first, explains the largest amount of the remaining variability and so on. Seems reasonable, however the problem is in the actual identification or “naming” of the components as each one reflects a number of influences that have come together at the time the returns are observed. The out-of- sample performance of statistical factors of this type is likely to be very poor. As a result, statistical factors are considered to be unreliable and rarely used.

- Economic factors are a much different animal. They have “face validity”, in that they capture various facets of economic activity. Being fundamental in nature they are easily understood and measured: inflation, growth, interest rates, unemployment and so on. However, economic factors are not investible and must be proxied with securities that are sensitive to those variables. Economic factors are very useful for those with a specific point of view on the future performance of specific economic factors and how that performance will affect securities. As the performance of economic factors vary over time, tactical bets can be made.

- Attribute factors are simply characteristics of securities. The idea here is that those characteristics reflect risk and carry a risk premium along with ownership of the security. For example, equities with small market capitalization or low P/E ratios would be considered riskier and exposure to those factors in a portfolio would provide higher expected returns. The premium associated with attribute factors is not available to investors in asset classes, thereby, providing an opportunity to asset allocators to enhance standard asset class allocation strategies.

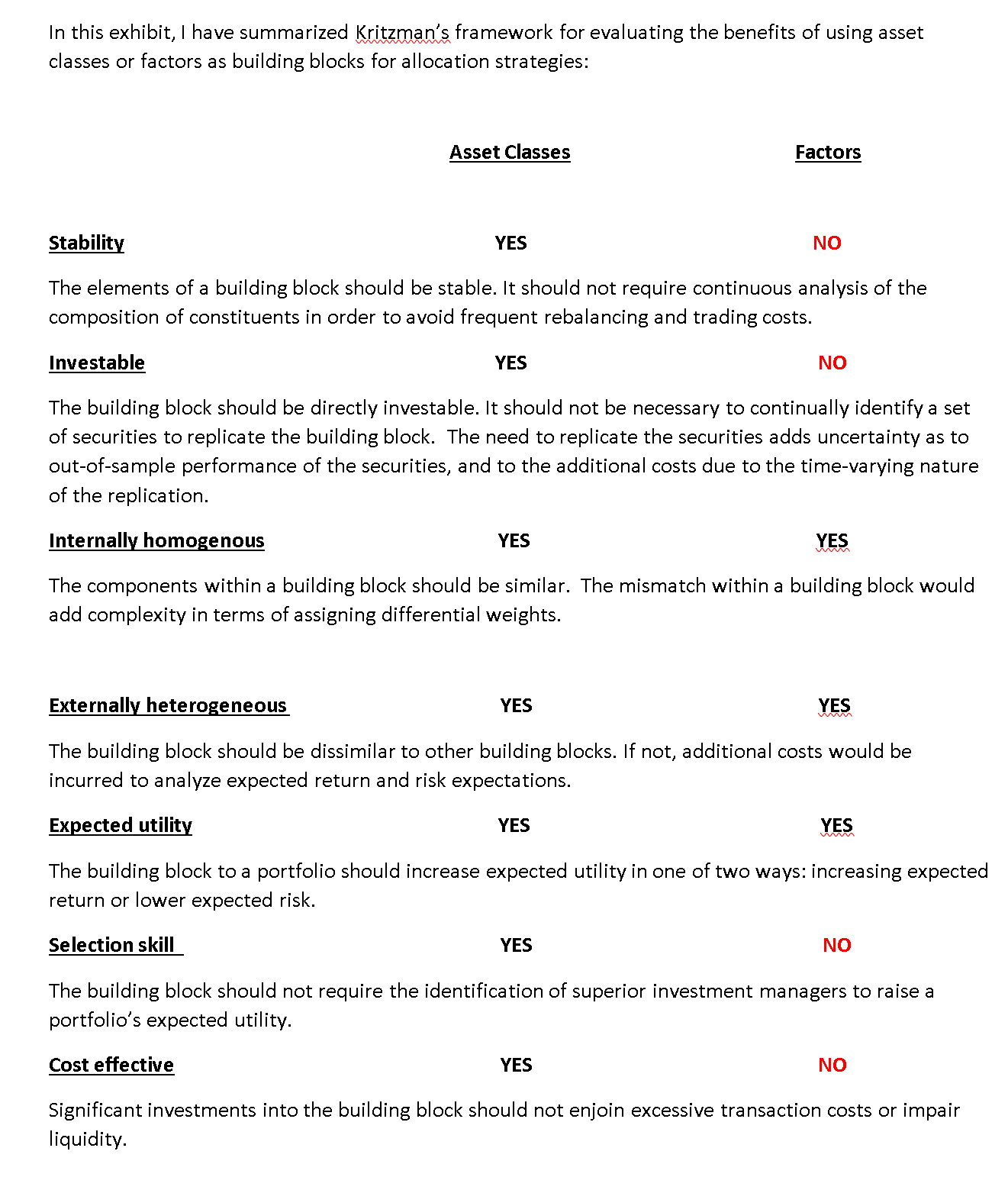

- The advantages of using asset classes as the building blocks for asset allocation far outweigh the advantages of using factors. Regardless of how factors are constructed (statistical, economic, or attributes), they are certainly not stable. Factor exposures must be continuously re-estimated and portfolios rebalanced. A costly requirement. Also, they are not directly investable. Another cost for investors. The securities used to gain factor exposures may not be liquid. Ka-ching. None of these drawbacks are present (or exist to a lesser extent) with traditional asset classes. I summarize the evaluation in the exhibit below.

- YES. INVESTORS CAN HAVE IT BOTH WAYS. Assuming the hypothesis that asset classes are superior building blocks, there is a role for factors in asset allocation. Factors present at least two sources of incremental return

- Make tactical bets. Overlaying economic factor bets assuming skill in forecasting economic performance as opposed to asset class performance.

- Extract factor risk premiums. There is significant and compelling evidence that attribute factors carry a risk premium across asset classes. An overlay or portfolio tilt that extracts risk premiums associated with the most reliable factors could add value.

Why does it matter?

In this thought piece, Kritzman provides a systematic and appealing argument for the integration of factors of any type with traditional asset class allocation. Using asset classes is less risky and less costly than using factors as building blocks, however, factors do represent an opportunity to enhance returns on a systematic basis. The reconciliation of the two approaches lies in the efficient application of each relative to their strengths and weaknesses and could be accomplished within the standard mean-variance framework. That would entail an adjustment of the objective function to include a constraint that incorporates a preference for a specific factor profile or limits the deviation from the desired factor profile. Commercial products that offer a factor tilt or overlay within an asset class could also be used.

The most important chart from the paper

Abstract

For many decades, asset classes have been the main building blocks for constructing portfolios, and, appropriately, they still are. However, in recent years investors increasingly have considered factors as an alternative to asset classes. In some cases, the motivation to substitute factors for asset classes is misguided, but factors can serve a valuable role in portfolio composition. The author discusses how investors should consider factors when constructing portfolios and, in doing so, exposes their misuse as well as their proper role in asset allocation.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.