Core Research Categories

Click Here for Category Archive

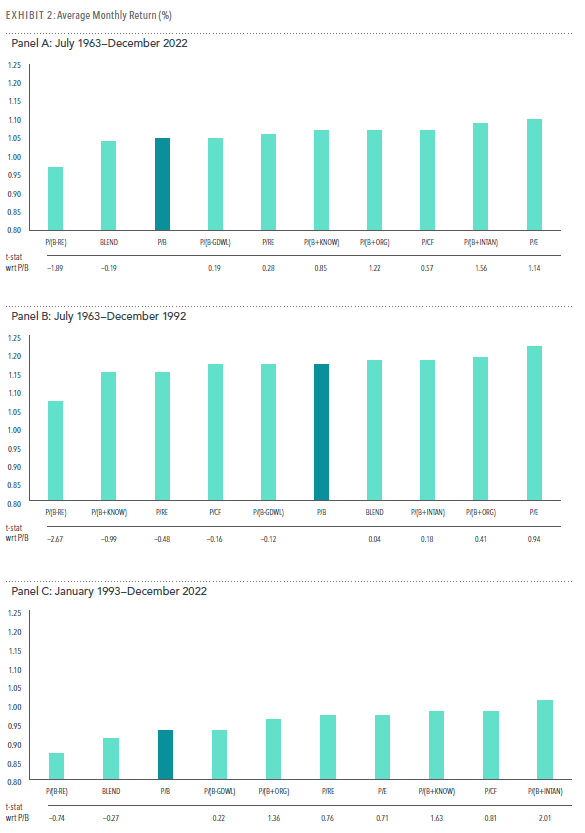

And the Winner Is: Examining Alternative Value Metrics

July 7th, 2023|

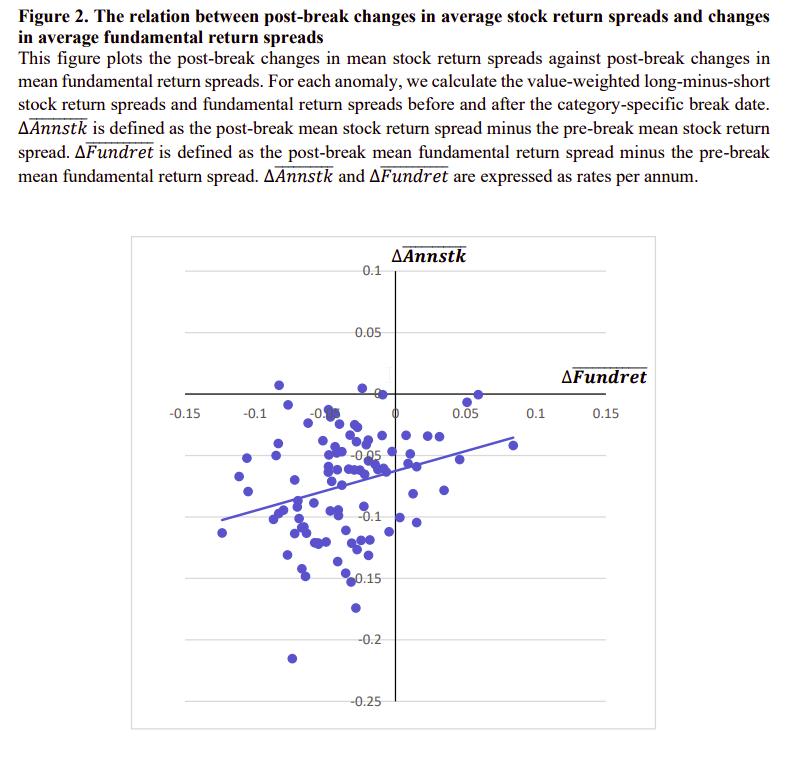

Fundamentals and the Attenuation of Anomalies

June 22nd, 2023|

Long-Only Value Investing: Size Doesn’t Matter!

