Predicting Fraud by Investment Managers

- Stephen Dimmock and William Gerken

- A recent version of the paper can be found here.

Abstract:

We test the predictability of investment fraud using a panel of mandatory disclosures filed with the SEC. We find that disclosures related to past regulatory and legal violations, conflicts of interest, and monitoring have significant power to predict fraud. Avoiding the 5% of firms with the highest ex ante predicted fraud risk would allow an investor to avoid 29% of fraud cases and over 40% of the total dollar losses from fraud. We find no evidence that investors receive compensation for fraud risk through superior performance or lower fees. We examine the barriers to implementing fraud prediction models and suggest changes to the SEC’s data access policies that could benefit investors.

Data Sources:

This paper collects historical Form ADVs from the SEC’s website for all investment advisors from August 2001 to July 2006. Readers can access these forms via http://www.adviserinfo.sec.gov/IAPD/Content/Search/iapd_Search.aspx. The authors also collect data on SEC administrative proceedings and litigation. These data can be accessed via http://www.sec.gov/litigation/admin.shtml

Discussion:

Bernie Madoff reminded everyone that money does not grow on trees. Looking back, it seems obvious that a perfect monthly return stream of 1% with no volatility is patently absurd and would raise red flags. And yet, very few investors were able to look past their own greed and question the credibility of Madoff. The natural question the authors in this paper address is “How can one predict potential fraud using publicly available information?”

Fund of funds and high-net worth individuals spent a lot of time and effort identifying which managers will succeed and which will fail. Another critical aspect of the due diligence process is to determine which managers have integrity and which do not. A simple look at characteristics on Form ADV suggest that a computer can help facilitate in the due diligence process.

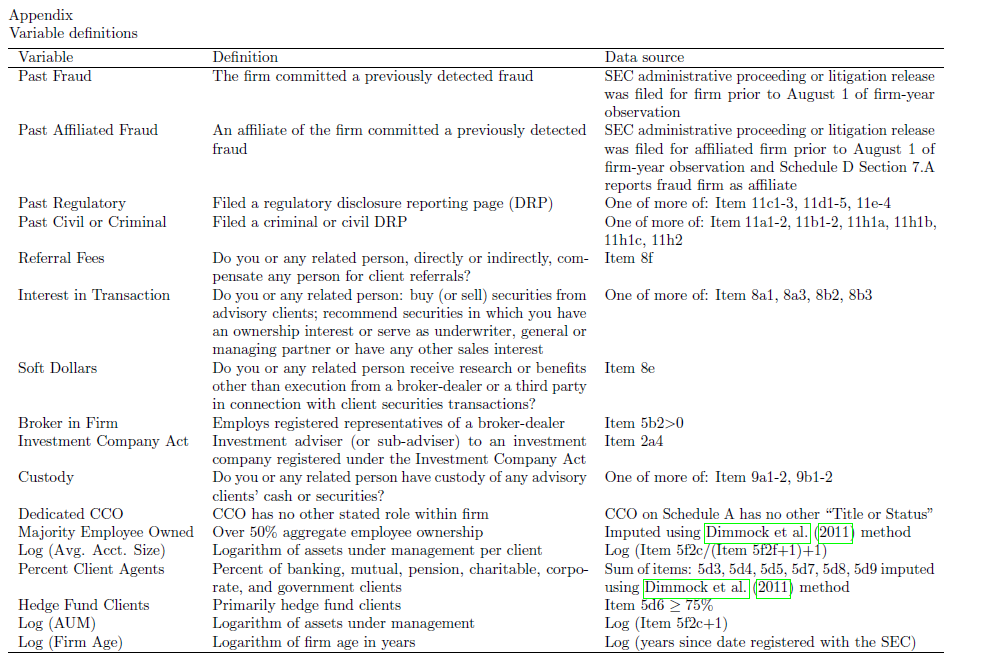

Below are the variables the authors include in their prediction model to see what variables are related to fraud.

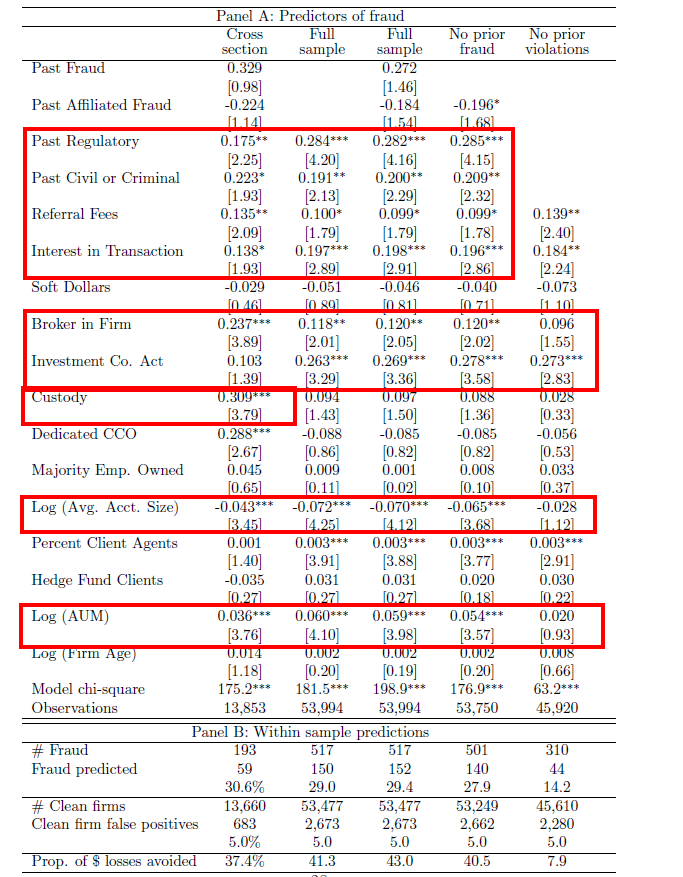

Panel A of Table 3 shows the results of probit regressions that predict investment fraud using Form ADV disclosures. In column one, the sample is a cross-section of firms. The independent variables are taken from each firm’s Form ADV ling during the sample period; the dependent variable equals one if the firm commits fraud at any time between its first fi ling during the sample period and July 2007. This speci cation includes indicator variables for the year in which the firm first filed Form ADV. In this cross-sectional specifi cation, the z-scores are based on robust standard errors.

Here are the actual numbers (interesting and significant findings are highlighted in red):

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Commentary:

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.