Multi-factor, long-short portfolios have provided significant portfolio diversification benefits by adding unique sources of risks that have historically produced premiums that meet the criteria Andrew Berkin and I established in our book “Your Complete Guide to Factor-Based Investing”—the premiums have been persistent, pervasive, robust to various definitions, survive transactions costs and have behavioral- or risk-based explanations for believing that the premiums are likely to persist.

It’s a Multi-Factor World

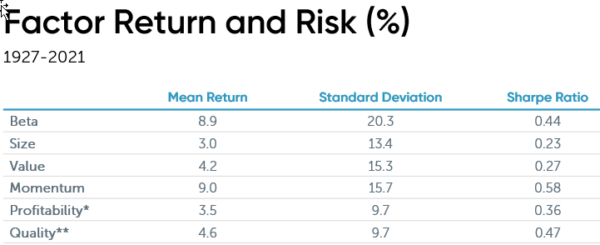

The 1993 study “Common Risk Factors in the Returns on Stocks and Bonds” by Eugene Fama and Ken French proposed that in addition to the market beta factor of the capital asset pricing model (CAPM), exposure to the factors of size and value further explain the cross-section of expected stock returns. Fama and French demonstrated that we lived not in a one-factor world, but in a three-factor world. Since then, academic research has improved on the Fama-French three-factor model, adding other factors that meet all the criteria, including profitability, quality, and momentum. The table below shows the historical returns, risk, and Sharpe ratios for all these factors.

Data for the beta, size, value, momentum, and profitability premiums is based on annual premiums from the Ken French library. Quality data is from AQR and compounded to approximate an annual premium. Indices are not available for direct investment and the data does not reflect expenses associated with the management of an actual portfolio.

The findings of additional unique factors with attractive risk/return characteristics presented investors with further opportunities to diversify their portfolio’s sources of risk and return and raised the question of how these findings should impact investment strategy.

Investment Strategy Principles

At Buckingham Strategic Wealth, our investment strategy is based on three core principles. First, markets are highly, though not perfectly, efficient. That leads to the conclusion that active management is the loser’s game. Instead, investors are best served by funds that define their eligible universe and then implement their strategy using systematic, transparent, and replicable methodologies. Second, if markets are efficient, you should then believe that all unique sources of risk have similar risk-adjusted returns—not similar returns, but similar risk-adjusted returns. Third, suppose all unique sources of risk have similar risk-adjusted returns. In that case, portfolios should be diversified across as many unique/independent sources of risk and return as you can identify that meet the criteria of persistence, pervasiveness, robustness to various definitions, implementability and have intuitive risk- or behavioral-based explanations that provide reasons for believing that the premium should persist in the future. The problem is that a single risk dominates traditional portfolios—because equities are much riskier than safe bonds (such as Treasuries), the typical 60 percent equity/40 percent bond portfolio has about 90 percent of its risk in market beta. The remaining exposure would be to term risk.

Believing that markets are efficient, and thus all risk assets should have similar risk-adjusted returns, you should not want to have 90 percent of your risk in one factor when academic research has uncovered other unique sources of risks that meet all the criteria we mentioned.

Independent Factors

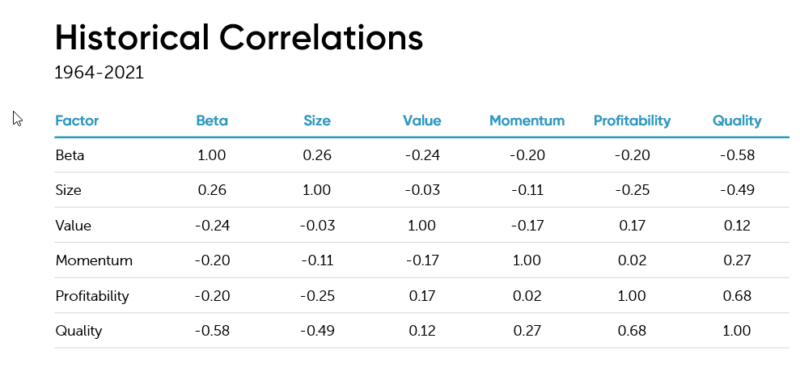

Evidence of the uniqueness (independence) of the factors can be seen when we examine their historical correlations to the market factor. High correlations would mean the risk factors would be relatively good substitutes. If that were the case, while investors could increase their portfolio’s expected return (and risk) by increasing their exposure to these risk factors, there would be little real diversification benefit. If the correlations are low, investors could increase expected returns for a given level of risk and gain a diversification benefit. Thus, finding factors with low correlation provides valuable information we can use to build more efficient portfolios. The table below presents the historical correlations for the six most prominent factors.