June 15th, 2023|

2023 Democratize Quant Conference Recap and Materials

May 23rd, 2023|

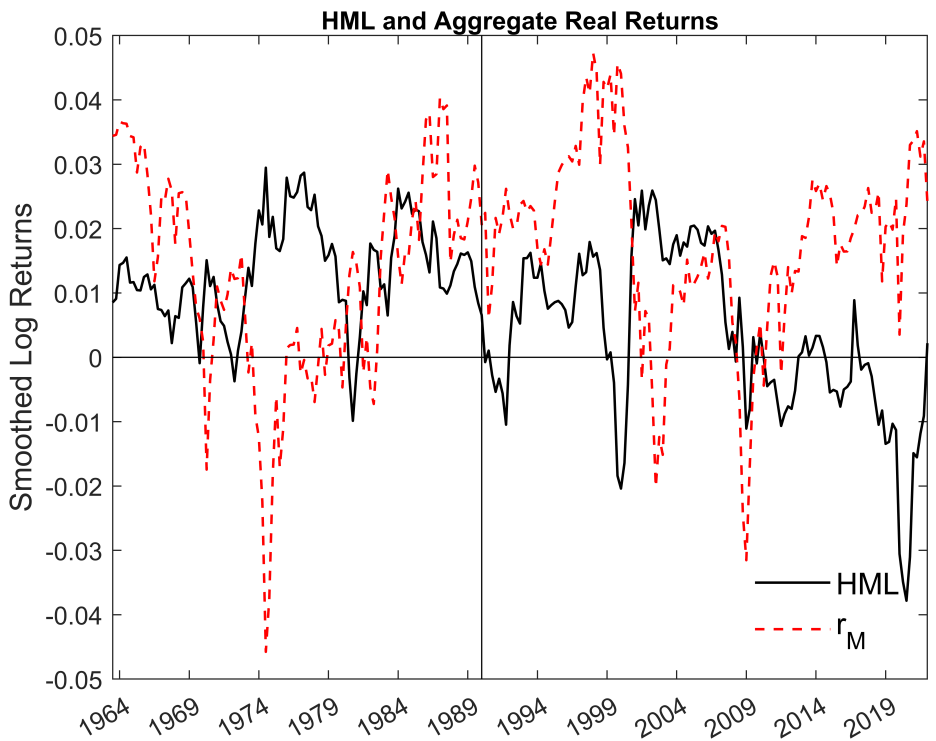

The Drivers of Booms and Busts in the Value Premium

April 28th, 2023|

Democratize Quant 2023 is Live. Sign-up!

April 26th, 2023|

Click Here for Category Archive

Cut Your Losses and Let Profits Run?

