Our goal is to democratize quant and help retail investors utilize quantitative tools to make better investment decisions.

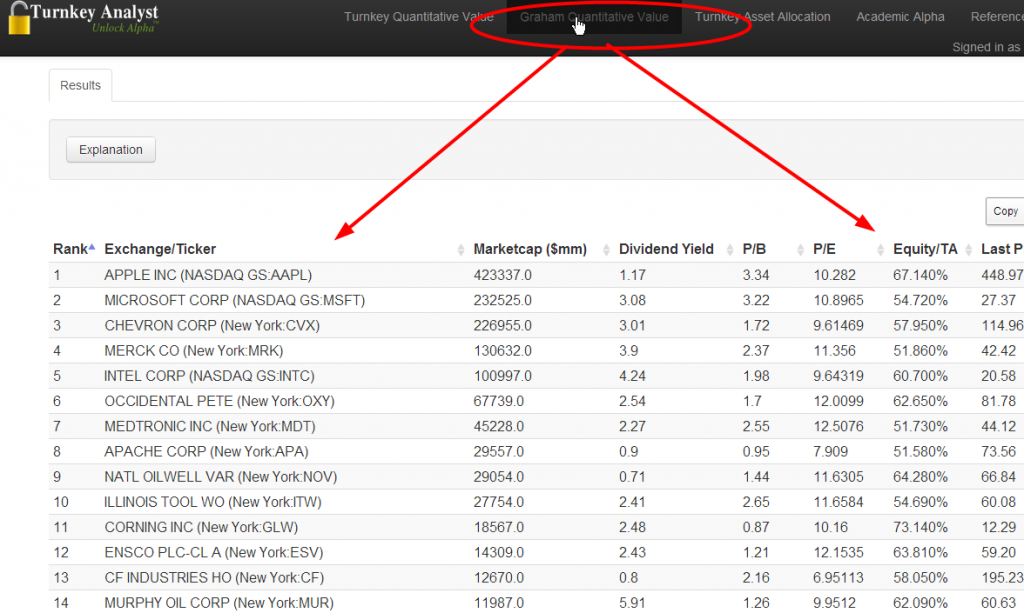

To this end, we have added our “Graham Quantitative Value” tool to our Turnkey Analyst Application.

Our Graham Quantitative Value tool simply follows the guidelines set forth by Graham in a 1976 article published in Medical Economics:

The Simplest Way to Select Bargain Stocks

Four simple concepts

-

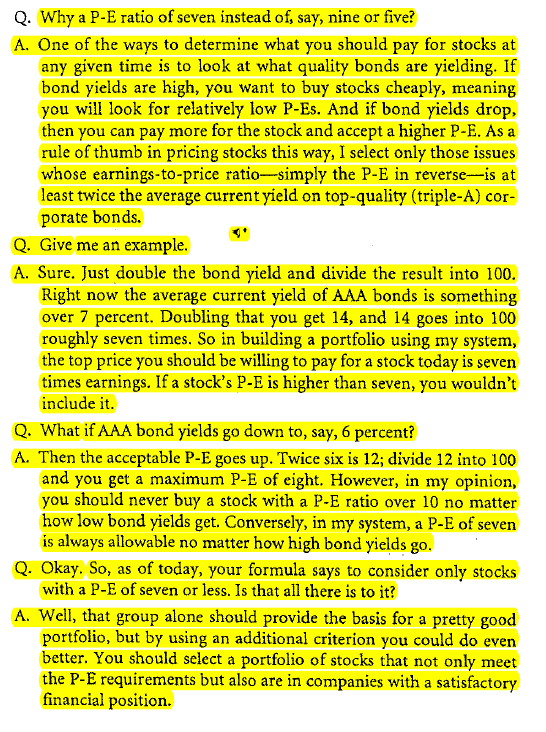

- Buy cheap stuff–only purchase stocks at a P/E that is 2x the AAA bond yield.

