Executive Summary

Employee Stock Ownership Plans (“ESOP”) offer a variety of liquidity, tax and operating benefits to business owners who are contemplating a sale or partial sale of their business. This updated(1) article is intended to serve as a reference for business owners who are contemplating forming an ESOP, and their trusted advisors, who wish to understand a particularly effective tax deferral strategy that reinvests sale proceeds in 1042 qualified replacement property (“QRP”) portfolios. The opportunity to defer capital gains tax can make an ESOP very attractive for business sellers. The challenge business sellers face is how to roll over the sale proceeds in a manner that meets 1042 qualified replacement property rules, yet aligns with their growth, income and liquidity needs.

Moreover, it is important that the seller evaluate available 1042 QRP rollover options up front, in order to understand their implications for the ESOP’s overall implementation.

There are several QRP options worth examining:

- Floating Rate Notes

- Passive Corporate Bonds

- Passive Blue-chip Equities

In this article, we survey these strategies and compare their relative benefits. In doing so, we urge investors to bear in mind the FACTS (Fees, Access, Complexity, Taxes and Search) when making an investment decision. Our experience suggests that the vast majority of taxable family offices and high net worth individuals should focus on strategies with low costs, high liquidity, simple investment processes, high tax-efficiency, and limited due diligence requirements. This approach flies in the face of the complex and expensive 1042 QRP investment solutions typically offered in the marketplace. Our analysis suggests that floating rate notes are often the least effective investment option. Instead, investors should focus on the passive solutions, with a special emphasis on passive equity strategies, which can be customized to maximize the benefits of the tax-deferral opportunity inherent in 1042 transactions.

Learn more about our 1042 QRP strategies. A PDF version of this post is available here.

Introduction

When we set out to research the range of qualified replacement property investment strategies available in the marketplace today we had one mission in mind:

- Identify the most effective way to capture the after-tax value that a 1042 qualified replacement property enables selling shareholders to achieve through an ESOP.

Our work was guided by two core beliefs:

- The solution must serve the needs and best interests of our clients; and

- Implementation and costs must be transparent so clients have confidence in the solution.

One might ask at the outset: How did Alpha Architect, a systematic investment shop focused on value and momentum equities, end up developing 1042 QRP solutions? The short answer is that we needed to help one of our business partners, who had a family member who wanted to sell shares in a large ESOP-owned company. Selling the shares to the ESOP was the easy part. The hard part was identifying the appropriate qualified replacement property that would both satisfy 1042 QRP regulations and simultaneously maximize the one-time deferral opportunity afforded by this attractive yet esoteric IRS tax law.

Our research into alternative 1042 QRP strategies was initially challenging. This is not a transparent market—even for finance professionals. I have 20+ years of experience as a financial advisor to corporations and individuals and consider myself a sophisticated capital markets participant. In addition, the Alpha Architect team is filled with professionals who have master’s and Ph.D. degrees in Finance. Despite our unique vantage point, our efforts to find publicly available information about 1042 QRP rollover strategies yielded only a handful of approaches. Each of these solutions, provided by investment banks or trust companies, was like an onion: Each time we thought we understood one layer, we found another layer—with fee, tax, and complexity implications—that complicated our understanding. If we cannot easily understand the costs of these solutions as experienced finance professionals, then what chance does the average business owner have when it comes to assessing 1042 QRP options?

Why are 1042 QRP solutions so limited?

We hypothesize that this is a niche, opaque, old-line business that is dominated by a few industry players whose solutions entail high-margin products that are sold to business owners seeking to pursue 1042 elections. Once providers of these types of financial products identify the most profitable approach, even if not necessarily the best for their clients, they may have an incentive to advance it to the exclusion of others. Further, there is a certain amount of tax risk involved in purchasing a qualified replacement property: Get it wrong, and your silent partner, the IRS, might become your new special friend. Finally, the definitional constraints on QRP, combined with the functional needs of the purchaser, create an investment asset profile that is relatively narrow.

To us, at Alpha Architect, these conditions are a clarion call to innovation! We addressed this call to action by pioneering our own transparent and affordable 1042 QRP solution.

The sections of this article are organized as follows:

- Summary of ESOPs and the 1042 deferred tax election rules—including the implementation of a QRP rollover;

- Specific investment attributes that would maximize the value of any asset purchased and held within the definitional constraints of 1042 qualified replacement property;

- Survey of the principal rollover strategies prevalent in the marketplace, as well as other techniques associated with their implementation to achieve common seller objectives.

We conclude our work with a numerical ranking of the strategies reviewed, as well as offer our further insights into the current nature of the ESOP implementation advisory landscape. We hope to empower business owners to take back control of their hard-earned wealth, through the proactive selection of the most appropriate 1042 qualified replacement property investment strategy for their needs.

Section 1. Formation of Section 1042-compliant Tax-Deferred ESOPs

Congress put section 1042 tax incentives in place in 1984 to encourage the formation of ESOPs, which are qualified employee retirement savings plans. Structures resembling ESOPs have been in use since the late 1950s. Subject to meeting certain conditions, a shareholder who sells qualified securities to an ESOP through a 1042 election incurs no taxable gain on the sale. In many states,

(2)the combined state and federal long term capital gains tax rate can be as high as 33%. The ability to invest and compound wealth that would otherwise have been taxed away can create a powerful incentive to implement a 1042 ESOP election.

The selling shareholder’s personal situation and wealth management objectives are foremost among the many factors that underlie whether or not to elect a Section 1042 sale. Although the ability to defer taxes adds significantly to an ESOP’s attractiveness for most sellers, the 1042 election entails significant time and resources. These can include accounting, legal and advisor fees, which vary according to the specific 1042 QRP strategy employed by the selling shareholder. Before examining later in this paper prevalent 1042 qualified replacement property investment strategies available in the market, we provide a brief overview of principal requirements for effecting such transactions.

Several important conditions must be met in order for the sale of qualified securities to an ESOP to achieve tax-deferred treatment:

- The selling shareholder must file appropriate notices(3) with the IRS associated with a 1042 sale election;

- The Company whose shares are being sold to the ESOP must be a domestic C-Corp(4) whose shares are closely held, i.e., with no stock outstanding that is “readily tradeable” on an established securities market;

- Immediately after the sale,(5) the ESOP trust must hold at least 30% of the outstanding stock

of the company;

Two further ongoing restrictions apply to the “qualified securities” that are sold to an ESOP by selling shareholders electing tax deferred treatment:

- No portion of the assets attributable to the qualified securities sold to an ESOP through a tax-free rollover may accrue or be allocated under the plan for the benefit of (i) the seller; (ii) any member of the seller’s family; or (iii) any person who owns, either before or immediately after the sale, more than 25 percent in value of the outstanding portion of any class of stock of the corporation,(7) and

- The employer must consent in writing to the election of tax-deferred treatment by the selling shareholder, and a 10% excise tax is imposed on an employer for certain dispositions of stock by the ESOP within three years after any sale in which tax deferred status is elected. This excise tax applies if the total number of shares held by the ESOP after the disposition is less than before the tax-deferred sale, or if the value of the ESOP’s share of the company ceases to meet the 30% requirement.

Purchasing the 1042 Qualified Replacement Property

Having met the requirements for a 1042 election, the selling shareholder can shift focus onto developing a strategy for rolling over the sale proceeds to maximize benefits. The seller has a 15-month window, beginning three months prior to the date of sale and extending 12 months after its completion, by which time he must purchase a qualified replacement property—which effectively “rolls over” into the QRP both the tax basis and holding period associated with the stock sold to the ESOP. If the cost of the 1042 qualified replacement property falls short of the seller’s sale proceeds, then a proportionate share of the gain allocated to such shortfall is recognized upon sale.

The constraints placed by the IRS on the qualified replacement property are intended to roughly maintain parallel attributes with the original asset being sold by the business owner. Although limiting in the context of the full breadth and depth of the universe of securities, the permitted range of investable assets under the IRS’ definition is nonetheless broad and encompasses the stocks and bonds of US operating companies, subject to both income and asset tests.

