Barry has a nice piece in the Washington Post asking a simple question:

What is the best valuation metric to assess if a stock is cheap or expensive?

Jack and I were honored to see that Barry highlighted our 2013 Journal of Portfolio Management paper:

Analyzing Valuation Measures: A Performance Horse Race over the Past 40 Years

You can download an old version of the paper here and there is a in-depth summary at the following link.

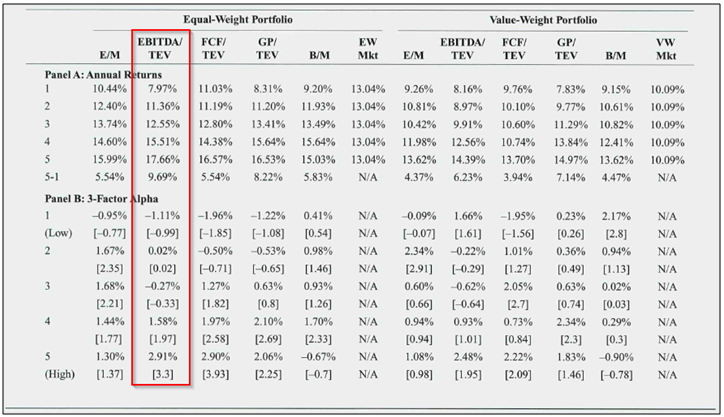

The chart below presents the key table from our paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Barry’s comment on our paper:

Perhaps the most readable of these is from Wesley Gray and Jack Vogel: “Analyzing Valuation Measures: A Performance Horse-Race Over the Past 40 Years” (Drexel University, January 2012).

These papers (and others) have identified a ratio that has been described as the single most successful measure of valuation in terms of historical track record: EV/EBITDA.

Barry also highlights another great paper on the subject from Tim Loughran and Jay Wellman.

A close second is Tim Loughran and Jay W. Wellman’s “New Evidence on the Relation Between the Enterprise Multiple and Average Stock Returns.”

We did a deeper dive on this paper in the following blog post.

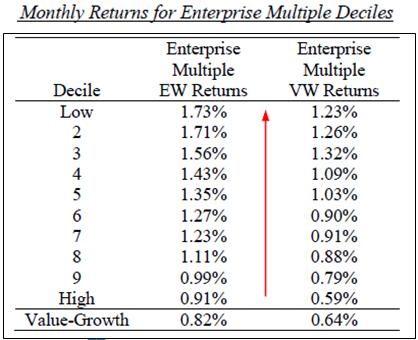

Here is my favorite chart from the paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Conclusion

Buying cheap stocks has been a good strategy–at least historically. And it certainly seems that enterprise multiples are more effective, on average, than measures that are more commonly used (e.g., book-to-market, or price-to-earnings).

Who knows which metric will be the best in the future, but one lesson is clear: buy cheap stocks. And if you don’t have the stomach of patience do buy individual stocks, identify value investing funds, value investing etfs, or value-focused stock-pickers searching in the bargain bin of the market-place.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.