-

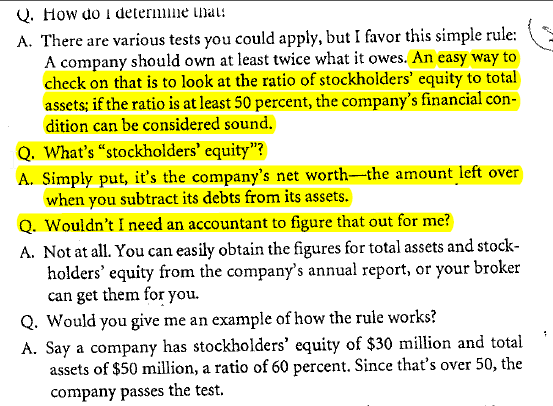

- Buy stuff that doesn’t have a lot of debt–only buy stocks that have common equity / total assets over 50%

-

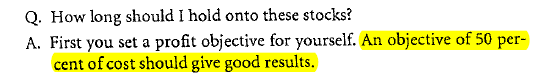

- Sell if a stock moves 50%+

-

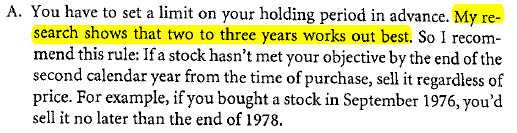

- Sell if a stock has been in the portfolio for 2 years

How to use the tool?

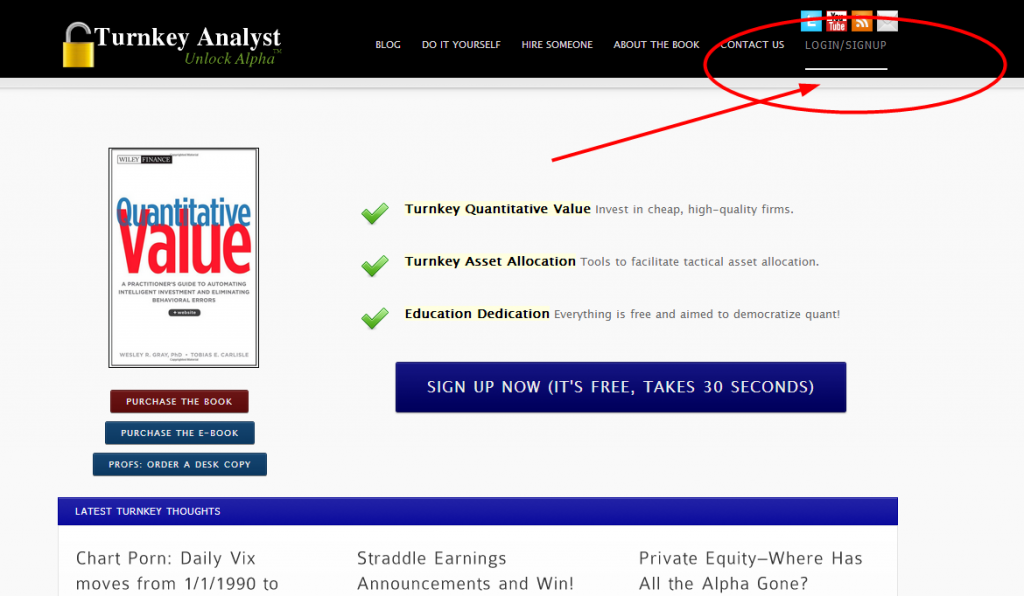

- Sign-up or login to the Turnkey Analyst application

- Access the Graham Quantitative Value screen

Some Last Minute Wisdom from Ben Graham

Some forty years after the publication of Security Analysis, Graham modified his approach in an important way. When asked in one of his last interviews whether he still selected stocks by carefully studying individual issues, Graham responded*:

I am no longer an advocate of elaborate techniques of security analysis in order to find superior value opportunities. This was a rewarding activity, say, 40 years ago, when our textbook “Graham and Dodd” was first published; but the situation has changed a great deal since then. In the old days any well-trained security analyst could do a good professional job of selecting undervalued issues through detailed studies; but in the light of the enormous amount of research now being carried on, I doubt whether in most cases such extensive efforts will generate sufficiently superior selections to justify their cost. To that very limited extent I’m on the side of the “efficient market” school of thought now generally accepted by the professors.

Instead, Graham promoted a highly simplified approach that relied for its results on the performance of the portfolio as a whole rather than on the selection of individual issues. Graham believed that such an approach “[combined] the three virtues of sound logic, simplicity of application, and an extraordinarily good performance record.”

Graham said of his simplified value investment strategy:**

What’s needed is, first, a definite rule for purchasing which indicates a priori that you’re acquiring stocks for less than they’re worth. Second, you have to operate with a large enough number of stocks to make the approach effective. And finally you need a very definite guideline for selling.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.