We’ve discussed the use of predictive regressions in the past. Here is an article to learn a bit more about the technique.

And while the idea sounds cool, and could even be relabeled a low-tier “machine-learning” technique if someone wanted to sell the idea, we can’t find anything exciting about the technique. Our mea culpa on trying to time the market is outlined in the first few paragraphs of our fairly detailed post on our downside protection system.

Having your cake and eating it too is a great way to go. It’s great to have the cake, and it’s also great to eat the cake. But you can’t have it both ways. This trend continues when we speak with fellow investors: “Give me high, after-tax, net of fee returns, but with limited risk and volatility.” Now, we certainly love high returns with low risk. We also love high reward with low effort and high calories with low weight gain. Unfortunately, this brings us to our first problem with the investing unicorn: Unicorns don’t exist, and neither do high returns with low risk.

Novy-Marx has a fun paper — with a great title — that emphasizes the futility of using predictive regression techniques to try and time the performance of various anomalies. We actually highlighted this paper over 4 years ago, but here is the published edition.

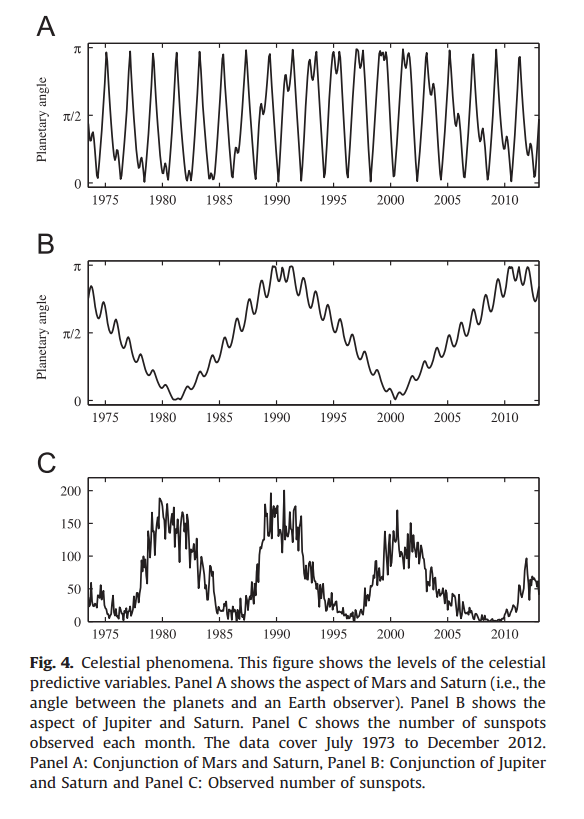

Predicting anomaly performance with politics, the weather, global warming, sunspots, and the stars

Predictive regressions find that the party of the US president, the weather in Manhattan, global warming, the El Niño phenomenon, sunspots, and the conjunctions of the planets all have significant power predicting the performance of popular anomalies. The interpretation of these results has important implications for the asset pricing literature.

Here is a great table from the paper:

Doing research can be incredibly humbling. Especially when someone highlights that we’re probably all full of bunk!

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.