Diversification Benefits

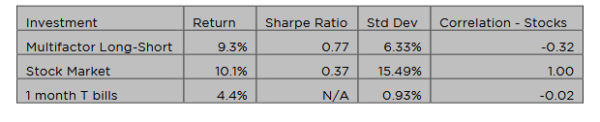

The benefits of combining these unique factors in a portfolio can be seen in the following analysis performed by the research team at the investment management firm Counterpoint. They modeled an equal-weighted portfolio of returns to long-short market neutral value, profitability, and momentum strategies as provided in the Kenneth French Data Library. The period is July 1963-August 2022. As you can see, while the return to the multi-factor strategy was, in relative terms, about 8 percent below that of the market portfolio (9.3 vs 10.1), the standard deviation was almost 60 percent lower (6.33 vs. 15.49). The result was a Sharpe ratio that was more than double that of the market. In addition, the multi-factor long-short portfolio had a negative correlation to the market portfolio, making it a candidate to provide a buffer against bear markets and reduce sequence risk for those in the decumulation of the portfolio phase.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

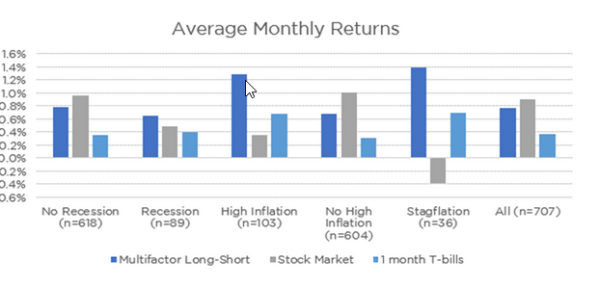

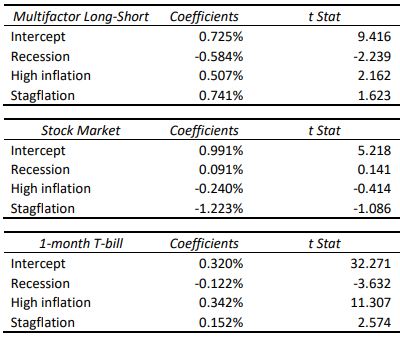

To determine if a multi-factor approach has provided diversification benefits in terms of exposure to economic cycle risks, the research team at Counterpoint evaluated returns to multifactor long-short strategies, stocks, and 1-month T-bills in a variety of economic conditions (recession or no recession, high or no high inflation, and stagflation) over the period July 1963-August 2022. Their definitions for the economic regimes were:

- Recession: Negative sequential GDP growth, lagged one month to adjust for “look-ahead” bias.

- High inflation: Year-over-year CPI change of more than 6.4 percent, one standard deviation above the mean CPI change, lagged one month to adjust for look-ahead bias.

- Stagflation: Simultaneous “recession” and “high inflation,” as defined above.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

As you can see in the above chart, long-short factor strategies’ relative consistency of returns has historically been helpful during challenging macroeconomic periods, especially for portfolios containing meaningful public or private equity exposure.

We can make a few observations from their conditional analysis:

- Factor strategies have been meaningfully less volatile than stocks—their returns were more consistent across macroeconomic scenarios.

- Stocks’ average returns experienced drag in recessionary, high-inflation, and stagflationary periods.

- Multifactor strategies performed better than their average when inflation was high (t-stat=2.2), including during stagflation (t-stat=1.6). Recessions, however, result in headwinds for them (t-stat=2.2), although the return was still positive.

Key Takeaways for Multifactor Long-Short Strategies

As you have seen, the evidence demonstrates that multi-factor strategies have shown strong long-run diversification potential within a strategic allocation. Their relatively attractive returns, distinctive correlation profile, and low volatility compared to stocks make them useful portfolio components across macroeconomic regimes. In addition, during recessionary and high inflation periods multifactor long-short strategies have the potential to reduce portfolio volatility without a notable sacrifice to long-run returns—in recessions long-short multifactor strategies have experienced headwinds but still have neutral-to-positive expectations and when inflation is high or amid stagflation, they tended to experience strong tailwinds. This is in distinct contrast to other risk assets such as debt assets with meaningful credit risk and venture capital which loses some of their diversification benefit in strained macroeconomic environments.

The conclusion you should draw is that multifactor long-short portfolios, which have provided uncorrelated strategies with reasonable positive return expectations, have the potential to dampen downside associated with macroeconomic shocks, thus reducing sequence risk. Two examples of long-short factor funds that should be considered are AQR’s Style Premia Alternative Fund (QSPRX) and their Alternative Risk Premium Fund (QRPRX).

Larry Swedroe is head of financial and economic research for Buckingham Wealth Partners.

Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third party information and may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured authors are their own and may not accurately reflect those of Buckingham Strategic Wealth® or Buckingham Strategic Partners®, collectively Buckingham Wealth Partners. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article. LSR-22-404

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.