Insider Trading Patterns

- David Cicero, and M. Babajide Wintoki

- A version of the paper can be found here.

Abstract:

“We document two patterns of informed insider stock trading: isolated trades and trade sequences. Isolated trades are trades in a single month while sequenced trades are those by the same insider over several consecutive months. Approximately 25 percent of trade months are sequenced, and they include about 40 percent of trade days. Monthly abnormal returns following isolated insider stock sale (purchase) months are -60 to -100 basis points (60 to150 basis points) greater in magnitude than those following trade months that are sequenced. Completed trade sequences are followed by abnormal returns of similar magnitudes, suggesting they are also motivated by private information that is eventually incorporated into prices. Trade sequences are associated with proxies for information asymmetry, investor inattention, and longer-lived private information. These patterns hold for a broad cross-section of insiders, and are more pronounced when only considering the trades of top executives.”

Data Sources:

The main data source used in this analysis is the Thompson Reuters Financial Network Insider Filing Data, which provides detailed information on insiders’ transactions in the stock and derivatives of their own companies.

Discussion:

Based on insider trading behavior, the authors identify two trading patterns. Insiders who have short-lived information are more likely to engage in isolated trades. In contrast, insiders with long-lived information are more likely to engage in an extended sequence of trades.

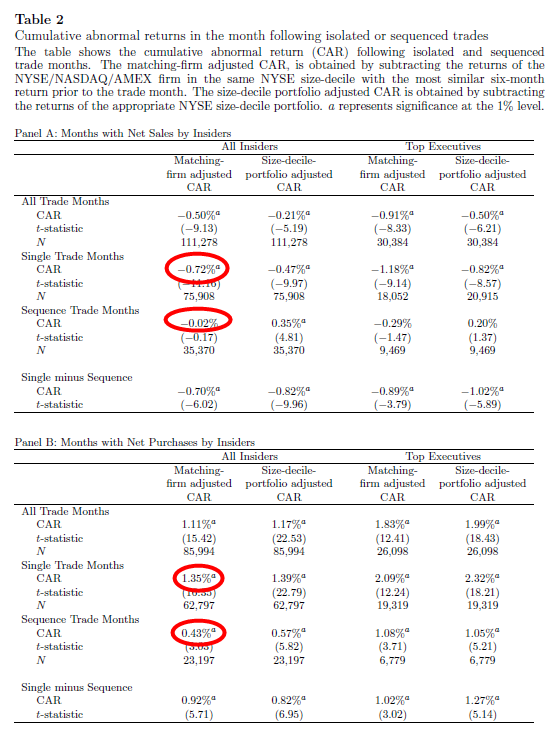

Isolated insider trades are more likely to precede information that is quickly incorporated into market prices. And research finds that there are significant negative abnormal returns for isolated insider stock sales/purchases in following months, but no significant abnormal returns in the month following sequenced stock sells/purchases.

The results are compelling. Single trade month sells generate 72bps/month in alpha; single trade buys earn 135bps/month alpha. Sequence trade month sells earn 2bps/month and buys earn 43bps.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

The authors also find that isolated trades are more likely to be followed by an immediate earnings surprise, than is the case for a sequence of trades.

Commentary:

For regulators and investors, this paper shows that insiders take advantage of the opportunities the market gives them and gives us a better understanding of the trading behavior of informed investors.

About the Author: Tian Yao

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.