There are many blogs/funds/research promoting low beta stocks as a way to get rich:

- A blog example –Falken

- A fund example –AQR Defensive Fund

- A research example — Betting Against Beta by Frazzini and Pedersen

In general, I’m still in the R&D stage of trying to determine if the low beta strategy (at least in the context of stock selection) is really that different than a “value” factor wrapped in some fancy new clothes. I realize everyone runs their Fama French regression to hold constant HML loadings, but I’m just skeptical…

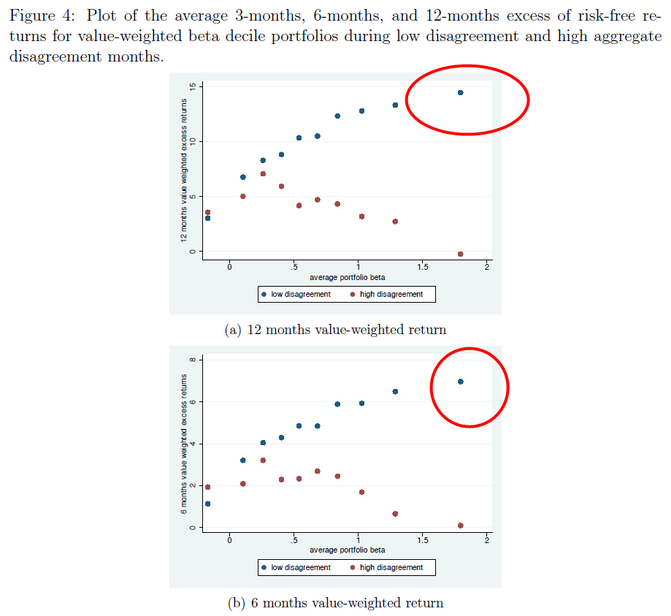

Hong and Sraer have a pretty cool paper explaining why low-beta might exist as a stand alone anomaly. The basic idea is that stocks with betas above a certain cut-off point and where investors expect a wide dispersion of possible outcomes, end up being overvalued. Why? Because in these high disagreement settings, investors who are extremely pessimistic about the stock will be unable to influence prices because of costly short-selling. Thus, on average, these higher beta, high disagreement stocks end up being overvalued.

[Not all high beta is bad; just high beta and high disagreement!] The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Anyway, still digesting this paper, but thought it would be good to share.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.