Paul Calluzzo, Fabio Moneta, and Selim Topaloglu, authors of the April 2025 study “Momentum at Long Holding Periods” investigated a key aspect of how academic momentum strategies are typically constructed when forming a portfolio. Specifically, at the end of each month t−1, the standard 12-2 momentum strategy sorts stocks based on their cumulative returns from month t−12 to month t−2 and goes long stocks that are in the top decile and short stocks that are in the bottom decile. The researchers noted:

“The academic definition of momentum, which is constructed with a one-month lag [because stocks experience reversals at short horizons] can help infer which stocks will exhibit momentum in the future.”

They explained:

“We know today which stocks will be in the top and bottom deciles next month based on cumulative returns from month t−11 to month t−1. We can also reliably predict which stocks will be in the momentum portfolio beyond next month. For example, momentum rankings based on returns from month t−10 to month t−1, have a correlation of 0.94 with the momentum rankings in two months, and rankings based on returns from month t−6 to month t−1 have a correlation of 0.72 with the momentum rankings in six months.”

Using this information, their goal was to develop new portfolio rules that would allow investors to maintain strong momentum exposure over longer holding periods, while addressing some of the practical challenges faced by traditional momentum strategies – a hurdle to achieving the momentum returns documented in the literature is the extremely high portfolio turnover required to rebalance the long and short legs of the strategy.

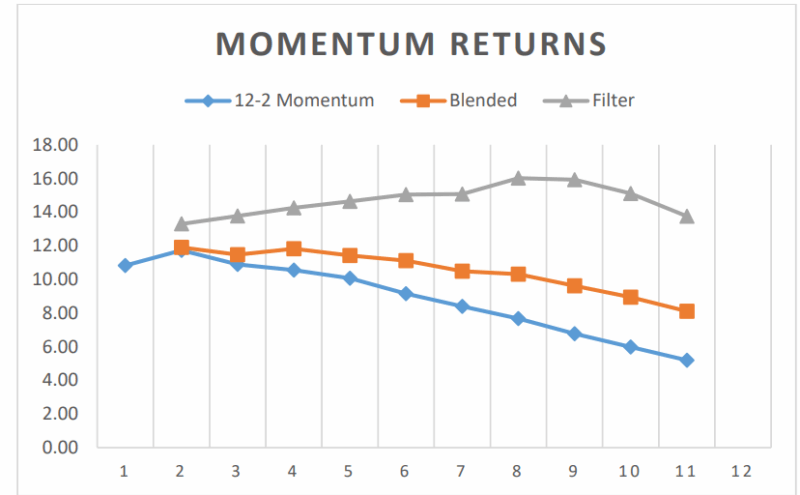

By exploiting the one-month lag in traditional momentum definitions, the researchers created new portfolio formation rules that improved upon standard approaches. For example, they created a filter rule so that if they knew a stock would exit the momentum portfolio next month, they would exclude it from the momentum portfolio this month. They developed two distinct momentum strategies:

“A concentrated approach that filters out stocks that will subsequently exit the momentum portfolio, and a more diversified approach that creates a blended momentum signal based on a stock’s current momentum and its anticipated future momentum. Both strategies exploit the fact that the returns used to build momentum portfolios beyond next month are partially known today, and that ranks based on these returns are highly correlated with future momentum ranks.”

Their data sample included U.S. common stocks traded on the NYSE, AMEX, and NASDAQ from January 1927 to December 2021 (December 2022 for subsequent returns), excluding utilities, financial firms, and stocks priced under $5. The following is a summary of their key findings:

- Lower Turnover: Their strategies dramatically reduced the frequency of buying and selling stocks, reducing trading costs.

- Lower Risk: The new approach produced more stable portfolios with reduced crash risk compared to conventional momentum strategies.

- Higher Capacity: The strategies can handle larger amounts of capital (because they hold more stocks) without negatively impacting returns, making them more scalable for larger funds.

- Reduced Decay in Post-Publication Returns: The net returns of blended and filtered strategies decayed less than the net returns of traditional 12-2 momentum.

- Improved Returns: Even after accounting for trading costs, the researchers estimated that their methods can boost net annual returns of momentum strategies by up to five percentage points. The long-only implementations of the blended and filtered portfolios also produced higher returns and Sharpe ratios than long-only 12-2 momentum at matching rebalancing horizons after accounting for potential trading costs.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Note: This figure plots the annualized net returns of the filter 11-1 and filter 11-2 momentum strategies at different rebalancing frequencies.

Investor Takeaways

Momentum Still Works: Momentum investing, which involves buying stocks that have performed well and selling those that have performed poorly, remains a viable strategy. However, the way you construct and manage your momentum portfolio matters greatly.

Longer Holding Periods Can Be Better: By holding stocks for longer and reducing how often you trade, you can lower costs and risk-potentially increasing your net returns.

Trading Costs Matter: High turnover eats into profits. The researchers’ approach shows that smart portfolio construction can significantly reduce these costs.

Adapt to New Research: The paper’s methods offer a way to keep momentum strategies effective even as markets evolve.

Scalability for Larger Investors: If you manage a large portfolio, these findings are especially relevant, as the new strategies can handle more capital without degrading performance.

Summarizing, for the average investor, this research highlights the importance of not just following momentum, but doing so with a thoughtful approach that minimizes costs and adapts to changing market dynamics. By leveraging the insights from this paper, investors can potentially achieve higher, more consistent returns from momentum investing.

Larry Swedroe is the author or co-author of 18 books on investing, including his latest Enrich Your Future. He is also a consultant to RIAs as an educator on investment strategies.

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.