This study provides valuable insights into how private equity performs in regions outside North America, reflecting broader trends in global investment.

Financial Literacy and Financial Resilience: Evidence from Italy

- Tommar, Darolles, Jurczenko

- Financial Analyst Journal, 2024

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

By studying the fund-level cash flow data from Eurekahedge, the authors ask the following questions:

- What are the characteristics of fund returns in international private equity markets, particularly in regions outside of North America?

- How do fund performance and persistence vary across different investment geographies and fund investment styles?

- How do international private equity fund returns compare with those of North American funds, and what implications does this have for investors targeting international markets?

- How does capital inflow affect subsequent fund performance in different geographical regions?

- Are there any differences in the factors driving fund performance between North American private equity markets and those in Europe, Asia-Pacific, and other regions?

What are the Academic Insights?

The authors find:

- Buyout funds perform well in Europe, comparable to North American buyouts, with global buyout funds generally outperforming their North American-focused peers. Growth strategies excel in Asia-Pacific. Venture capital returns are highest for global funds but remain relatively low elsewhere, particularly below North American venture capital returns

- Fund performance and persistence vary across different investment geographies and fund investment styles in several ways.

- Geographical Variation:

- Europe: Buyout funds perform well, similar to North American buyouts, with evidence of performance persistence for funds with a European focus.

- Asia-Pacific: Growth strategies excel, while venture capital returns are relatively low compared to North American markets. However, there is limited evidence of performance persistence in this region.

- Rest of the World (ROW): Limited data is available for this region, but there is no evidence of performance persistence.

- Investment Style Variation:

- Buyout Funds: Strong performance in Europe and evidence of persistence for European-focused funds and global buyout funds.

- Growth Strategies: Excel in Asia-Pacific, with limited evidence of performance persistence.

- Venture Capital: Best returns for global funds, but generally lower returns compared to North American markets and limited evidence of performance persistence.

- Persistence Patterns:

- Evidence of performance persistence is stronger for buyout funds with a European or global focus, suggesting a continuation of strong performance over time.

- Limited evidence of performance persistence is found in Asia-Pacific and ROW, indicating challenges in consistently achieving high returns in these regions.

- Geographical Variation:

- International private equity fund returns compared with those of North American funds show variations in performance and persistence, as highlighted in the article.

- Performance Comparison:

- Europe: Buyout funds in Europe perform comparably well to North American buyouts, with evidence of performance persistence for European-focused funds.

- Asia-Pacific: Growth strategies excel, but overall returns, especially in venture capital, tend to be lower compared to North American markets.

- Rest of the World (ROW): Limited data, but generally lower returns compared to North America.

- Implications for Investors:

- Diversification Benefits: Investing in international markets offers diversification benefits, especially when North American markets may be saturated or experiencing lower returns.

- Risk Management: Understanding regional variations in performance helps investors manage risk by allocating capital to regions with stronger performance and avoiding regions with lower returns.

- Opportunities for Growth: Despite lower returns in some regions, international markets offer opportunities for growth, especially in emerging economies where growth strategies may outperform.

- Due Diligence: Investors targeting international markets need to conduct thorough due diligence to understand regional dynamics, regulatory environments, and potential risks associated with investing outside North America.

- Access to Local Expertise: Partnering with local private equity firms in international markets can provide investors with access to local expertise, market insights, and deal flow, enhancing investment opportunities and mitigating risks.

- Performance Comparison:

- The impact of capital inflows on subsequent fund performance varies across different geographical regions, as outlined in the article:

- Europe:

- Large capital inflows negatively affect follow-on fund performance, similar to patterns observed in North America.

- Fund performance is significantly impacted by the amount of capital flowing into the industry, leading to lower subsequent returns as markets correct for inflated values at exit.

- This suggests that fund performance in Europe is influenced by market dynamics similar to those documented in North American funds.

- Asia-Pacific and Rest of the World (ROW):

- In these regions, fund performance does not seem to be significantly affected by capital inflows, contrary to what is largely documented in North America and Europe.

- Despite capital inflows, subsequent fund performance remains relatively unaffected, indicating differences in market dynamics compared to North American and European markets.

