Core Research Categories

Click Here for Category Archive

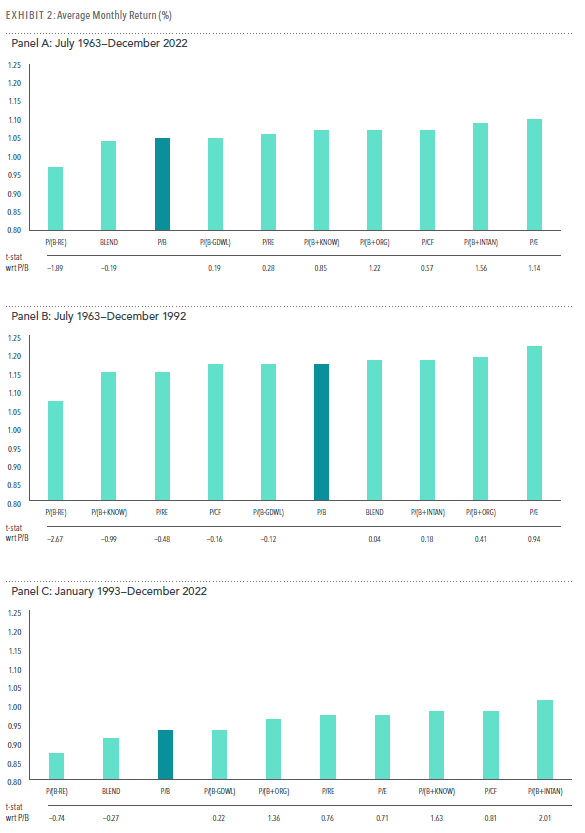

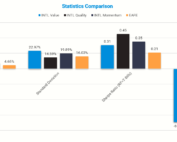

And the Winner Is: Examining Alternative Value Metrics

July 7th, 2023|

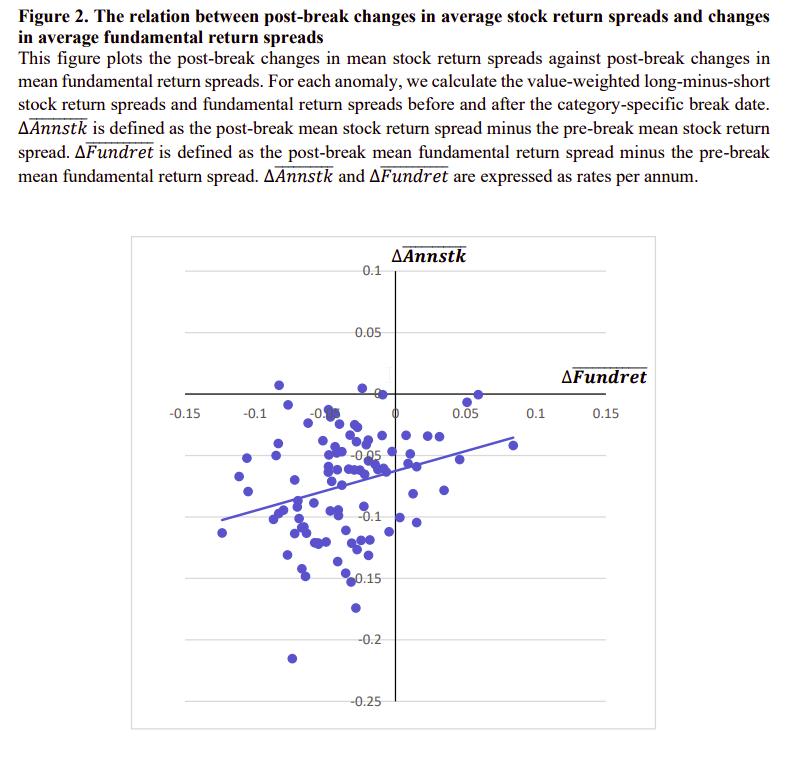

Fundamentals and the Attenuation of Anomalies

June 22nd, 2023|

Long-Only Value Investing: Size Doesn’t Matter!

