As mind-bending as it sounds, although a company’s internally generated intangible investments generate future value, they are currently not accepted as assets under US GAAP. Omission of this increasingly important class of assets reduces the usefulness and relevance of financial statement analysis that uses book value. In fact, Amitabh Dugar and Jacob Pozharny, authors of the December 2020 study “Equity Investing in the Age of Intangibles, (summary and here and here)” concluded that the relationship between financial variables and contemporaneous stock prices has weakened so much for high intangible intensity companies in both the U.S. and abroad that investors can no longer afford to ignore the changes in the economic environment created by intangibles.

Recent studies have attempted to overcome this deficiency by capitalizing the outlays reported in selling, general, and administrative (SG&A) expenses and estimating book values with capitalized intangibles. However, those studies relied on one-size-fits-all mechanical rules of thumb, such as treating a uniform 30, 50, or even 100 percent of SG&A as investments and assuming the same useful lives of SG&A investments across all industries.

Compounding this one-size-fits-all capitalization assumption are the questions of how much of research and development (what proportion of maintenance R&D—outlays that improve products and processes for the current period, not the distant future—and what proportion of investment R&D) to capitalize and over what period they should be amortized. These assumptions are critical to estimating book values with capitalized intangibles. In fact, a tenet in International Accounting Standard (IAS) 38 of the International Financial Reporting Standards (IFRS) Foundation is the requirement that firms distinguish between investment and maintenance R&D.

Attempting to address this problem, Aneel Iqbal, Shivaram Rajgopal, Anup Srivastava and Rong Zhao, authors of the September 2021 study “Value of Internally Generated Intangible Capital,” proposed a new method to estimate the industry-specific capitalization and amortization rates for research and development and SG&A outlays. They estimated:

“Two regressions, one with R&D as the dependent variable and the other with MainSG&A (SG&A less R&D), on current revenues and a series of future revenues, with all variables scaled by average total assets. The focus on future revenues implicitly leads to the inclusion of R&D and MainSG&A expenditures that produce future benefits and exclusion of those that turn out to be unproductive, ex post. Ideally, from a financial statement user perspective, the former should be capitalized and included in the assets, and the latter should not be. A better identification of either category of expenses should lead to better estimates of book value than a method based on mechanical rules of thumb.”

They explained:

“We use expenditures as the dependent variable (and not as an independent variable, as in prior studies). Second, we use future revenues as the outcome variables (and not the operating income, used in prior studies). These modifications enable us to identify the optimal lag structure by industry, that is, the model that shows the best association of current expenditures with future revenues. Our method simultaneously identifies the investment portions and the useful lives of intangible expenditures. The investment portion is the part of intangible expenditures associated with future revenues, and useful life is the optimal number of future revenues that maximizes the adjusted R-squared of the equation estimated.”

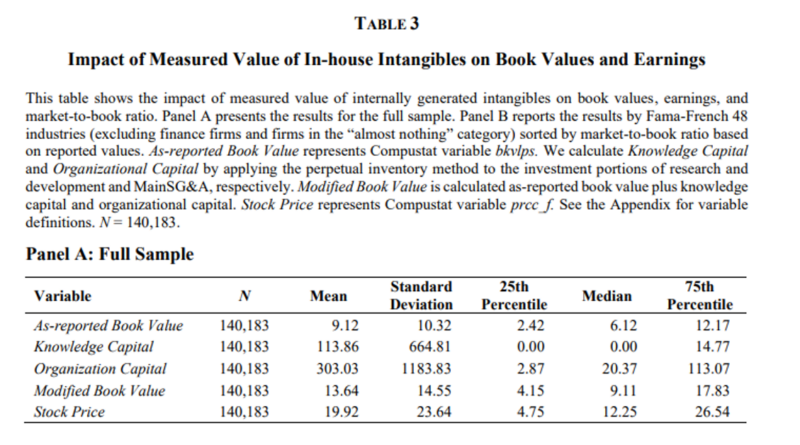

For each industry, they selected the model that gave the highest adjusted R-squared. Once they estimated the investment portions of R&D and MainSG&A and their amortization schedules, they computed the capitalized values of intangibles using a perpetual inventory method and then added the capitalized values to reported values to recalculate what they called the “modified book values” of equity. Their data sample covered the period 1975-2018 and more than 13,000 firms across 48 industries. Following is a summary of their findings:

- The investment portions of R&D and MainSG&A differed dramatically across industries. For example, investment portions of R&D for pharmaceutical products, medical equipment and computers were 92%, 89% and 74%, respectively—it was not 100% even for the most innovative industries.

- For most industries, the investment portion was less than 50%. For instance, the investment portion was less than 5% for business supplies and transportation industries, indicating that most of their MainSG&A supported current, not future, operations.

- The useful lives for R&D and MainSG&A also differed across industries, averaging 5.1 and 2.7 years, respectively. For example, for R&D, useful life varied from zero years for the recreation industry to seven years for pharmaceutical industries. For MainSG&A, useful life ranged from zero for textiles to five years for communications. Thus, the amortization schedules of intangible investments are not uniform across industries.

- The useful lives of MainSG&A are shorter than considered in prior literature, which was typically five years for studies assuming a 20% amortization rate.