The formal definition of 1042 Qualified Replacement Property is as follows:

Any security issued by domestic operating company that (a) does not have passive income exceeding 25% of gross receipts for the preceding taxable year, (b) has more than 50% of its assets in an active trade or business, and (c) is not the corporation that issued the qualified securities that were sold to the ESOP (or one under its control).

The QRP securities can be either equity or debt, including common stock, preferred stock, corporate fixed-rate bonds, convertible bonds, or floating rate notes. Securities of privately held corporations can also constitute QRP, as long as the other requirements are met.

This operating company requirement disqualifies many securities from meeting the definition of QRP, including the following: US federal and municipal government bonds, mutual funds, ETFs, bank CDs, real estate investment trusts, as well as ownership through means other than a security. Alas, there is no magic ETF that selling shareholders can purchase to satisfy their 1042 qualified replacement property needs, a fact that appears to feed and clothe an entire army of ESOP intermediaries!

Section 2. Attributes of a Value-Maximizing Qualified Replacement Property

Purchasers of qualified replacement properties can obtain a broad spectrum of investment security attributes within the universe of US operating company stocks and bonds. All else equal, some attributes create more value than others in meeting a purchaser’s specific rollover needs. Preserving the shareholder’s tax-deferral on the gain from the original share sale to the ESOP is likely to rank foremost among his needs. Other objectives might include income generation, capital preservation, capital growth, gaining liquidity from the QRP, passing wealth to future generations, charitable giving, etc. At the risk of stating the obvious, a superior 1042 qualified replacement property strategy will also achieve ongoing tax efficiency and low fee(8) drag over the life of the portfolio. While specific to the unique circumstances of ESOP transactions, these attributes further benefit by examination through the lens of the FACTS framework we proposed in our Executive Summary, above.

We set forth below a range of desirable security-specific and portfolio-specific attributes that contribute to the achievement of investor goals.

Tax Efficiency

Once purchased, the 1042 qualified replacement property can generate cash distributions to the purchaser, including interest, dividends and payments from outright dispositions of QRP assets. In a QRP-compliant portfolio, these distribution streams are taxed in kind, as though they were held in a conventional portfolio. Under current tax rates, such payments would trigger a range of tax consequences:(9)

- Taxable Interest/Non-qualified dividends: 40.8%

- Qualified Dividends: 23.8%

- Long Term Capital Gain: 23.8%

The current tax rate regime suggests that, all else equal, qualified dividend-paying equities are preferable to interest-bearing securities, such as notes and bonds. As stated previously, the deferred capital gain on the sale is triggered on a “disposition” of the QRP. An outright sale of the QRP would be considered such a disposition. For a QRP with growth attributes, however, a strategy of harvesting a portion of ongoing capital gains can be a very tax efficient approach to achieving the seller’s overall income objectives for the QRP.

Diversification

Our seed investor, a businessman with a multi-billion dollar family office, has a great investing maxim: “Wealth is created through concentrated investment holdings, and wealth is protected via diversification.” It is consequently not surprising that many business owners who have built wealth by investing time, energy and resources in what is generally considered to be the single most risky US asset—the closely-held middle-market company—would seek reinvestment in a 1042 qualified replacement property that affords them lower risk through diversification. This insulates the portfolio from idiosyncratic corporate risk associated with an individual security. Similarly, a diversified portfolio lessens the potential of any one security to torpedo the QRP through disqualification by the IRS for reasons of security selection error. Finally, diversification reduces the likelihood of premature capital gains recognition through an unanticipated purchase of common shares by an acquiror or through the redemption of preferred stock, bonds or notes by the issuer.

A long QRP holding period exacerbates asset attrition through drawdowns associated with credit events and bankruptcies: the cumulative risks of bad stuff happening simply compound with time. Therefore, diversification is more important the lower down the capital structure a QRP purchaser ventures. All else equal, an equity-based QRP investment strategy requires more diversification than a high-grade bond strategy. Achieving diversification constitutes an enormous challenge for 1042 QRP purchasers. These investors face enormous diligence and documentation burdens to meet the needs of the IRS. Being right is not enough if an IRS audit is underway: The 1042 QRP purchaser must provide detailed, line item-by-line item documentation to support each holding covered by his notarized statement of qualified replacement property purchase(10).

Quality

The desire to reinvest sale proceeds in a lower risk asset is further compounded by the “one-and-done” nature of the 1042 rollover: Once purchased, the QRP asset may not be sold or traded without triggering capital gains on the inherited basis of the seller’s stock. Such an asset ideally would be designed to withstand inevitable financial crises and market tribulations without catastrophic loss in value.

Highly rated fixed income securities and common equities of blue chip companies are especially critical if the purchaser seeks to gain liquidity by monetizing the qualified replacement property through a loan that is collateralized by the assets of the QRP (more on this, below). Banks will lend amounts ranging anywhere from 50% of the portfolio’s value (on margined, publicly traded equities) to up to 90% of value (on margined, high-grade floating rate notes).

Duration

The prospect of being able to invest money through a 1042 election that would have been taxed away exercises a strong attraction to many business sellers. For such investors, an asset having very long term maturity or perpetuity is preferable from a capital gains tax perspective. This is especially true if the QRP is intended to be passed through the seller’s estate at a stepped-up basis. Imagine your disappointment if, having intended to pass the wealth from the sale of your business to the next generation, you awoke in old age to learn that the bond you purchased for your qualified replacement property had been called for redemption by the issuer, or that you had outlived its maturity date. (Congratulations—you now owe Uncle Sam 30% on everything!) For sellers at a sufficiently advanced stage in life, long-maturity notes and bonds with adequate call protection can overcome this challenge. But don’t place yourself in the position of having to bet against your own longevity. Your choice of qualified replacement property should not require that you suffer an early demise in order to fulfill its purpose!

Growth

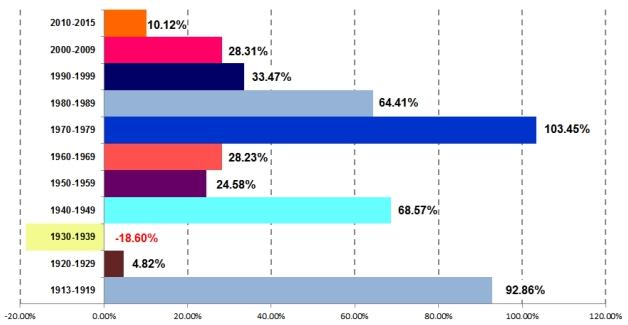

The long term intended holding period of the 1042 qualified replacement property portfolio makes inflation one of your greatest enemies. The average annual inflation rate in the US between 1913 and 2015 was 3.18%. As a geometric mean, the rate compounds annually. Even in a benign 2-3% inflationary environment, such as the one experienced in the US between 1990 and 2015, the cumulative total rate of inflation for the period was more than 88%. What cost a dollar in 1990 now costs $1.88, implying that a portfolio of that vintage that failed to hold its own against inflation could have lost 53% of its value by 2016. Periods of inflation prior to 1990 have been even more debilitating, as per figure 1.

Figure 1. Cumulative Inflation by Decade(11)

If a 1042 qualified replacement property is intended to be held for an extended period, and especially if it is to be passed to a seller’s heirs through their estate, it is critical that it be constructed to overcome the relentless erosion of inflation.

Liquidity

The ability to monetize the 1042 qualified replacement property is critical if the seller wishes to gain access to a portion of their sale proceeds on a tax deferred basis. Brokers will often provide access to low-cost loans collateralized by the QRP assets to sellers who wish to reinvest the proceeds outside of the QRP. In order to support such loans, the securities need to have stable values over time. For that reason, high grade, floating rate notes with special long-dated maturities are frequently sought: Their variable interest rates serve to buffer their value from interest rate swings. Equities can also support such liquidity loans, and we will explore this topic below.