March 1st, 2024|

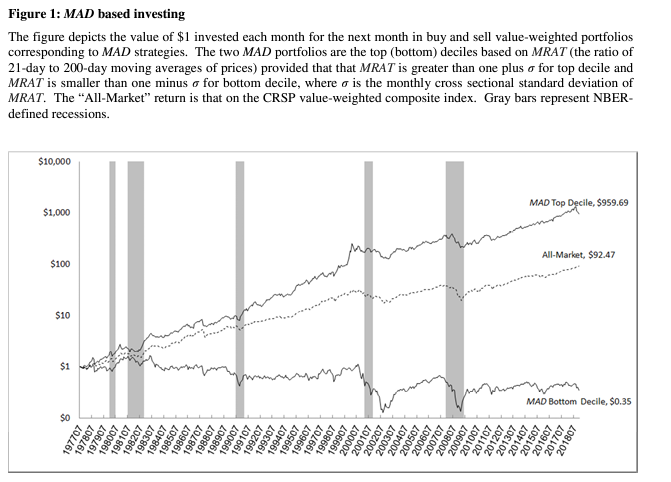

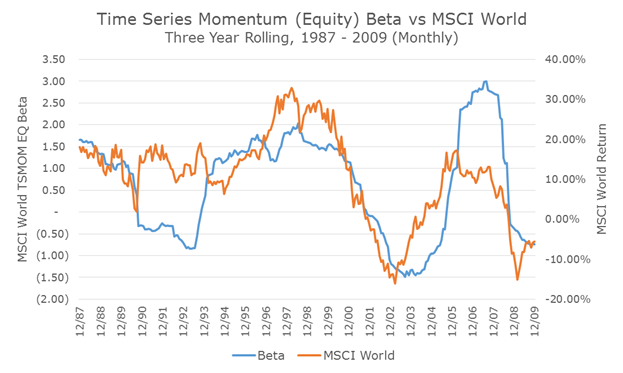

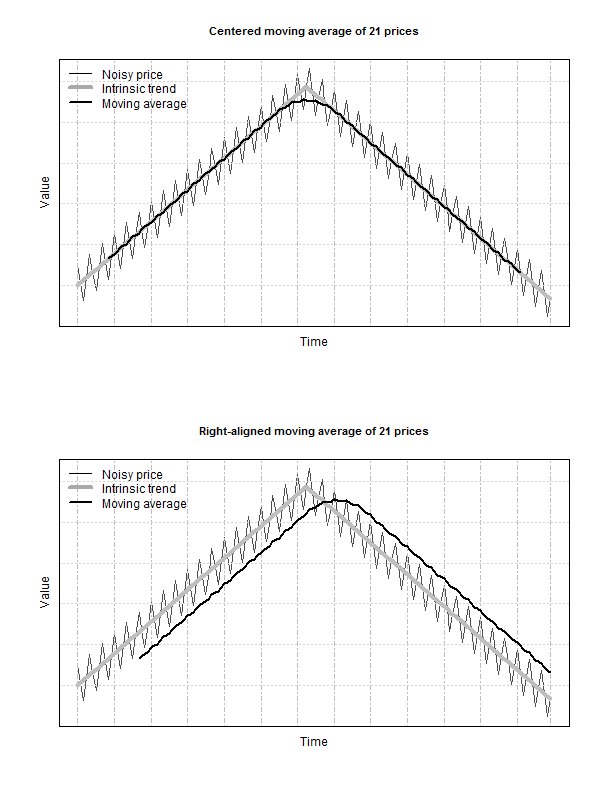

Moving Average Distance and Time-Series Momentum

January 26th, 2024|

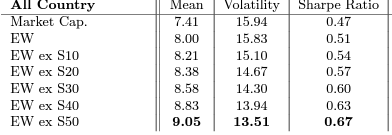

Outperforming Cap- (Value-) Weighted and Equal-Weighted Portfolios

January 19th, 2024|

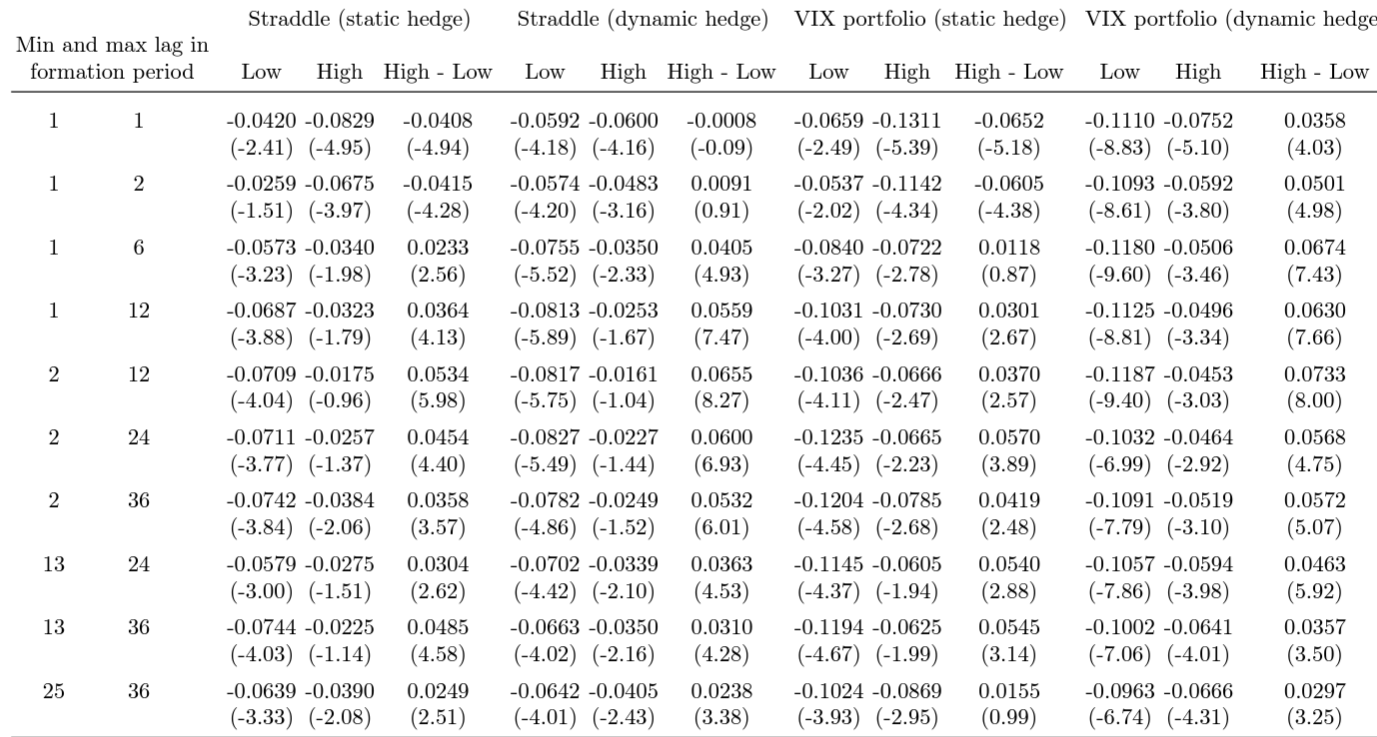

Momentum Everywhere, Including Equity Options

December 22nd, 2023|

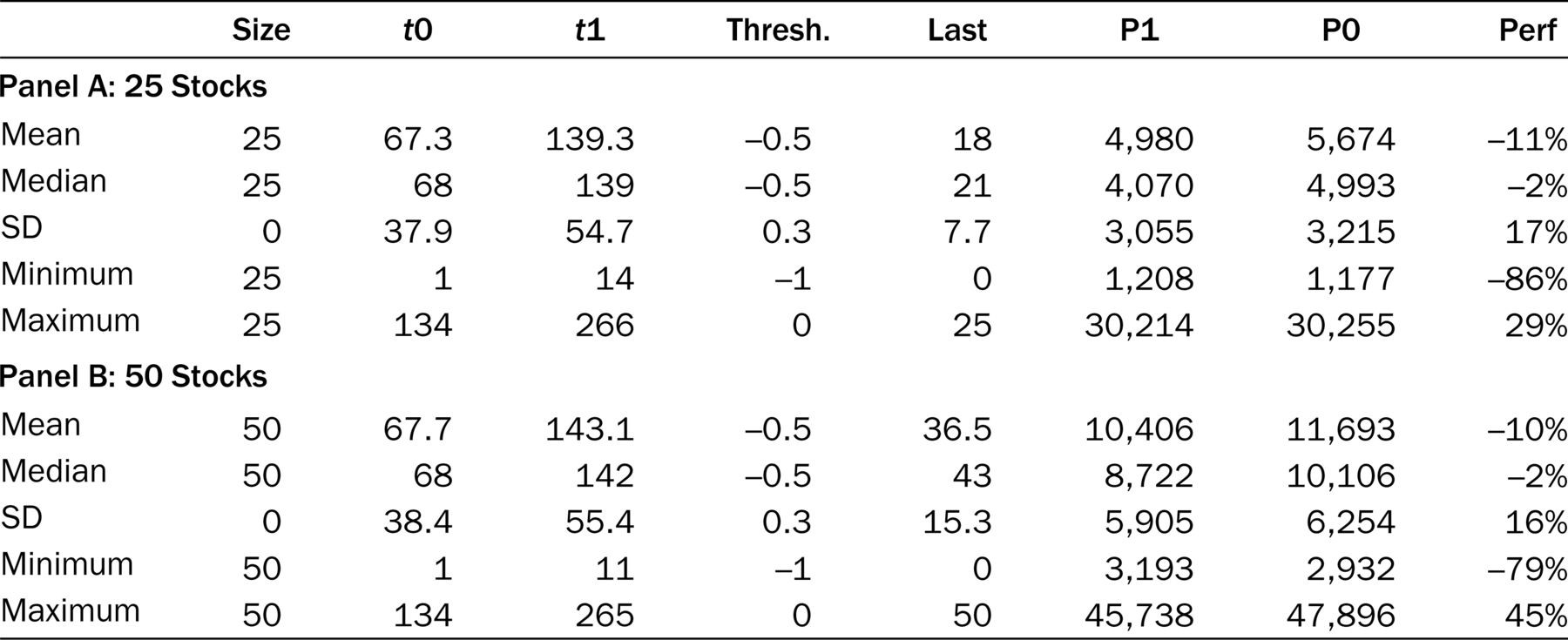

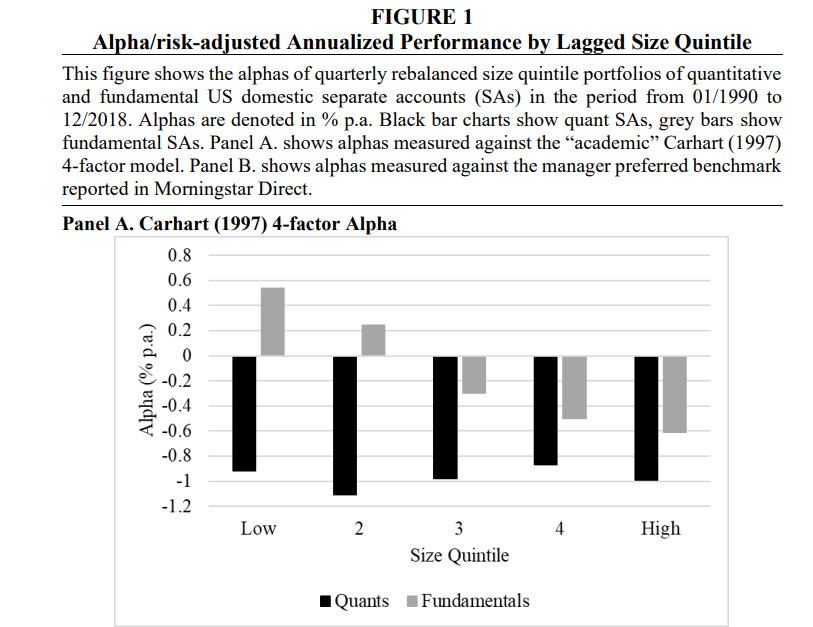