- Global Funds:

- Global funds seem to mitigate the effects of capital inflows due to their high geographical diversification.

- The impact of capital inflows on subsequent fund performance is less pronounced for global funds compared to regional funds, suggesting that geographical diversification helps buffer against market fluctuations caused by capital inflows.

- Europe:

- YES- there are differences in the factors driving fund performance between North American private equity markets and those in Europe, Asia-Pacific, and other regions. Here are some key distinctions:

- Investment Strategies:

- North American private equity markets may have a stronger focus on certain investment strategies, such as technology and innovation-driven ventures, compared to other regions.

- In Europe, traditional industries and established companies may play a larger role in private equity investments, influencing the performance drivers.

- Asia-Pacific markets might emphasize growth opportunities in emerging markets, leading to different performance drivers compared to North America.

- Regulatory Environment:

- Regulatory frameworks differ across regions, affecting the ease of doing business, exit strategies, and overall investment climate.

- Variations in regulatory environments can impact fund performance by influencing deal structures, investment timelines, and exit options.

- Market Dynamics:

- Market maturity and economic cycles vary across regions, leading to differences in deal flow, valuation multiples, and investment opportunities.

- North American markets, being more mature, may exhibit lower growth rates but higher stability compared to emerging markets in Asia-Pacific and other regions.

- Access to Capital:

- Availability of capital and investor appetite for private equity investments differ between North America and other regions.

- Differences in access to capital can impact fundraising efforts, deal sourcing, and overall portfolio management strategies, influencing fund performance.

- Managerial Expertise:

- Local expertise and industry knowledge vary among fund managers operating in different regions.

- Fund managers in North America may have deeper insights into specific industries or sectors prevalent in the region, while those in Europe or Asia-Pacific may specialize in regional markets and industries.

- Exit Environment:

- The availability of exit options, such as IPO markets, strategic acquisitions, or secondary buyouts, varies across regions, affecting fund performance.

- Differences in exit environments can influence investment strategies, portfolio management decisions, and ultimately, fund returns.

- Investment Strategies:

Why does this study matter?

This study offers valuable information for making informed investment decisions in international private equity markets. By understanding the performance drivers, risk factors, and geographical variations, investors can better allocate capital and optimize their portfolios for growth and diversification.

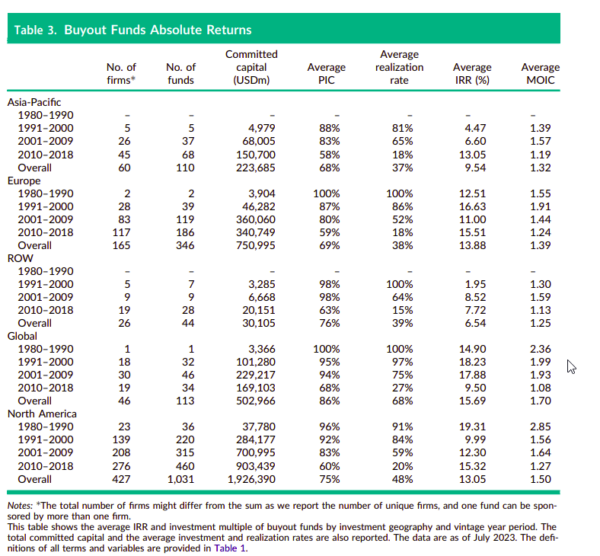

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index

Abstract

We construct a novel dataset to explore the returns of private equity in international markets (i.e., other than North America). We investigate fund performance and persistence and compare the findings to the extensive evidence on North American funds. We find that both investment strategy and investment geography characterize the performance and return persistence of private equity. Buyout funds have the highest returns in Europe, while growth equity funds perform better in Asia-Pacific. Venture capital returns are modest across all international geographies. As documented in the literature for North America, large capital inflows result in lower returns in Europe, while this does not affect other investment geographies. We also find evidence of important market segmentation and strong return persistence for buyout and growth funds in Europe, as well as for a sample of globally diversified, US-sponsored buyout funds. We do not find evidence of persistence in Asia-Pacific or other world locations. Our results are robust to different performance measures and various tests for selection effects. They also hold important implications for both fund managers and investors targeting international markets.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.