High credit quality is a critical attribute for fixed income securities that are purchased as QRP, such as floating rate notes. The credit’s ability to weather market turmoil will determine not only its intrinsic value as a QRP asset during the holding period, but also its collateral value for any loan supported by the QRP. Why is that important? Because a decline in value reduces the collateral cushion of the QRP, and may thus result in a margin call from the lender. We understand anecdotally that certain fixed income QRP portfolios constructed before the great financial crisis failed to achieve their purchasers’ goals due to the deteriorating credit circumstances of their issuers.

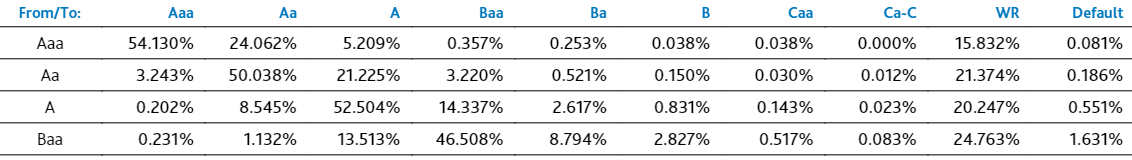

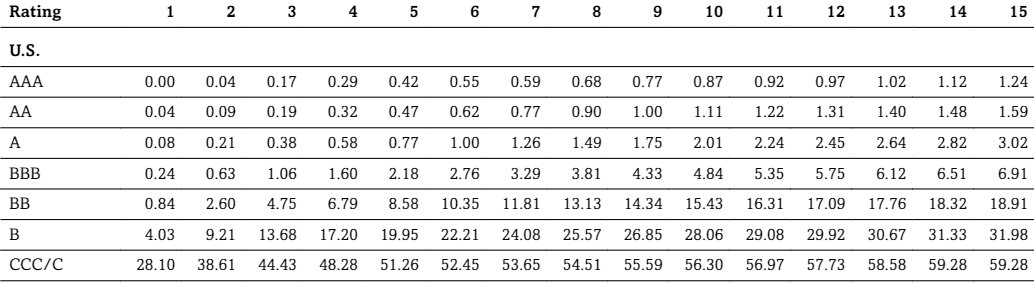

It does not take an event of default to undermine the value of a QRP consisting of one or more floating rate notes. While default rates of high grade securities are actually low, a significant proportion of investment grade bonds and notes migrate down the credit ratings ladder over time. Although public sources of information for floating rate note transition rates are not available, the following table demonstrates the high incidence of historical credit deterioration across the broader universe of US corporate investment grade bonds and notes.

Figure 2. Average 5-Year Credit Rating Migration Rates, 1970-2006(12)

According to Moody’s, just 54.1% of Aaa-rated corporate bonds and notes retained their original credit ratings after five years. Most were downgraded, presumably with attendant markdowns of principal value, or else withdrawn. Moody’s Investor Services withdraws bond ratings after debt repayment and as a result of events generally adverse to the principal value of the securities.(13)

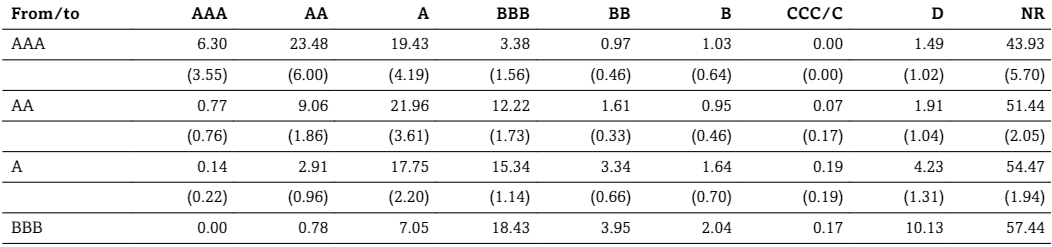

For longer-dated securities, the available data suggest that deteriorating creditworthiness remains an ongoing and significant concern. The following table, compiled by S&P, sets forth the high incidence of historical credit deterioration across their universe of long term investment grade corporate bonds and notes having maturities of 20 years or more.

Figure 3. Average 20-Year Credit Rating Migration Rates, 1981-2014(14) (15)

After 20 years, only 6.3% of AAA-rated corporate bonds retain S&P’s original triple-A ratings, on average! Approximately 48.3% of such notes and bonds were downgraded, with a further 1.5% having defaulted. Withdrawn ratings accounted for the remainder of the issuance. Empirical research(16) shows that declines in creditworthiness, and associated bond ratings, are largely due to company specific factors (42%), followed by industry stress (30%) of the issuer, among others. Even if the issuer of your own QRP bond is keeping its head above water, its debt securities can still receive downgrades due to broader peer group underperformance. As you can see, cumulative credit risk is amplified the longer the bond’s maturity period. With maturities of 30-50 years, floating rate notes have a high credit bar to clear!

To conclude this review of the liquidity attributes of long-dated bonds and notes, it is important to distinguish between the perspective of a buy-and-hold investor and that of his collateralized lender: For investors who hold securities to maturity, anything short of an event of default will have no impact on cash flows and the return of principal. For a lending broker, however, any deterioration in credit rating immediately diminishes the collateral’s mark-to-market value (a “haircut” in credit parlance), potentially necessitating a return of loan proceeds by his borrower. How violently fast the lender demands this payback is a question all QRP investors should ask of their brokers before buying.

While bonds are a reasonable source of collateral, it is also worthwhile to examine equities in the context of the liquidity they can support for an investor in a 1042 QRP portfolio. Common equity securities lie at the bottom of the capital structure in terms of priority of payment in the event of bankruptcy, holding only a residual claim on the assets of a company. When you purchase an equity security, the issuer has no contractual obligation to pay you anything. One consequence of this is inherently higher market volatility observed in the daily market prices of publicly traded equities, compared with most fixed income securities. Therefore, investors typically focus on established, large cap equities when evaluating QRP opportunities. Such shares typically represent companies with operating track records, proven products, competent management teams, and access to capital and other resources. What constitutes ‘large cap’? The mean equity market cap of the constituents of the S&P 500 is $39.5 billion, with the smallest company at the time of publishing having a market cap of $2.4 billion.

(17)Nonetheless, it is difficult to monetize even stable, “blue chip,” large cap equities to the same degree as high grade bonds. Brokers lending against equities generally demand a higher collateral cushion, typically 50% loan-to-value, than for loans backed by fixed income securities. Some equity QRP strategies, examined below, permit much higher lending rates.

Section 3. A Survey of 1042 Qualified Replacement Property Strategies

What follows is our team’s best effort to shine a light on available strategies. In assessing 1042 QRP options for this article, we have developed a framework of comparison across a range of 10 criteria, most of which we have discussed above. We have essentially adapted our FACTS framework to the special requirements of the 1042 qualified replacement property asset class. After reviewing each respective strategy and describing its implementation process, we rank its performance across these critical evaluation criteria. Our estimates of capital market terms, such as loan-to-value levels and pricing spreads, are intended as guideposts only. Sellers and their financial advisors who seek a deeper understanding of a strategy’s cost and terms should consult with implementation experts to obtain accurate indicative levels.

Floating Rate Note (Monetization)

Floating rate notes (FRN) appear to be the most prevalent 1042 qualified replacement property in the marketplace today. They are used almost invariably as the first piece of a complex strategy to borrow against the QRP in order to monetize the wealth that is tied up in the property.

As the name suggests, FRNs are variable rate debt instruments. The bonds have a coupon that is tied to a widely referenced variable money market rate, such as LIBOR, the fed funds rate or the prime rate. A “spread”(18) is added or subtracted to the reference rate in order to calculate the FRN’s coupon. The reference rate varies over time, as a reflection of market conditions, while the spread remains contractually fixed for the life of the bond. For example, an FRN coupon expressed as “3-month LIBOR minus 30 basis points” would equal 0.94167% (the 3 month US dollar LIBOR rate, as of the date of this article) minus 0.30% (a basis point is 1/100th of 1%), for a coupon of 0.64167%.(19)

Floating rate notes can be issued by both governments and corporations; however, only corporate FRNs satisfy the requirements of QRP described above. The typical (i.e., non-ESOP) floating rate note has a maturity of 1–5 years, making it too short for the tax deferral needs of most QRP purchasers. Instead, special FRNs with 30 to 40-year maturities are issued by certain well known US companies(20) that satisfy 1042 operating company definitions, making them more suitable for ESOP tax-deferred rollover transactions.

