Worrying About the Stock Market: Evidence from the Hospital Admissions

- Engelberg and Parsons

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category.

Abstract:

Using individual patient records for every hospital in California from 1983-2011, we find a strong inverse link between daily stock returns and hospital admissions, particularly for psychological conditions such as anxiety, panic disorder, or major depression. The effect is nearly instantaneous for psychological conditions (within the same day), suggesting that anticipation over future consumption directly influences instantaneous utility.

Alpha Highlight:

A variety of research has demonstrated that increased stress can affect investors when the stock market gyrates. For example, here we discussed how cortisol is produced in response to market volatility, and here where we discussed how cortisol affects our brains and drives changing attitudes towards risk. We must be aware of this reality. If market volatility affects our brain chemistry, which in turn affects our financial decision-making, we can end up in a vicious feedback loop of poor decision-making. But it gets worse…the authors of this paper highlight that a brutal financial market can be harmful to our overall physical and psychological well-being. Specifically, the research question at the heart of this paper is “How

Does Market Volatility Affect Our Physical Health?”

Using the daily hospital admission data for the state of California from 1983 to 2011, this paper finds a negative relationship between stock market performance and hospital admission, particularly for mental heath conditions such as anxiety, panic disorder, or major depression.

A brutal stock market does affect our health, especially our psychological well-being…

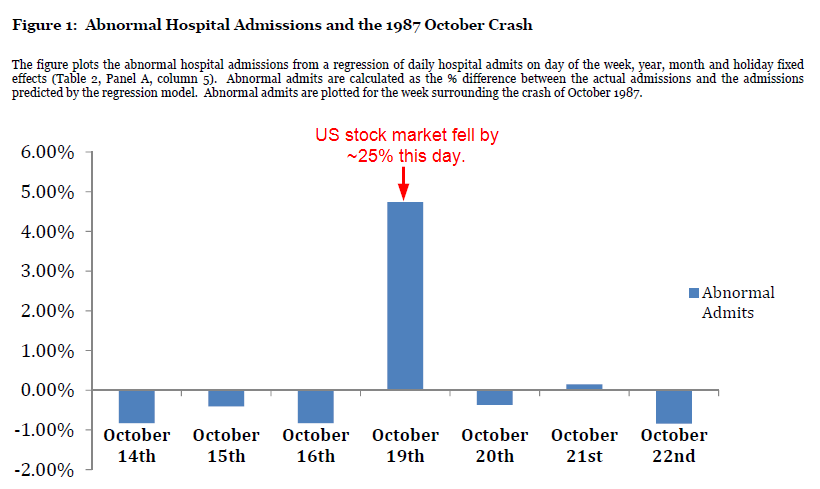

From the paper: In October 19, 1987, known as “Black Monday“, the US stock market slumped by almost 25%. On the same day, the seasonally adjusted hospital admissions in CA spiked over 5%.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Key Findings:

Using the three-decade sample, the authors conduct time-series regressions and finds that a 1 standard deviation drop in stock prices (roughly -1.5%) leads to a 0.18% to 0.28% increases in hospital admissions over the next two days. Additionally, when the authors restrict the sample to mental health conditions (anxiety, panic attacks, etc), the negative correlation is more significant. So, poor stock market performance appears to induce psychological distress.

Of course, you might be thinking that the spike in hospital admission could also be caused by other factors, such as reactions to geopolitical events (wars, terrorist attacks, etc), or to macroeconomic news (inflation, job reports, etc). To control for other factors that might explain the results, the authors manually investigates the 1,500 worst market days in the sample. Specifically, they reviewed the New York Times (NYT) and Wall Street Journal (WSJ) coverage for these days. They find that of the 1,500 worst market days, foreign conflicts were reported 50 times, macro announcements were reported 203 times, stories invoking prices in other markets (old, fx changes, etc) were reported 115 times. When the authors remove these factors and re-run the regressions, they find no impact on the main results.

The authors suggest that big market drawdown affect investors expectations about the future, which relates to their utility today, and thus drive an instantaneous reaction. In other words…

A bad stock market will literally make you sick.

Recommendation:

Stop paying attention to the stock market…and consider letting a computer do the investing for you.

Sometimes investing is simple, but not easy.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.