June 15th, 2023|

2023 Democratize Quant Conference Recap and Materials

May 23rd, 2023|

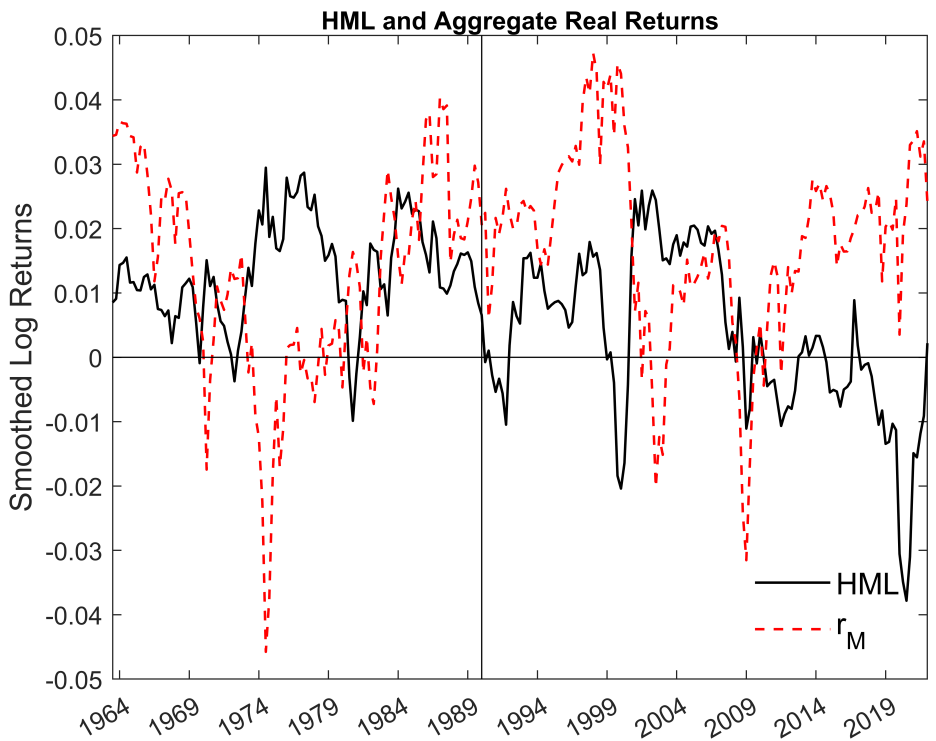

The Drivers of Booms and Busts in the Value Premium

April 28th, 2023|

Democratize Quant 2023 is Live. Sign-up!

April 26th, 2023|

Click Here for Category Archive

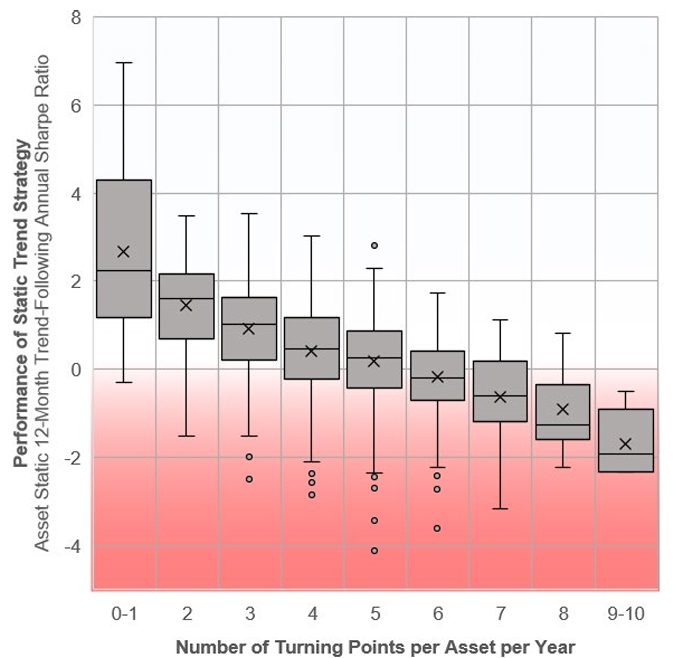

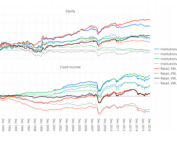

Breaking Bad Momentum Trends

March 15th, 2024|

Cut Your Losses and Let Profits Run?