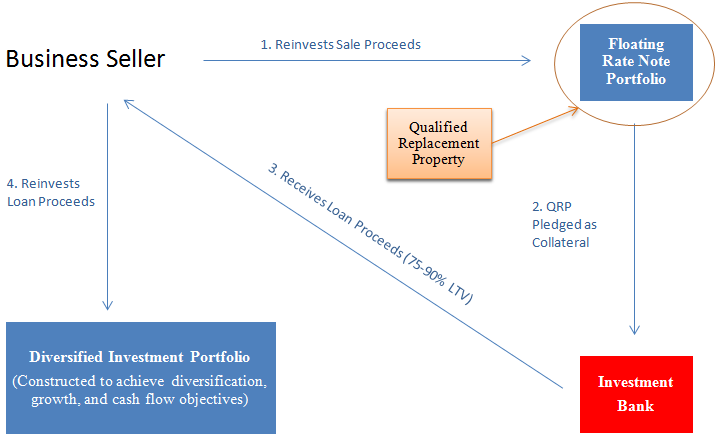

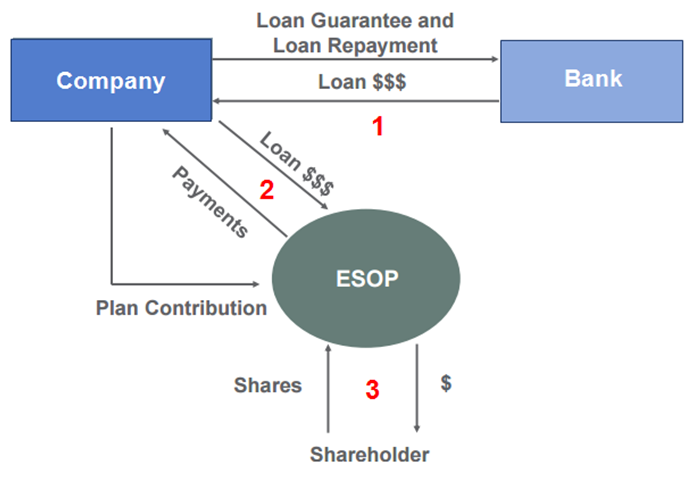

As investment grade corporate bonds with variable coupons, these FRNs pay very low absolute interest rates: They would not be inherently attractive investment assets on a standalone basis to most 1042 qualified replacement property purchasers. Nevertheless, their use in implementing a QRP monetization strategy appears to be widespread. To do so, the bonds are purchased by the selling shareholder as qualified replacement property and subsequently pledged as collateral to the lending broker (who is typically associated with the investment bank that underwrote the FRN issuance). The lending broker then lends the selling shareholder typically 90% of the value(21) of the FRN portfolio, however this percentage can be lowered by brokers in periods of more volatile market conditions. Having thus “monetized” the qualified replacement property through this loan transaction, the selling shareholder is then free to invest the loan proceeds as desired. For example, a seller who requires the sale proceeds to support their lifestyle might invest the wealth in more diversified growth or income-oriented assets. Figure 4 illustrates the complex flow of funds associated with the floating rate notes monetization strategy, described above.

Figure 4. Typical FRN Monetization Strategy – Flow of Funds

As you can appreciate, the seller implementing this FRN strategy embarks on a complex and relatively costly detour between receiving their ESOP sale proceeds and investing their wealth in the final asset of their choosing. We can understand that investors might be frustrated by this situation.

From the perspective of an investor’s critical needs, floating rate notes inherently represent a relatively inefficient QRP investment strategy. The asset comprising the QRP is a debt instrument that pays a low-yielding variable interest coupon that is currently taxed at maximum rates of 40.8%. QRP diversification can be difficult to achieve in a low interest rate environment, such as the current one. This is due in part to the reluctance of corporate issuers to borrow on a floating rate basis in the face of potentially rising market rates; locking in fixed rates elsewhere may be more attractive for such issuers. As of the date of this market survey there is a dearth of floating rate notes available in the secondary markets for QRP purchasers. Consequently, selling shareholders seeking 1042 elections can pay meaningful premiums in the secondary market to acquire an FRN position, thereby driving their QRP asset yield even lower.

In practice, the process entails the client’s broker approaching his firm’s internal bond trading desk to locate floating rate notes on behalf of his client, the QRP purchaser. That bond desk is a profit-maximizing dealer that typically maintains an inventory of FRNs and also knows the names of prior purchasers of the securities with whom it deals. In times of scarcity, the desk will “mark up” the price of the floating rate notes in its own bond inventories, to align customer demand with its own supply. The investment banker who represents that bond desk and obtains the client’s floating rate notes is not a fiduciary to the QRP purchaser in this instance. Rather he is a counter-party to the purchaser, acting in his own best interests to maximize his profit. Bond trading desks have no obligation to disclose the level of mark-ups and commissions that QRP clients are charged, undermining the price transparency of this monetization strategy. This fact speaks to the delicate position of the 1042 qualified replacement property purchaser, who must identify and purchase the QRP within 12 months of receiving his sale proceeds from the ESOP trust: Without making an extraordinary effort himself, for which he is unlikely to be qualified, the client purchaser is unlikely to feel confident in selecting QRP securities on his own. He is therefore reliant on his experts to guide him. We wonder how much dealers would need to mark up prices of FRN inventories before purchasers are driven to seek other QRP solutions. Our suspicion is that the FRN strategy described here is a lucrative business model for investment banks, which would imply that they have a vested interest in maintaining the status quo.

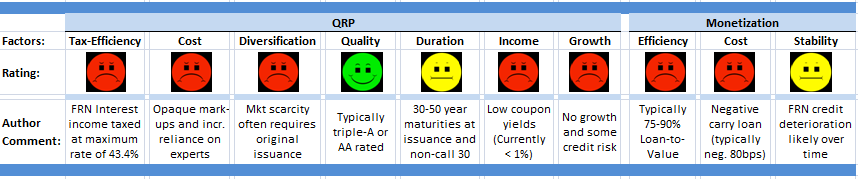

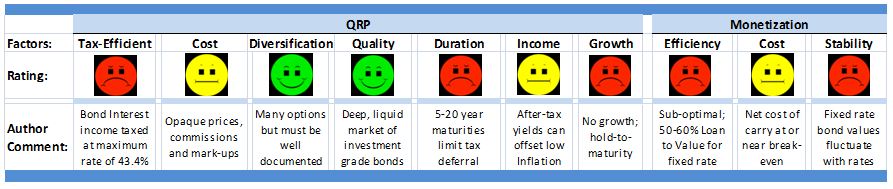

Figure 5. Floating Rate Note Strategy 10-Factor Rating

The floating rate note monetization strategy can be viewed in its entirety as a structured product, which is designed to facilitate highly customized risk-return objectives. This is accomplished by taking a traditional security, such as a conventional investment-grade bond (e.g., floating rate note), and replacing the usual payment features (periodic coupons and final principal) with non-traditional payoffs derived not from the corporate issuer’s own cash flow, but from the performance of one or more underlying assets (e.g., a separate portfolio of assets purchased with loan proceeds from the QRP). Like most structured products, pricing is not transparent. The investment bank blends the various costs, such as the floating rate note’s yield and the interest rate on the collateralized loan, into the net fund flows of the strategy. Further, how does one quantify the lost opportunity associated with leaving 10% (or more) of the seller’s QRP sale proceeds on the sidelines as collateral cushion required by the banker for his loan? This makes it almost impossible to compare the strategy’s explicit costs to other, simpler strategies. Like most structured products, it scores poorly in our FACTS framework: High and opaque fee structure, poor access to our wealth, highly complex to understand and implement, relatively inefficient tax drag and burdensome manager selection and due diligence requirements.

