Following value strategies can be hazardous to one’s wealth in the short run.

Oil stocks are a great example of the challenge value investors face:

The stocks are down big–and getting cheaper–but could go down even further!

Successful value investors are able to buy and hold cheap stocks for a number of years and avoid short-run noise.

However, if you are an emotional and impatient investor, you should think twice before you invest in a value strategy.

Here is an article we wrote on this subject:

We dig a bit deeper into this concept in this post.

Preliminary Details

Here we construct a value portfolio of mid/large cap stocks (formally above the 40th percentile for NYSE market capitalization). We select the top 10% of stocks in the universe based on EBIT/TEV, and rebalance the portfolio annually. The portfolio parameters specifics are similar to those outlined in our valuation horse race paper. We want to examine, at a monthly level, how much a value strategy can outperform as well as underperform.

So What Do the Monthly Spreads Look Like?

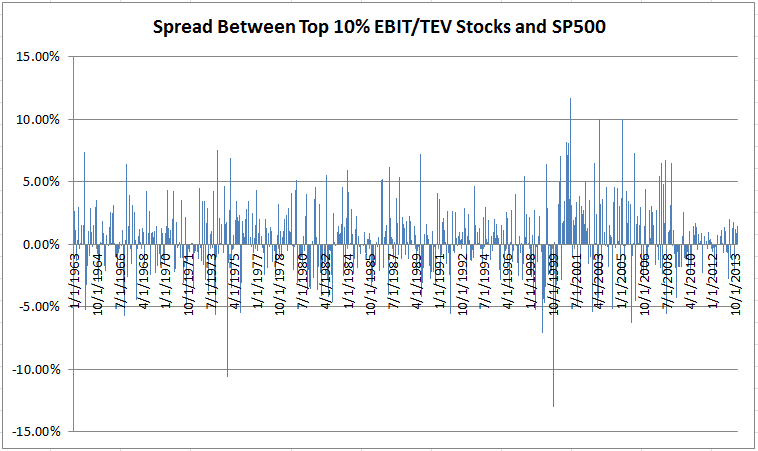

This graph shows the spread in returns between our value portfolio and the SP500. Monthly spreads can be huge!!!

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

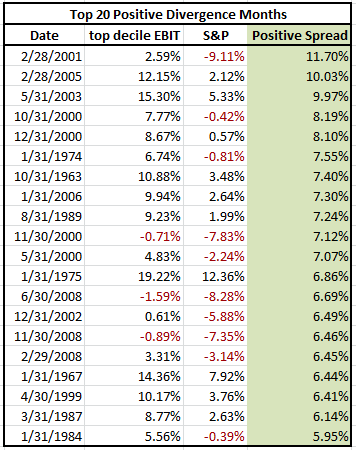

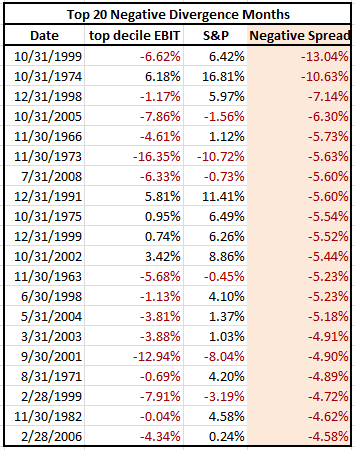

Below is a table showing the top 20 best and worst spreads:

Tracking error:

The annualized “Tracking Error” for the value portfolio (Top 10% EBIT/TEV) with the S&P 500 is about 9.38%. “Tracking Error” here is calculated as the Standard Deviation of the difference of the returns between value stocks and the S&P500 benchmark. Compared with many passive ETFs, which have ~zero tracking error, 9.38% is large. Roughly translated, this implies that in any given year, the value portfolio will be all over the map relative to the S&P 500.

Can you imagine a month where your portfolio gets beat by over 5% relative to the benchmark? As a value investor, this isn’t abnormal, you can expect it!

Taking on tracking error is a great way to get fired as an asset manager. As an individual, it is a great way to break your confidence and sell your hated value stocks.

Yuck!

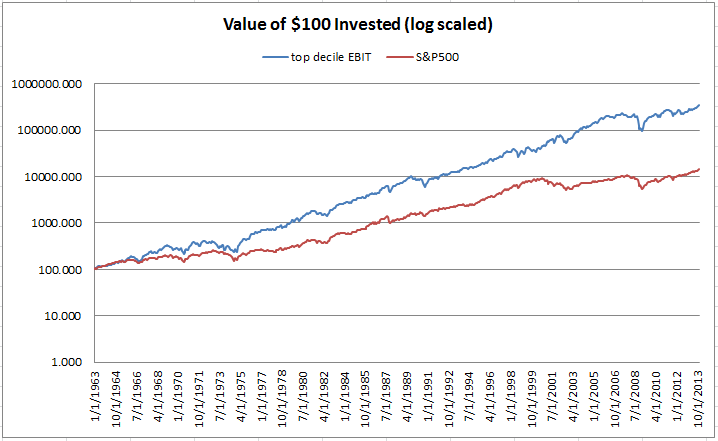

But what is the Upside of Tracking Error Pain?

In a nutshell, the benefit of taking on the pain of tracking error is higher expected performance. But expect a crazy ride! The markets are generally efficient and there is always a catch: Value investing can work, but it requires a serious commitment!

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.