The article aims to explore the possibility that changes in fundamentals play a role in the attenuation of stock market anomalies, offering an alternative explanation to the prevailing arbitrage-based explanation.

Can the changes in fundamentals explain the attenuation of anomalies?

- Choi, Lewis and Tan

- Journal of Financial Economics, 2023

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

- Have the four categories of anomalies decayed in recent years?

- Are the changes in fundamental performance responsible for the decay of anomalies in the categories of Momentum, Value, Investment and Profitability?

- Can the attenuation of anomalies be attributed to reduced costs of arbitrage or the publication of these anomalies on academic journals?

What are the Academic Insights?

By analyzing data from the investor population in Finland (during the period 2004-2008) as well as employing various methodologies and identification strategies to explore the role of social influence within the family, the authors find:

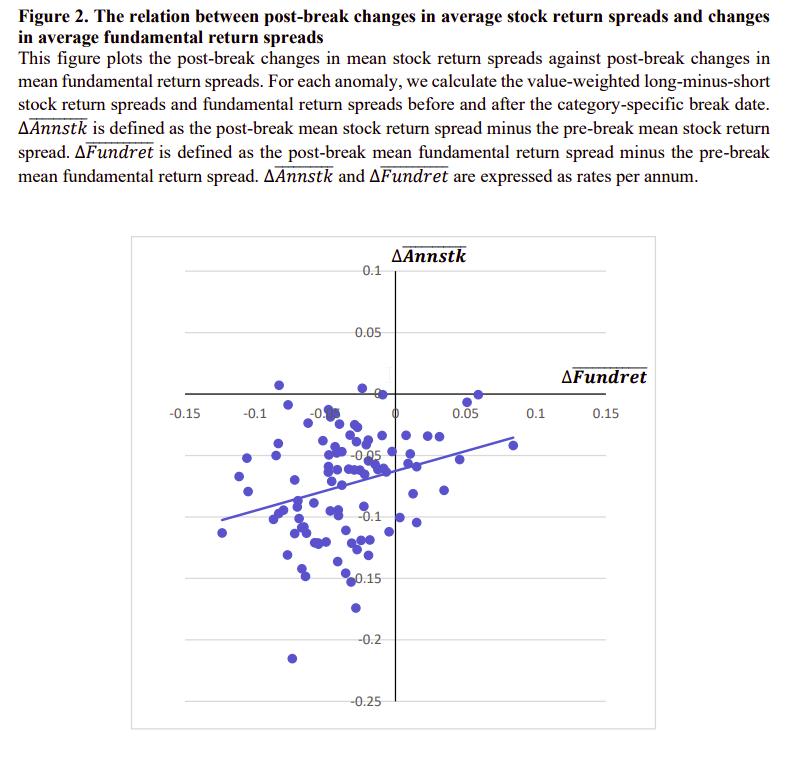

- YES – there are structural breaks in the returns to all four categories of anomalies with the following dates: September 2002 for Momentum, June 2006 for Value, January 2004 for Investment, and July 2002 for Profitability. The average anomaly’s long-minus-short fundamental return spread decreased by 59% from the pre-break level with the following specifics: Momentum by 40%, Value by 57%, Investment by 64% and Profitability by 75%

- YES – they are responsible in the categories of Momentum, Investment and Profitability but NO- they are not able to explain the decay of Value anomalies

- NO – neither of those hypothesis can explain the attenuation

Why does this study matter?

This study is important because contrary to prior literature it provides initial evidence that the attenuation of a number of stock market anomalies is related more to time-varying discount rates rather than to improved market efficiency.

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

The existing literature attributes the recent decay of stock market anomalies to increased arbitrage activities (e.g., Chordia, Subrahmanyam, and Tong, 2014; McLean and Pontiff, 2016; Green, Hand, and Zhang, 2017). In this paper, we present evidence that the apparent demise of several prominent classes of stock market anomalies is better explained by changes in underlying fundamentals. The attenuation of anomalies in the Momentum, Investment, and Profitability categories are accompanied by a reduced difference in fundamental performance between the long- and short-leg portfolios, as measured by the fundamental return from a two-capital investment CAPM. After accounting for the change in fundamental return, the attenuation of Investment and Profitability anomalies decreases to statistically insignificant levels. These results are consistent with the q-theory of investment, which attributes the attenuation of stock returns and fundamental returns of anomalies to the time variation in discount rates implied by fundamentals. We also show that neither academic publication nor proxies for increased arbitrage activities can explain the attenuation of these anomalies.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.