Finally, a floating rate note monetization strategy binds the investor to one institution through the bundling of services. This is bad practice, in our view, because it removes the competitive dynamic of the financial services marketplace thereby driving up your costs. This is most evident in wealth management, where business owners tend to fixate on obtaining low-cost borrowings yet ignore other costs that are far more consequential to them. For example, it is common practice for investors implementing FRN monetization strategies to engage a wealth manager from the lending institution to provide active wealth management services for the monetized wealth from the strategy. The entire strategy may even be premised on a take-it-or-leave-it proposition that includes wealth management services, thus rendering the QRP investor a captive client of the financial institution. Caveat emptor! Annual advice fees and product implementation fees can easily add 2% fee drag per year onto your portfolio—more if expensive so-called proprietary or alternative investment products are allocated to your holdings by wealth managers exercising discretion over your investments. We have even become aware of at least two banks seeking to collateralize the company loan that finances the overall ESOP’s share purchase with the seller’s QRP. That is merely a long-term earn-out, in disguise, and the seller should walk away. Remember always to follow the FACTS!

Instead, business owners who sell shares to an ESOP should force lending institutions to compete for the loan on the basis of the loan’s inherent merits. After all, the bank is getting an attractive commercial client out of the deal. The same should be true of wealth management services—unbundle now to gain the benefits of a competitive marketplace!

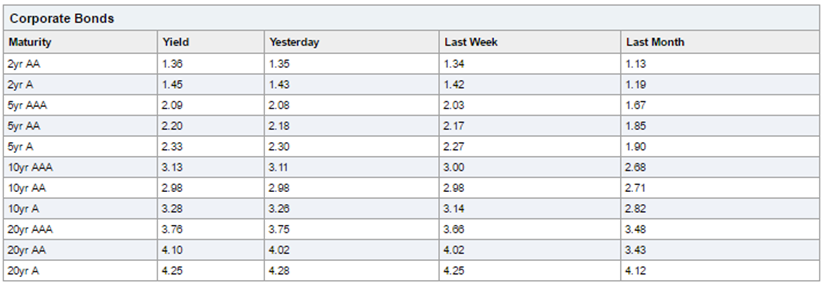

Passive Corporate Bond Investment

Although not optimal from a tax standpoint, an investor seeking safety and income generation can roll over the proceeds from the sale of his shares into a 1042 qualified replacement property consisting of one or more passively owned corporate bonds or notes.(22) Such securities pay either fixed or variable rate coupons and have maturities typically of between 1–15 years, with some having 20 year maturities. At the time of their issuance, corporate bonds’ income-generating capacity is tied to their credit ratings and, in the case of fixed rate securities, their length of maturity. After issuance, they trade in secondary markets, where their prices and investment yields are then driven by prevailing market interest rates. The following table sets forth recent composite corporate bond yields.

Figure 6. Corporate Bond Composite Yields(23)

As of the date of publication, we are in a rising rate environment. This is evident in the table, above, by the movement of bond market yields over the past month, with investors demanding higher returns the greater the likelihood of rising interest rates. Prices of bonds move inversely with market interest rates. Thus the timing of the purchase has a lot to do with a bond’s yield to maturity. Spikes in perceptions of inflation risk can create buying opportunities in the market.

Redemption risk is another common challenge for investors in corporate fixed income securities. An issuer’s ability to subject an investor to an involuntary redemption of its bonds (i.e., repayment of principal ahead of scheduled maturity) is governed by the issue’s call protection, which stipulates the period during which the bonds may not be redeemed buy the issuer. Some bonds are non-callable, which is obviously preferable from the standpoint of maximizing the tax deferral of the QRP. An issuer will pay a slightly lower interest rate by giving up the option to redeem its bonds.

Corporate bonds are also vulnerable to credit rating downgrades, as reflected in figures 2 and 3, above. However an investor who buys and holds a bond to its maturity and who does not intend to borrow significantly against the QRP portfolio will only suffer cash losses on the bond in the event of a default. For that reason, high grade bonds may be preferable as a QRP asset to high yield bonds, which have a significantly greater likelihood of defaulting, as illustrated in Figure 7, below. The trade-off, as their name implies, is that investors forego incremental yield associated with lesser rated high-yield bonds.

Figure 7. Average Cumulative Corporate Default Rates (1981-2014) (%)(24)

Pricing opacity is a significant strike against bonds as an asset class, because like floating rate notes they are generally purchased through dealer trading desks and entail mark-ups and commissions. This is particularly true for high yield bonds, where deep credit expertise is required to understand their values. A recent Bloomberg article(25) highlights this point:

“Securities regulators have struggled for decades to improve transparency in the [corporate] bond market, where the majority of trades are still completed by telephone and most price quotes are never made public. Some retail investors pay markups that are more than 2 percent of the value of their investment-grade bond trade, according to FINRA data.”

Why would an investor choose an asset such as straight corporate bonds for a 1042 QRP roll-over? Corporate bonds can provide safety and stability, and this is particularly true when these assets are part of a broader wealth management asset allocation strategy. With their positive investment yields versus FRNs, corporate bonds provide modest income as well as some inflation protection. The incremental yield versus floating rate notes stems from three key sources:

- Lower Purchase Costs: The corporate bond market dwarfs the ESOP floating rate note market in terms of outstanding issues. Investors have greater ability to shop around for their purchases, and competition among trading desks at different firms is keener. This suggests mark-ups and commissions should be lower;

- Term Premium: Corporate bonds paying fixed rate coupons have higher yields to maturity than variable rate notes, such as FRNs, all else equal. Floating rates provide for more stable bond values, a feature essential to lenders in an FRN monetization strategy. Collateral value stability supports higher loan-to-value ratios and reduces the likelihood of margin calls. Hold-to-maturity investors, such as QRP purchasers, should be less concerned about price fluctuations in the absence of credit events;

- Positive Carry: The bonds are purchased primarily for their inherent investment yields, not as collateral for a loan. Therefore, there is no offsetting borrowing cost to detract from the bond’s yield;

What happens at maturity? Corporate bonds purchased as 1042 QRP that mature and repay investor principal are recognized as a disposition by the IRS, triggering capital gains tax. For sellers with 20+ years of longevity ahead of them, a passive corporate bond investment strategy will not, in and of itself, achieve the elimination of capital gains tax on the original share basis of the business. The downside of significantly shorter asset duration may be mitigated by much reduced complexity. The investor merely purchases the bonds directly, as illustrated below:

Figure 8. Passive Corporate Bond Investment Funds Flow

Your ability to monetize, or borrow against, fixed rate bonds is more limited than against variable-coupon bonds, whose values are more stable in the face of fluctuating market interest rates. In the current low-rate environment we question why an investor would want to purchase variable rate corporate bonds as part of their QRP investment portfolio, unless they felt interest rates were going to climb meaningfully. It seems preferable to purchase corporate bonds that pay higher-yielding fixed coupons and then avail yourself of the option to leverage them to access additional liquidity as a secondary objective (albeit at a lower loan-to-value ratio).

It can be challenging to achieve asset diversification when pursuing a corporate bond investment strategy. There are many bonds issued by US domestic operating companies that trade in the secondary markets; however, you have to vet them and document their compliance with the IRS’s rules governing QRP. This is hard work. As we indicated, above, your silent partner, the IRS, is paying attention. You must file a notarized statement of purchase with the Service when buy your portfolio, therefore your documentation must be robust, ultra-conservative and iron-clad.

Figure 9. Passive Bond Investment Strategy 10-Factor Rating

In summary, the passive corporate bond investment strategy bypasses the deep complexity and overall pricing opacity of the FRN monetization strategy yet is an imperfect solution by itself for the purposes of 1042 qualified replacement property. Its lower cost gives after-tax investment yields a fighting chance to keep up with modest inflation. Nevertheless, the strategy still faces high ongoing tax rates on investment income, zero prospects for the growth of your investment capital and, perhaps hardest of all to stomach, a shorter capital gains tax deferral.

