Predicting Material Accounting Misstatements

- Dechow, Ge, Larson and Sloan

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category.

Abstract:

We examine 2,190 SEC Accounting and Auditing Enforcement Releases (AAERs) issued between 1982 and 2005. We obtain a comprehensive sample of firms that are alleged to have misstated their financial statements. We examine the characteristics of misstating firms along five dimensions: accrual quality, financial performance, non-financial measures, off-balance sheet activities, and market-based measures. …. The output of this model is a scaled logistic probability that we term the F-Score, where values greater than one suggest a greater likelihood of a misstatement.

Alpha Highlight for Value Investors:

Stock prices are highly sensitive to firms’ earnings reports. It is not new to investors that managers would purposely manipulate earning announcements or delay bad news.

But investors are the ones who pay for it. Value investors should find ways to avoid frauds, manipulators, and financially distressed firms.

This paper provides a laundry list (Table 3) of variables that may help us uncover accounting shenanigans. The authors investigate a comprehensive sample of 2,190 AAERs between 1982 and 2005 and summarize the common characteristics of the misstating firms:

- Misstating firms have high accruals, show declining performance, are raising financing, and have high growth expectations embedded in their stock prices.

Let’s boil down these characteristics one by one:

- Accrual Quality

Cash flow doesn’t lie, whereas accrual-based income involves some manager discretion. Managers can juice accruals to manipulate short-term earnings, thus causing a stock to become temporarily misvalued (the “accrual anomaly”). The accrual anomaly was first highlighted by Sloan (1996). If you are not familiar with accruals, here is an old post that walks a reader through the process of how they work and how managers manipulate the marketplace via accrual accounting.

The time-series analysis results in this paper show that in the years prior to and during the manipulation phase, all accrual measures are unusually high.

- Financial Performance

The statistics show that ROA of misstating firms are generally declining; however, cash sales are increasing.

- Non-financial Measures

The paper shows that abnormal change in employees and abnormal change in order backlog can also help detect firms’ misstatements. Reduction in numbers of employees and orders may indicate declining demands for a firms’ products.

- Off-Balance Sheet Measures

While balance sheets are important barometers, some off-balance sheet indicators, such as operating Leases and pension plan assets, are also helpful clues. Specifically, the paper finds that the use of operating leases is unusually high during misstatement firm-years.

- Market-Related Variables

The paper studies the market-related incentives of these misstating firms. One possible incentive for misstatements is to maintain a high stock price. In line with this hypothesis, the results show that high P/E and M/B ratios are associated with firms that misstate results. Misstating firms also have unusually strong stock return performance in the years prior to misstatement.

How Do the Authors Build a Prediction Model?

The paper builds three models:

- Model 1 only includes financial statement variables;

- Model 2 adds non-financial and off-balance-sheet measures;

- Model 3 adds market-related variables.

Please refer the regression results in Table 7.

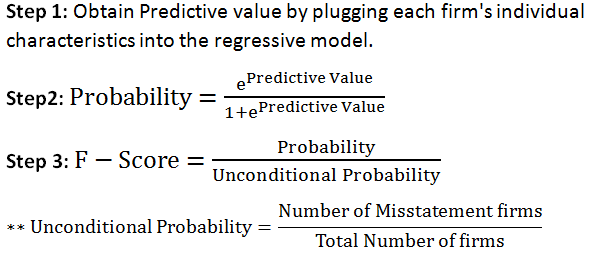

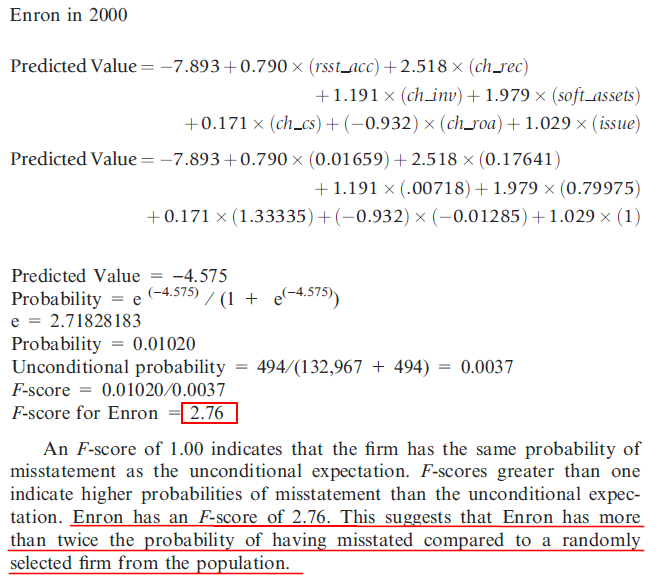

The paper uses F-score as the likelihood of manipulation. F-score is calculated below. We cite an example of how F-score is used for Model 1 for Enron in 2000.

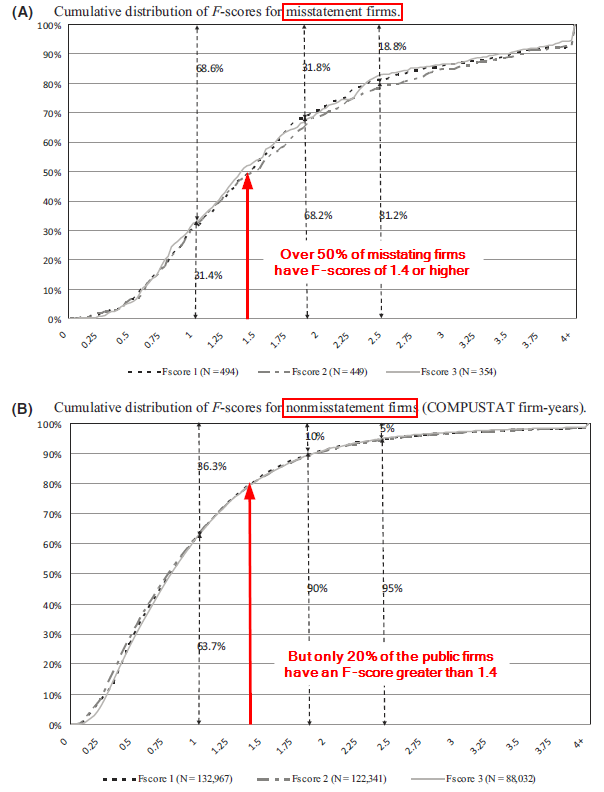

The charts below show that over 50% of misstating firms have F-scores of 1.4 or higher, while only 20% of non-misstatement firms have F-scores of 1.4 or higher. The average F-scores for misstating firms increase for up to 3 years prior to the misstatement, but decline rapidly to more normal levels in the years following the misstatement.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Please see disclosures for additional information. Additional information regarding the construction of these results is available upon request.

Key Takeaway

As systematic value investors, we’ve done a lot of work on using forensic accounting to identify financial fraud, manipulation, and financial distress. We’ve outlined a few techniques in the past. The current piece adds to our collection and we encourage value investors to investigate forensic accounting techniques to avoid buying the proverbial “falling knife.”

Good luck!

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.