Efficiency and the Disposition Effect in NFL Prediction Markets

- Hartzmark and Solomon

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category.

Abstract:

Examining NFL betting contracts at Tradesports.com, we find mispricing consistent with the disposition effect, where investors are more likely to close out profitable positions than losing positions. Prices are too low when teams are ahead and too high when teams are behind. Returns following news events exhibit short-term reversals and longer-term momentum. These results do not appear driven by liquidity or non-financial reasons for trade. Finding the disposition effect in a negative expected return gambling market questions standard explanations for the effect (belief in mean reversion, prospect theory). It is consistent with cognitive dissonance, and models with time-inconsistent behavior.

Alpha Highlight:

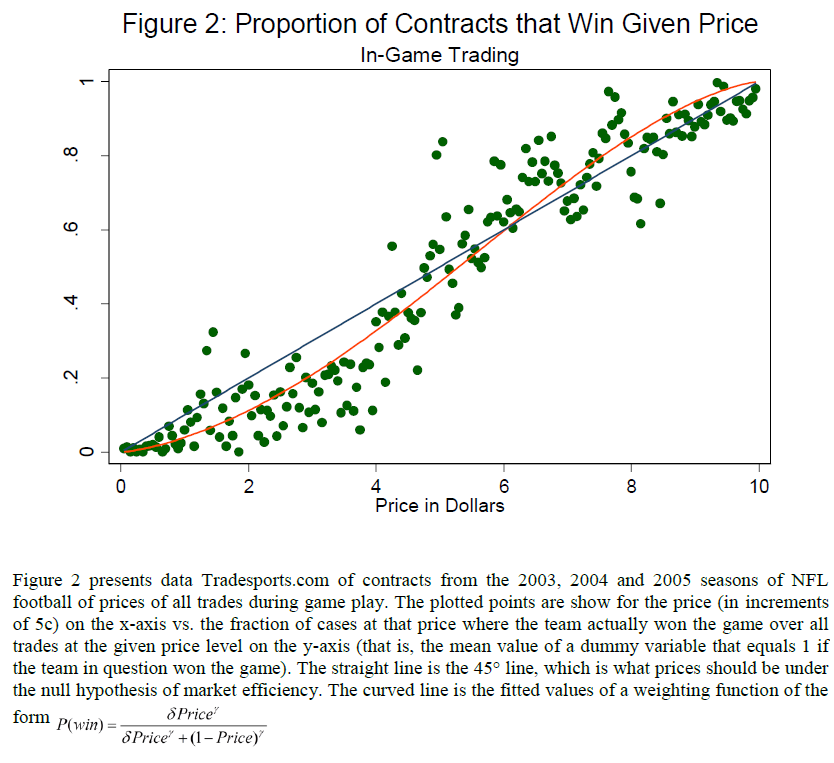

This paper examines gambling behavior on Tradesports.com for the 2003-2004, 2004-2005, and 2005-2006 NFL seasons. The main test is the following: “the contract price at any time should represent an unbiased estimate of the true probability of the event occurring.”

So are gambling markets efficient?

No!

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

The paper finds mispricing consistent with the disposition effect. The figure above shows that prices are too low when teams are ahead and too high when teams are behind (the data points should fall on the 45 degree line in an efficient market).

So next time you are in Vegas and decide to place a bet, remember this study!

About the Author: Jack Vogel, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.