March 1st, 2024|

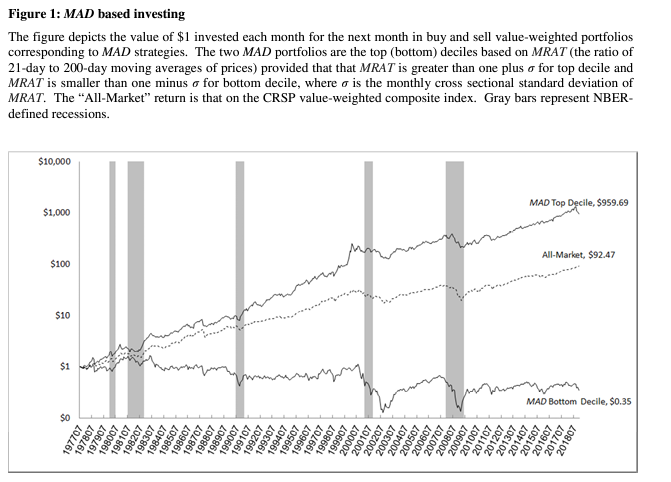

Moving Average Distance and Time-Series Momentum

January 26th, 2024|

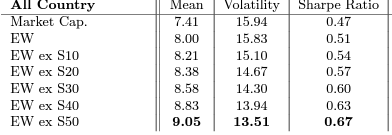

Outperforming Cap- (Value-) Weighted and Equal-Weighted Portfolios

January 19th, 2024|

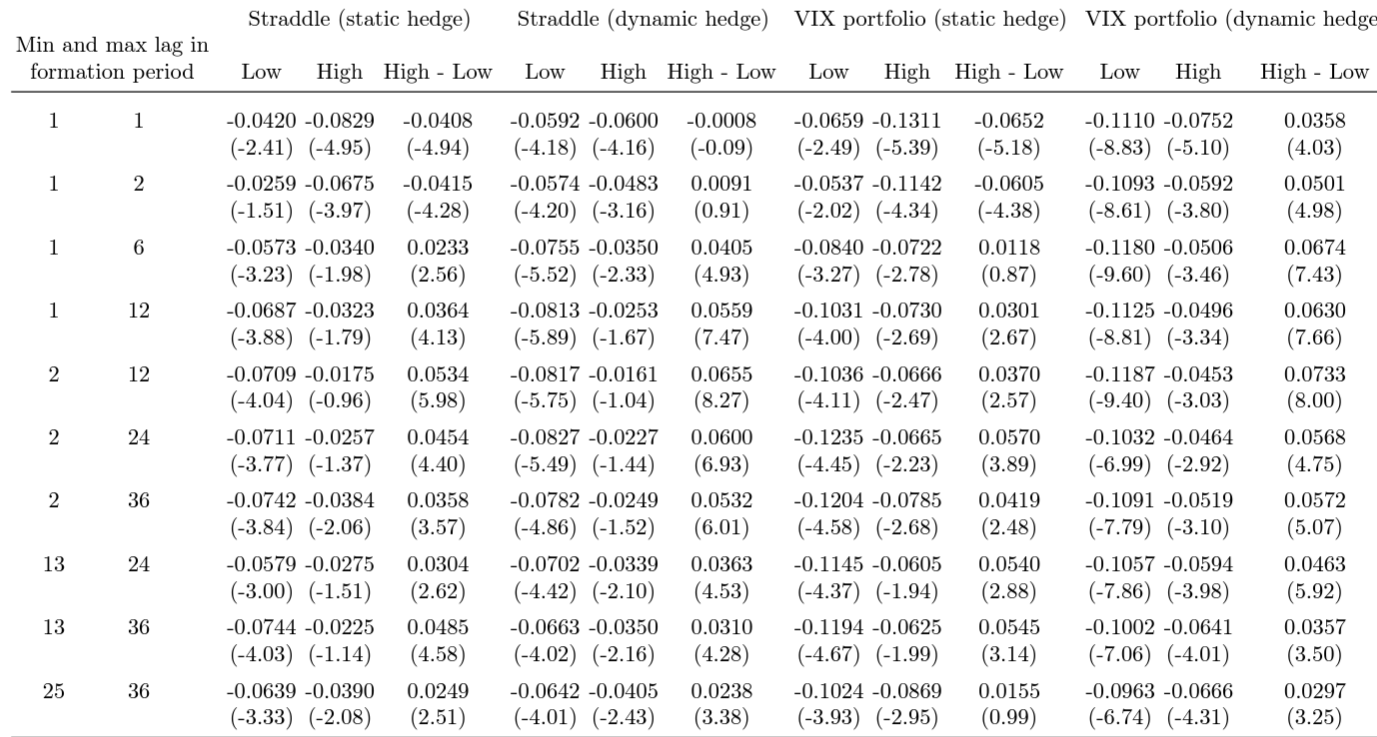

Momentum Everywhere, Including Equity Options

December 22nd, 2023|