This strategy has the virtue of freeing you from being an unwilling participant in a structured product and un-bundles your ongoing personal wealth management from the ESOP’s broader implementation. However, in the event you wish to borrow against the assets in this strategy to achieve additional liquidity, your loan-to-value ratios will likely be lower than what can be achieved through a floating rate note monetization strategy. Viewed through the lens of our FACTS framework, the passive corporate bond investment strategy achieves a more advantageous rating than floating rate notes however it still leaves much to be desired.

Passive Blue Chip Equities Investment

The stars appear to align for equities as an asset class for the implementation of a 1042 qualified replacement property rollover strategy. Equities are the bottom of the capital structure, therefore quality matters. In order to harness the power of perpetuity, you need to select securities that have staying power, such as blue chip issues. The S&P 500 is the ideal pond in which to fish for candidate shares. Equities demonstrate strong total investment returns for investors who have stayed invested. For the 20-year period through May 27, 2016, the S&P 500 gained 209.31%.

(26)Importantly, the bulk of equities’ investment returns accumulate on a tax-deferred basis, through the growth in the share price value.

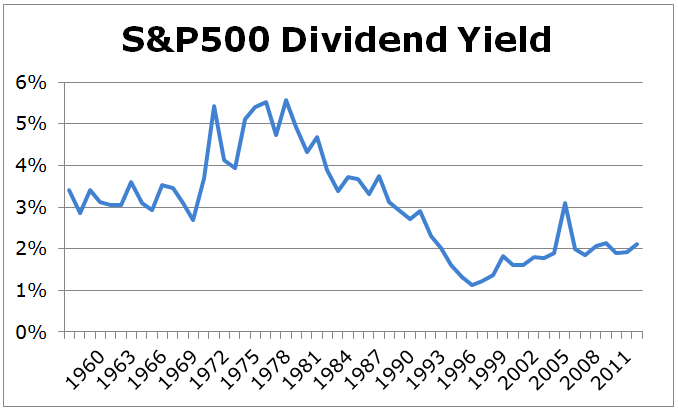

Compared to the high quality bonds discussed in the previous strategies, equities are a viable alternative source of income. Many shares have high dividend yields, well in excess of the bond yields of floating rate notes and many other triple-A debt issues. Indeed, the S&P 500 has a composite dividend yield of more than 2% at the time of publication. The income equities generate is also tax advantaged, versus that of bonds. Properly selected shares pay qualified dividends, which currently enjoy the lowest (23.8%) rate of taxation among the various types of cash distributions from a QRP. Finally, this income can be supplemented through the periodic harvesting of capital gains, which have historically exceeded inflation, on average.

Figure 10. Percent Dividend Yields of the S&P 500 (1960-2015)

(27)

Ideally, qualified replacement property must be a very long term holding if it is going to maximize the value of the 1042 tax deferral. Because equities are perpetual securities, with no maturity and no redemption provisions, they can be a superior QRP asset. The downside of individual equities is that they are also highly volatile and exposed to firm-specific risks. To minimize this potential risk, and because of the ultra-long-term holding period for a QRP investor looking to maximize the tax-deferral benefits, the equity portfolio of a QRP investor should require an extreme degree of diversification.

The passive equity QRP investment strategy has the important advantage of providing the purchaser symmetrical asset class returns. That is to say, the equity you sell to the ESOP benefits from a return profile that can be correlated with the rollover equities that are purchased through the QRP. By and large, the valuation level of the equity that you sell to the ESOP is reflected in the valuation level of the rollover property you purchase, if both transactions are completed within a similar timeframe. In practical terms, if you sell your business when stock prices are generally high, then you may be getting a good price for it but are reinvesting in expensive equities. Conversely, a seller who completes his divestiture in a “down market” is likely to be purchasing his qualified property also in a down market. Timing the transaction consequently becomes less critical to the overall ESOP implementation, as the correlated values between the business and the QRP have a reduced likelihood of “gapping” through the rollover mechanism.

This symmetry is due to the manner in which value is assigned to a seller’s shares when determining the sale price he receives. The IRS stipulates that the Company’s equity be valued at the time of the ESOP’s formation by a qualified independent appraiser for the purpose of setting the sale price of the seller’s shares. The methodology the appraiser uses to develop that valuation follows specific industry-wide standards, that incorporate market-derived valuation indications of comparable, publicly traded companies. The IRS rightly understands that market perceptions of value vary with time and, as most business owners are well aware, affect private asset pricing levels. For equities, these valuation methodologies predominantly include publicly traded comparables analysis, precedent M&A transactions analysis and discounted cash flow(28) analysis. The bottom line is that the valuation methodology and mechanics that determine the proceeds received by the selling shareholder for his shares from the ESOP are linked to the valuation levels at which he “buys in” when purchasing his QRP. Of course, if the appraiser’s valuation were to be finalized, say, 12 months before the selling shareholder purchases his equity QRP, this mechanical linkage would have some likelihood of decoupling. Nevertheless, asset symmetry is not a predictable benefit of fixed income securities purchased for the purposes of QRP. An investor who purchases floating rate notes always buys at the “top” of the market, i.e., at par, and the value of such securities has only one direction it can move from there. More broadly, fixed income asset values historically have shown less correlation to equity values and may even be negatively correlated, particularly in a rising interest rate environment.

For passive equity investors, there are also favorably aligned market mechanisms in place to compensate the QRP purchaser for unanticipated share dispositions. Unlike the case with bonds, preferred stock and convertible stock, corporate issuers cannot ordinarily redeem common shares against the will of their investors. In most instances, if somebody wants to take a particular shareholding from you, they have to ask you nicely for it—they have to entice you to sell it to them. “Acquirers often pay premiums of 20-30% in acquisitions of publicly traded firms,” according to a leading valuation authority, professor Aswath Damodaran

(29)of NYU. This acquisition premium mitigates to a large degree the tax bill that QRP investors face for any share dispositions resulting from a strategic transaction. Company boards of directors have a serious fiduciary duty to ensure shareholders receive fair value. Scores of activist investors are looking over their shoulders in your best interests.

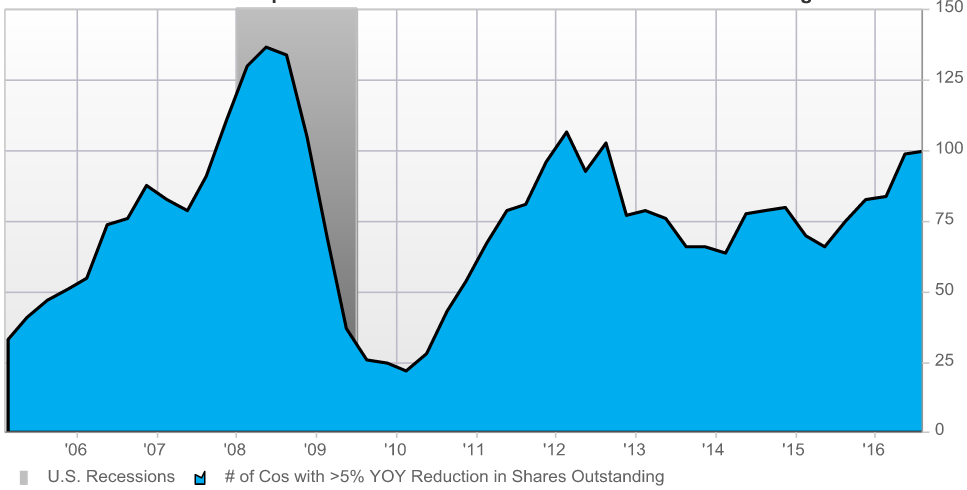

Stock buybacks are another benefit of the passive equity QRP investment strategy. With bank borrowings so affordable, corporations have all but institutionalized the periodic repurchase of their shares in the secondary market. QRP investors benefit as economical free riders when company management teams institute share buybacks. Shareholders can benefit from stock price appreciation when share count is reduced, all else equal. Price appreciation translates into tax-deferred compounding for the passive equity investor. As of September 2016, 100 of the S&P 500 constituent companies had reduced their year-over-year share counts by more than 5% of outstanding stock.