Diseconomies of Scale in Investing

December 8th, 2023|

A new twist on momentum strategies: Utilize overlapping momentum portfolios

November 27th, 2023|

Click Here for Category Archive

Natural Gas and Oil Spread: Opportunity or a Pain Trade?

October 5th, 2012|

News and Google Hits: A Path to 20% Alpha?

December 9th, 2012|

Tactical Asset Allocation Insights via the Geeks from Thinknewfound

February 16th, 2017|

Technical Analysis may actually work!

May 2nd, 2011|Tags: Technical Analysis, Cross-Sectional Profitability, abnormal returns|

The Dirtiest Word In Finance: Market Timing

March 20th, 2017|

Click Here for Category Archive

What’s the Story Behind EBIT/TEV?

May 1st, 2020|

Is Passive Investing Better than Active Investing?A Critical Review.

January 2nd, 2020|

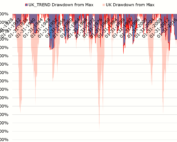

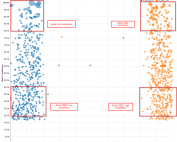

Trend Following: The Epitome of No Pain, No Gain

June 26th, 2019|

Momentum Investing, Like Value Investing, is Simple, but NOT Easy

September 18th, 2018|

Do factor portfolios survive transaction costs?

November 28th, 2017|