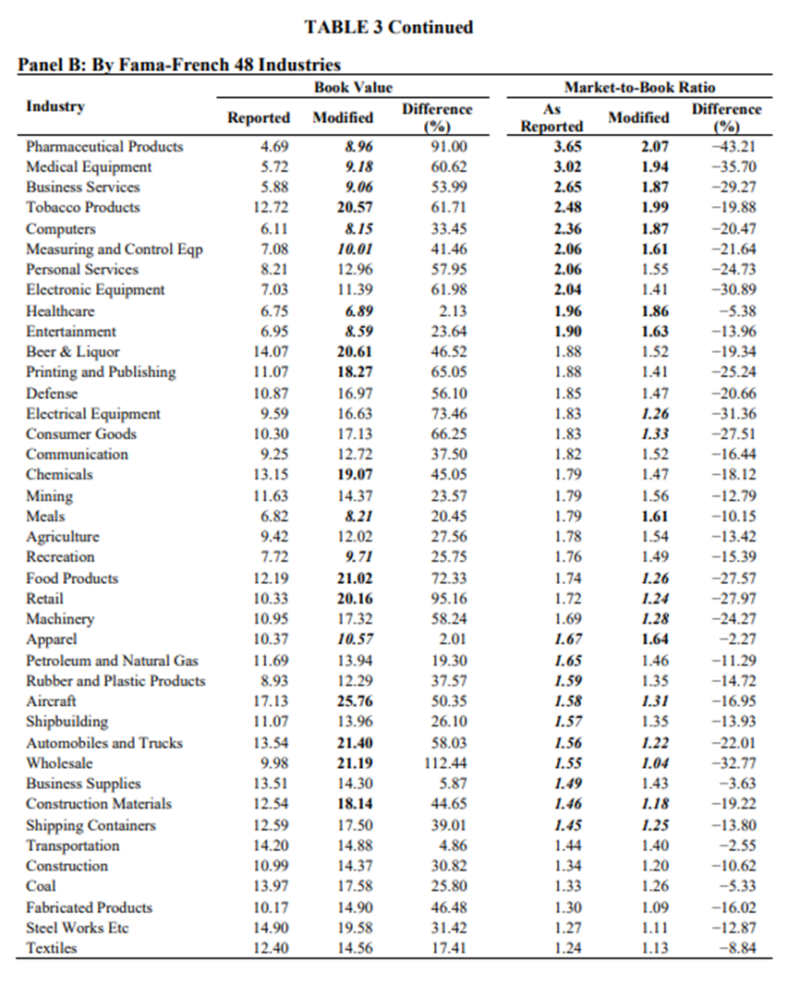

- After capitalization of internally generated capital stock, the average book value increased almost 50%—book values increased in all cases, but the increase varied across industries, from just 2% to as much as 112%.

- The market-to-modified book ratio displayed lower intra-industry variation—there was a relatively greater similarity in growth prospects of industry firms after considering the role of intangibles.

- For most intangible-intensive industries, the larger changes were observed in pharmaceutical products (book value increased by 91%), medical equipment (book value increased by 61%), business services (book value increased by 54%), tobacco products (book value increased by 62%) and computers (book value increased by 33%). In contrast, for many old-economy industries, such as transportation, business supplies and shipbuilding, no significant change was evident in book value or the market-to-book ratio.

- The modified book value exhibited greater association with future risk-adjusted returns, future investments and bankruptcy probability per the Altman Z-score model relative to both as-reported book values and the mechanically adjusted book values, and their results were stronger for intangible intensive industries, such as high tech and health tech, than other industries.

Their findings led Iqbal, Rajgopal, Srivastava, and Zhao to conclude that their

“capitalized values are more useful for predicting future outcomes such as risk-adjusted returns and investments relative to extant methods used by the literature.”

Summary

The relatively poor performance of value stocks over the past decade has led researchers to seek explanations. Since the past decade has also witnessed a dramatic increase in spending on intangibles (not just research and development and advertising expenditures, but expenses related to human capital) relative to capital expenditures on plant and equipment, it should not be a surprise that researchers, including the authors of the 2020 studies “Explaining the Recent Failure of Value Investing,” “Intangible Capital and the Value Factor: Has Your Value Definition Just Expired?” and “Equity Investing in the Age of Intangibles,” have investigated the impact on equity valuations and returns resulting from the change in the relative importance of intangible assets compared to physical assets. The findings have been consistent that the increasing importance of intangibles, at least for highly intangible industries, is playing an important role in the cross-section of returns and thus should be addressed in portfolio construction. For example, not accounting for intangibles affects not just value metrics but other measures, such as profitability, which often scale by book value or total assets, both of which are affected by intangibles—and investors recognize at least some of their value.

While my crystal ball is always cloudy when it comes to predicting securities prices, given the increasing role intangibles are playing, it’s safe to say we will be reading more papers that try to identify the best way to measure the value of intangibles and their impact on expected returns. In the meantime, academics and fund managers have tried to address the issues related to intangibles not being on the balance sheet through various methods. One is to use alternatives to price-to-book (P/B) as the value metric, such as price-to-earnings (P/E), price-to-cash flow (P/CF), and enterprise value-to-earnings before interest, taxes, depreciation, and amortization (EV/EBITDA). Many fund families (such as Alpha Architect, AQR, BlackRock, Bridgeway, and Research Affiliates) use multiple metrics. Another alternative is to add other factors into the definition of the eligible universe. For example, since 2013 Dimensional has included profitability as a screen in their value funds. A third alternative is to add back to book value an estimate of the value of intangibles, such as R&D expenses. A fourth way to address the issue is to apply what some call “contextual” stock selection, using different metrics or different weightings of those metrics depending on the intangible intensity. For example, if book value is not well specified for industries with high intangibles, it may be less effective in those industries than in industries with low intangibles. Stay tuned.

Important Disclosures

The content contained is for informational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based on third party data which may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of the Buckingham Strategic Wealth® and Buckingham Strategic Partners®, collectively Buckingham Wealth Partners. Neither the Securities and Exchange Commission (SEC) nor any state or federal agency has approved, confirmed the accuracy, or determined the adequacy of this article. LSR-21-153

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.