In a sustained effort to try too hard, investors are constantly analyzing and assessing the growth rates of various markets around the world. The key assumption behind this analysis is that knowledge of these growth rates enhances their ability to predict the future and expected returns. This assumption is empirically invalid. Unfortunately, a big trick in investing, and life in general, is separating the signal from the noise.

A recent article by Baijnath Ramraika highlights what the author calls “The GDP Growth Rate Myth.”

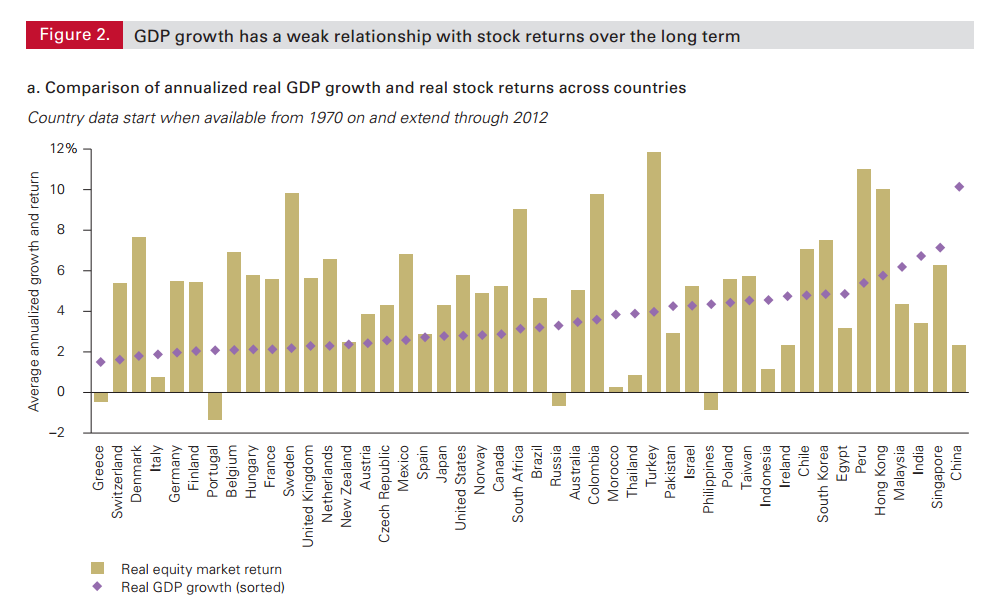

Baijnath references an interesting piece by Vanguard, which stated:

In a 2010 research paper, we cautioned equity investors that these markets should not be expected to outperform their developed counterparts solely on the basis of higher anticipated economic growth.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

All great stuff, but why is Vanguard basing a research piece on a subject that has already been explored extensively by academics. This is old news. In an older post we highlight the work of the great academic finance researcher Jay Ritter. Jay has a paper called, “Is Economic Growth Good for Investors.”

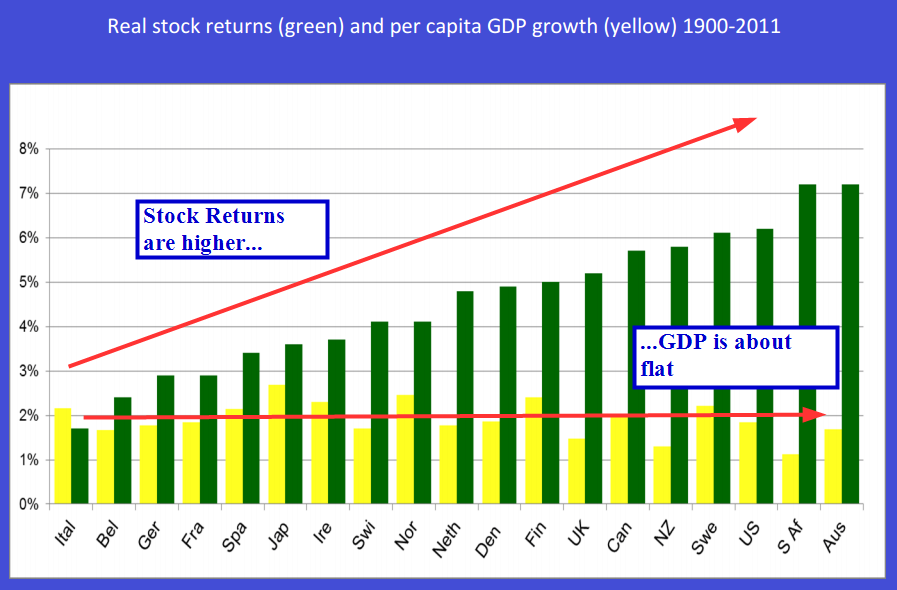

Here’s Jay’s punchline:

When measured over long periods of time, the correlation of countries’ inflation‐adjusted per capita GDP growth and stock returns is negative.

And here is the chart from Jay’s paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

On our piece on behavioral finance, we highlight that Warren Buffet reminds investors why they shouldn’t cling to macroeconomic growth stories. So, if not on growth, in which area should investors focus? As Ritter says quite succinctly: “current earnings yields.” Translated for non-finance geeks, this simply means price. And as any intelligent investor will tell you, the price you pay has everything to do with the returns you will receive. If an investor pays a high price for a given asset, they can expect low returns; if the same investor pays a low price for a given asset, they can expect high returns. The real story here is that high equity returns are earned by investors who focus on paying low prices for firms with strong abilities to invest in positive net present value projects. It may be that the best prices can be had in times of low economic growth when prices are depressed, whereas we tend to overpay in a growing economy. The idea that strong economic growth translates into strong stock returns is a superstition, not backed by evidence.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.