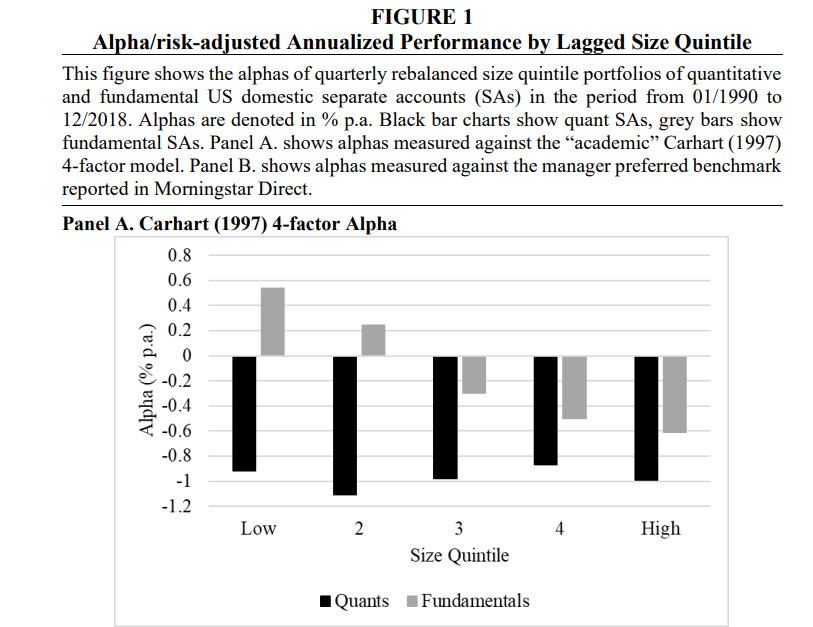

Diseconomies of Scale in Investing

December 8th, 2023|

Click Here for Category Archive

Book Review — Market Timing with Moving Averages

December 20th, 2017|

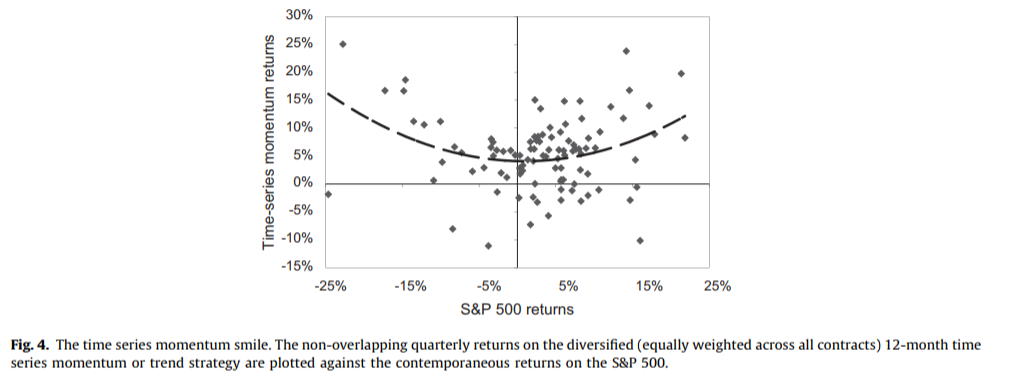

Diversification Benefits of Time Series Momentum

August 10th, 2017|

Do Trend-following Managed Futures Increase Safe Withdrawal Rates?