Figure 11. Number of S&P 500 Companies with >5% Share count Buybacks(30)

In aggregate, the buyback yield of the S&P 500 (calculated as the number of shares repurchased by companies in the trailing twelve months divided by the aggregate shares outstanding) stood at 2.97%. Think of this as a supplement to the index’s 2% dividend yield. Will management teams continue to support stock buybacks in the future? It is difficult to know; however, QRP investors who own blue chip equities are aligned with management incentives: Some of the shares repurchased are used by companies to support the deferred compensation plans of their top executives. ‘Shareholder Value’ is not just a mantra in corporate America, it is a management ethos. A QRP investor who holds equities is aligned with the animal instincts of the world’s arguably most astute capitalists. Equity investors stand on the shoulders of giants.

Leveraging a qualified replacement property can be less efficient for an investor pursuing this QRP rollover strategy. Brokers typically accord equities a 50% margin level, meaning the owner of a qualified replacement property consisting of blue chip equities can borrow 50% of the value of the portfolio held within that margin account. This is lower than the 75%-90% that holders of floating rate notes can achieve from brokers. If the thought of all that equity seems like too much volatility, a margin loan might be an appropriate way to finance an investment in fixed income securities—say, through the purchase of a bond ETF. The carrying costs of the new securities purchased (netted against the margin loan rate) might be breakeven or slightly negative, however, one could obtain, e.g., a 70%-30% asset allocation without too much challenge. Another alternative is to obtain a securities-backed line of credit (SBLOC) from a bank, which can be used to purchase virtually any non-financial asset, at a similar ratio of loan-to-value. Both a margin loan and an SBLOC can be attractive for this strategy, because they enable you to enjoy the upside benefits of your QRP portfolio while providing additional access to liquidity.

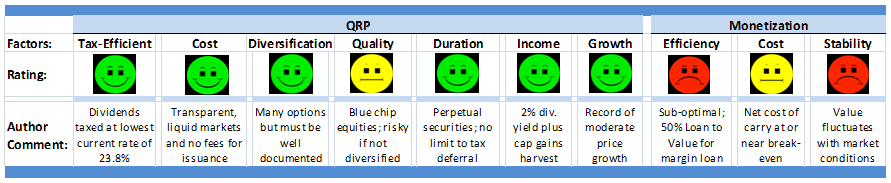

Our 10-factor ranking of the passive blue chip equity QRP investment strategy is very high. This is not surprising in light of the many unique roles the strategy fulfills for the purchaser. The greatest challenge lies in achieving securities diversification, due to the onerous documentation requirements for the QRP created by the IRS’s definition of qualified issuers. Notwithstanding the importance of this due diligence and documentation, the strategy is well suited to the critical tax-deferral attributes that the 1042 election creates for selling shareholders. The tax-efficient nature of the strategy’s cash distributions is another critical advantage. Whether through dividends or capital gains, the taxation rate does not exceed 23.8% of payouts under the current tax regime.

Figure 12. Passive Blue Chip Equities Investment Strategy 10-Factor Rating

A passive equity investment strategy is also very affordable. Investment returns are not dragged down by high up-front costs or ongoing fees, for several critical reasons:

- Blue chip equities are a deep, liquid market, with relatively strong price transparency and minimal commissions;

- There is no negative carry associated with detours through intermediate transactions (unlike with floating rate notes). Investors purchase their intended long term assets directly;

- Ongoing accounting and advisory fees remain low as a benefit of the utter simplicity of the strategy;

- The purchaser is not locked into a fee-burdened relationship for wealth management with a financial institution that has him over a barrel due to entangled recourse financings; and

- The equity investment strategy puts all of an investor’s sale proceeds to work earning investment returns. There are no ‘dead assets’ sidelined due to loan-to-value constraints on the portfolio.

Considerations for Enhancing Leveraged ESOPs

Generally speaking, qualified replacement property investment strategies can provide sellers with an important deal sweetener that enhances the attractiveness of seller financing. Most ESOPs implemented in the current environment are leveraged. A leveraged ESOP simply entails using the Company’s balance sheet to support the purchase of the selling shareholder(s)’s stock. In a leveraged ESOP, the Company borrows from a bank to the extent prudent and then lends the money to the ESOP. The ESOP trust in turn uses the loan proceeds to purchase the shares from the seller. You can think of it as being akin to a management buyout, in the sense that the employees are indirectly buying the seller’s shares and using bank borrowings to finance the purchase, as depicted below:

Figure 13. Leveraged ESOP Funds Flow

The debt capacity of the Company is often inadequate to fund the entire purchase of the seller’s equity, requiring the seller to accept a portion of his sale price in the form of a note payable by the ESOP (and thus the Company). Nonetheless, the seller often can use the cash sale proceeds to purchase qualified replacement property in the amount of the total sale price of his equity (i.e., including the value associated with the seller’s note receivable). This is enabled by the collateral value of the QRP itself. For example, assume a business owner sells his equity to an ESOP for $10. The ESOP (through the Company) obtains a bank loan of $6 and uses it, together with an IOU to the seller for the remaining $4, to purchase the seller’s equity. The seller now has $6 cash with which to purchase his qualified replacement property. In order to attain the entire capital gains tax deferral, in accordance with QRP rules, a seller must purchase QRP having a cost equal to the sale proceeds received for his equity. The seller therefore purchases qualified replacement property assets worth $10 from his investment manager, $4 of it on margin. When the seller note is repaid over time by the ESOP, the seller pays down the margin loan and “releases” the value of the entire $10 QRP to himself. Alternatively, he can simply pocket the seller note proceeds for other purposes, as they are paid out.

QRP Tools for Charitable Giving

QRP is an excellent vehicle for supporting a seller’s charitable intentions. This may be particularly attractive for assets that, by their nature, have looming taxable gains due to maturities or redemptions, such as debt securities or preferred shares. Many of our clients use trust structures to implement their investment strategies. Certain trusts can be designed to forestall or eliminate capital gains, while providing financial benefits to both the donor and the charity of his choosing. In its simplest form, the QRP may be donated outright to the subject charity. Remember, passing QRP through one’s estate or through gifting does not constitute a taxable disposition of the asset for the donor. In fact the gift is tax-deductible.

Section 4. Conclusions

In summary, the purchase of 1042 qualified replacement property is a financial investment. We advise investors to use our FACTS framework to evaluate alternatives, just as they would if they were contemplating any other investment strategy. Seek out investment solutions that reduce your Fees; maximize Access to your wealth; reduce Complexity; reduce Tax exposure; and lessen resources expended on Searching for investment managers. The asset classes examined in this overview have very different rankings when viewed through the lens of our factor framework.

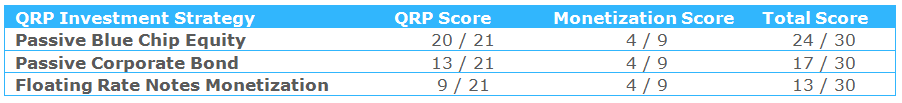

We summarize in Figure 14 the factor rankings of the three principal 1042 qualified replacement property investment strategies outlined in this article, with the most attractive ranked first. In an effort to develop an objective comparison approach, we have scored each factor on a scale of 3 points (3 = Green, 2 = Yellow and 1 = Red). Each of the three principal strategies is graded on the basis of its inherent QRP attractiveness (21 total points), the strategy’s ability to be monetized (9 total points) and its overall combined score (30 total points):

Figure 14. Numerical QRP Strategy Rankings

We wrote this article to empower business owners and their trusted advisors to take back the decision-making process around selecting a QRP investment strategy that meets their needs. It is your wealth, after all, and you worked hard for it. While empirical data do not exist, anecdotal evidence suggests that very few sellers are capitalizing on passive investment strategies to roll over their tax-deferrable sale proceeds from ESOPs. Most business owners appear to be corralled by advisors into floating rate note monetization strategies. We hypothesize a number of reasons for this bias toward FRNs.