November 8th, 2017|

Time Series Momentum (aka Trend-Following): A Good Time for a Refresh

February 8th, 2018|

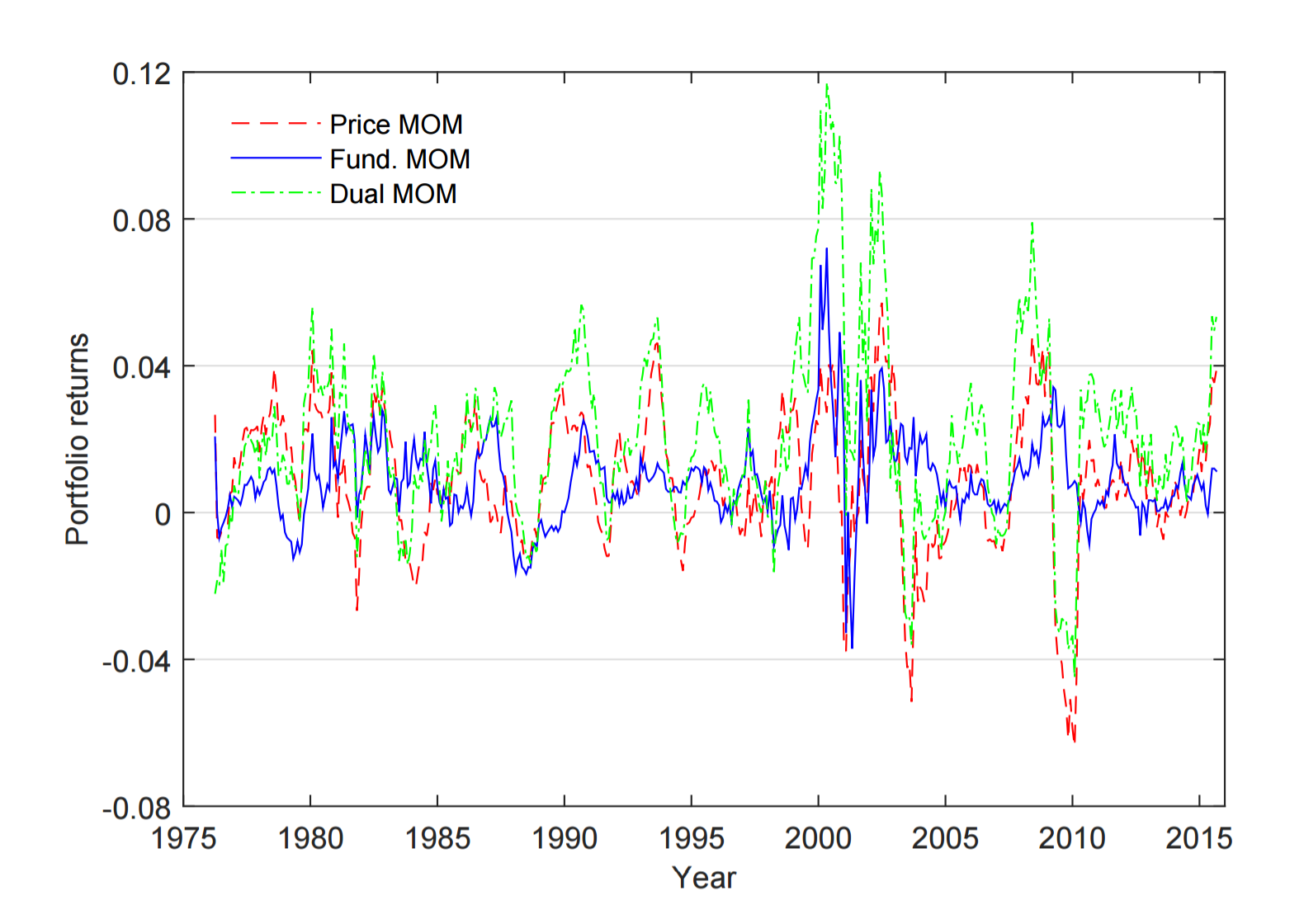

Dual Momentum with Stock Selection

March 14th, 2017|

Click Here for Category Archive

Value Investing: An Examination of the 1,000 Largest Firms

August 18th, 2020|

Value Factor Diversification: Is Quality Better Than Momentum?

June 26th, 2020|

ETF-prenuers: An Introduction to ETF White Label Services

June 24th, 2020|

What’s the Story Behind EBIT/TEV?

May 1st, 2020|

Is Passive Investing Better than Active Investing?A Critical Review.

January 2nd, 2020|