An entrenched ecosystem of advisors—from investment bankers to private bank lenders to wealth managers—exists to support the floating rate notes structure, and it is a lucrative one for them. There are many ways for an advisor to extract fees. For example, investment bankers capitalize on the seller’s unique purchasing needs to offer low-cost, long term bond financing options to their own corporate clients who satisfy the domestic operating company rules. Those same firms’ private bank lenders then offer collateralized loans to the seller using the very same FRN securities that their investment banking colleagues just sold to the seller. The proceeds from those loans create an ongoing wealth management opportunity for financial advisors from the same financial institution that issued the FRN and lent against it. From notes to loan proceeds to the wealth management portfolio, the seller’s assets never leave the financial institution’s custody, with each stage of the transaction generating fees for the Firm. That same firm may well also be providing the bank loan that finances the ESOP’s share purchase from the seller—totaling five separate financial transactions.(31) The high costs, ongoing fees and tax drag from this strategy bear down relentlessly on the investment returns of the hapless business seller, decreasing the odds that his wealth will fulfill his dream of lasting for future generations.

Business owners are a savvy bunch, so how does this happen to them? In our experience, the seller often leaves the evaluation of prospective QRP rollover strategies until the end of the ESOPs implementation, confidently relying on the comfortable twelve-month purchase window in which to make his decision. By then, he has failed to understand fully the implications of his advisor team’s expertise and institutional biases. Did he select them on the strength of their ability to finance the Company’s balance sheet? Was that financing tied to other ongoing financial services to the seller, or does it rely on credit recourse to the seller’s sale proceeds? Perhaps the advisory team warned the seller against the tax liability risks of other QRP rollover strategies, suggesting the precedent path through floating rate notes was well worn, tried and tested. Once the QRP purchase clock is ticking, a decision to stray from that path would appear to be lined with pitfalls. Once rutted, the path to implementation can become further entrenched through the personal referral relationships among the seller’s accountants, attorneys and wealth managers. We feel it is important to illuminate these embedded institutional biases (all firms have them—even ours), so that sellers can anticipate and proactively manage them. Sellers who take the time to understand their QRP options will be empowered to maximize their economic benefits and meet their objectives. The devil is in the details, so we advise all investors to follow the FACTS.

Learn more about our solution here.

1042 Qualified Replacement Property is one of our core fiduciary competencies, capitalizing on our advantages as an algorithmic manager of ETFs and quantitative strategies. Have questions? Reach out. We’ve spent quite a few years thinking about ways to help investors succeed and we are always open to having a discussion and helping readers out. In fact, our firm mission is to empower investors through education. So help us accomplish our mission.

If you are interested in learning more about our 1042 ESOP rollover solutions, contact us (ask for Doug) and we will collaborate to build a win-win solution.

References[+]

| ↑1 | Article updated February 6, 2019. |

|---|---|

| ↑2 | Source: Tax Policy Research Foundation website: http://taxfoundation.org/blog/how-high-are-capital-gains-tax-rates-your-state accessed on November 28, 2016. |

| ↑3 | These filings include an irrevocable statement of election, a statement of corporate consent, and a notarized statement of purchase of qualified replacement property. |

| ↑4 | S-Corp shares do not qualify for tax-deferred treatment. It may be possible for owners to terminate S-Corp election in favor of C-Corp status for purposes of receiving 1042 treatment. Please consult with your tax advisor. |

| ↑5 | Two or more shareholders may sell shares in the sale in order to meet the 30% threshold, however the sales must be completed in the same transaction. |

| ↑6 | Upon sale, the ESOP trust “must hold either 30% of each class of outstanding stock of the corporation or 30% of the total value of all classes of outstanding stock issued by the corporation.” Source: The ESOP Association: Issue Brief #4 – The ESOP Tax-Free Rollover, pg. 1. |

| ↑7 | Source: US Treasury Department Temporary Regulation Section 1.1042-1T, viewed at https://www.law.cornell.edu/cfr/text/26/1.1042-1T and accessed on November 28, 2016. Note, a prohibited allocation causes a 50% excise tax to be imposed on the employer and adverse income tax consequences for the participant receiving the allocation. |

| ↑8 | Fees can include ongoing accounting, legal and financial advisory services and are proportional to the complexity of the purchaser’s strategy to design, construct and maintain a 1042 qualified replacement property. |

| ↑9 | Based on 2015 rates. |

| ↑10 | The Statement of Purchase is one of three critical, required filings associated with the ESOP’s formation and implementation, and it must be produced within 30 days of purchasing the replacement property. |

| ↑11 | Source: www.InflationData.com, accessed on 05 December 2016. Data as of 15 June 2015. |

| ↑12 | Source: Moody’s Investor Service, 2011, “Special Comment: Corporate Default and Recovery Rates, 1920-2010”, pg. 24. |

| ↑13 | Moody’s Investor Service, October 3, 2016, “Policy for Withdrawal of Credit Ratings”, pgs. 1-3. |

| ↑14 | Note: Numbers in parentheses are weighted standard deviations, weighted by the issuer base. |

| ↑15 | Source: Standard & Poor’s Ratings Services, 2015, “2014 Annual Global Corporate Default Study And Rating Transitions”, pg. 78. |

| ↑16 | Moody’s Investor Service, February 3, 2014, “Why Fallen Angels Fall: An Examination of Nonfinancial Corporate Fallen Angels 1999-2013 and 2014 Outlook”, pg. 8. |

| ↑17 | Source: Standard & Poor’s S&P 500 index fact sheet, http://us.spindices.com/indices/equity/sp-500, accessed on December 10, 2016. |

| ↑18 | Spreads are used and calculated to bridge the difference between the asset class being priced by the reference rate (e.g., overnight US dollar deposits in European banks) and the floating rate notes, themselves. Among FRN issues, spreads differ across credit ratings, with lower-rated notes having wider spreads, all else equal. |

| ↑19 | Our recent review of seven floating rate note prospectuses found online revealed spreads ranging from minus 25 bps to minus 35 bps. |

| ↑20 | At the time of publication, we managed to find publicly available prospectuses online for just four publicly traded issuers, including 3M, General Electric, Colgate Palmolive and UPS. |

| ↑21 | Financial institutions lend against floating rate notes at a specified loan-to-value ratio (i.e., collateralization rate). The standard LTV rate is 90%. However, during the credit crisis, and for several years afterward, loan-to-value ratios were typically lower, often in the 75% to 80% range. Credit market participants have regained confidence in the current environment, and rates have returned to pre-crisis levels. |

| ↑22 | Notes are debt securities with maturities of 2 – 10 years; bonds have maturities of >10 years. We call both of the “corporate bonds” for the purpose of this strategy. |

| ↑23 | Source: Yahoo Finance website and ValueBond, accessed on Tuesday, December 13, 2016, at http://finance.yahoo.com/bonds/composite_bond_rates |

| ↑24 | Source: Standard & Poor’s Ratings Services, 2015, “2014 Annual Global Corporate Default Study and Rating Transitions”, pg. 57. |

| ↑25 | Source: Bloomberg, February 26, 2016, “Bond Dealers Required to Report Retail Markups in Finra Plan” |

| ↑26 | Source of returns in this paragraph: Investopedia, “S&P 500 Index: A Performance Analysis of Long-Term Returns”, accessed at http://www.investopedia.com/articles/markets/061216/sp-500-index-performance-analysis-longterm-returns.asp on December 15, 2016. |

| ↑27 | Source: A. Damodaran, http://www.stern.nyu.edu/~adamodar/pc/datasets/histretSP.xls, accessed on 15 December 2016. |

| ↑28 | The latter approach, DCF analysis, relies on public market comparable inputs for its terminal valuation and cost of capital components, among others. |

| ↑29 | A. Damodaran, “The Value of Control: Some General Propositions”, accessed at http://people.stern.nyu.edu/adamodar/pdfiles/country/controlshort.pdf on 15 December 2016. |

| ↑30 | Factset, “Buyback Quarterly”, September 20, 2016. |

| ↑31 | These encompass (1) financing the ESOP transaction, (2) underwriting the FRN issuance, (3) selling the FRN to the selling shareholder as QRP, (4) lending to the seller against the FRN portfolio and (5) actively managing the seller’s wealth stemming from the QRP loan proceeds. |

About the Author: Doug Pugliese

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.