The ETF industry has been around for over 20 years at this point, but over the past 5 years the ETF industry has captivated the investment world. I’ve had a front seat on the action, launching over 650 exchange-traded products while I was an associate at the NYSE in the Global Indexing and Exchange Traded Product Group. We built indexes for ETFs, participated on weekly calls with the SEC trying to get approval for innovative ETFs that fell outside the standard rules, and guided new ETF issuers through the whole process. It was here that I learned one important fact of a new ETF: You, the financial advisor, will never see a bad backtest for an ETF. If the investment idea had a poor backtest, it didn’t make it to market.

I transitioned to RevenueShares to be their Head of Capital Markets, which we grew from $450 million to $1.1 billion and was eventually sold to the mutual fund giant, Oppenheimer Funds. During my seven years in the industry, I’ve witnessed that some industry players were prepared, some were caught flat-footed, and some are still trying to figure out what to do next.

In this piece, Wes asked me to share some insights on the ETF industry and where it might be heading based on some trends I’ve witnessed. I’ll start this essay with a recap of recent merger and acquisition activity in the ETF space, then discuss why advisors are back in the driving seat, mention briefly some trends in ETF product development, and end with some discussions of what we could expect going forward.

Photo Source

ETFs Create Disruption: Do You Buy Your Way Into the Business?

In 2014 and 2015 there was a wave of ETF company acquisitions by large asset management firms. The reason was simple: if an asset management company was not in the ETF game, they realized they really needed to get in it. ETFs were not a fad that was going away.

Asset management firms had two options:

- Build the ETF division of their firm from within

- Acquire an ETF company and its existing team and/or ETF products.

Some asset managers chose option 2: IndexIQ was acquired by New York Life. Janus bought VelocityShares. Oppenheimer Funds bought RevenueShares (full disclosure: my former employers). Hartford Funds acquired acquired Lattice Strategies. Columbia Threadneedle bought Emerging Global Advisors. Victory Capital acquired Compass EMP.

If you’re a big asset management firm acquiring a small ETF firm, you want to lever your strengths (your brand, large distribution force, and large amount of capital). You need to acquire an ETF company that enables you to do that. The sweet spot for an acquisition is an ETF company that is small enough in assets under management (AUM) that it isn’t an impossibly steep price, yet large enough in assets that your firm has a head start on distribution and marketing. Combine that sweet spot of assets with a decent length of time for their ETFs track record, and you have a company that is an ideal acquisition target.

If you examined the list of ETF Companies in the U.S. at the start of 2014, there was a decent number of acquirable firms in that AUM and track record sweet spot: ~$500 million — $5 billion in AUM and three to eight years of track record.

At the start of 2017, the ETF landscape looks very different for potential ETF company acquirers.

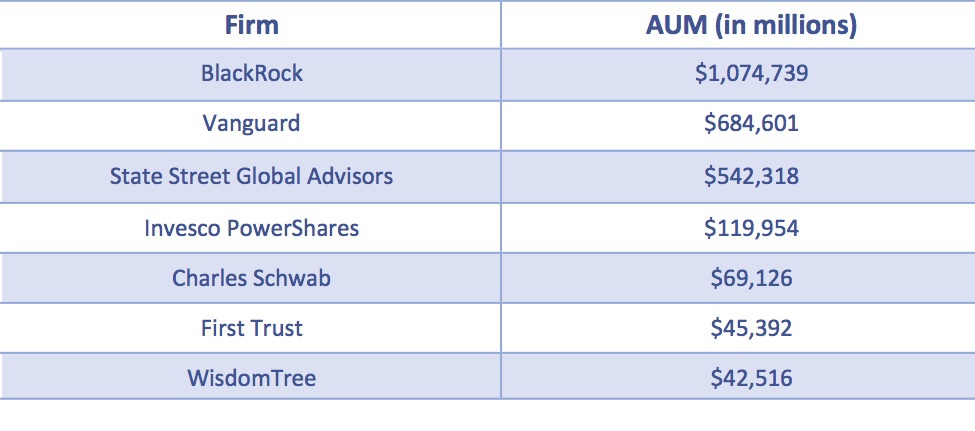

Looking at the ETF league table from ETF.com, let’s categorize all the ETF product lines/companies that have over $1 billion in AUM. I’ll use some very official divisions to categorize why they’re either totally not acquirable or near impossible (A.U.M. numbers below as of April 5, 2017).

The “You Can’t Buy Us, but Maybe We’ll Buy You” Division

- BlackRock — $1.082 Trillion

- Vanguard — $681 Billion

- State Street — $531 Billion

- Invesco PowerShares — $120 billion

- Charles Schwab — $69 Billion

- Guggenheim — $35 Billion

The Privately Owned/Unicorn Division:

- First Trust — $46 Billion

- VanEck — $36 Billion

- ProShares — $27 Billion

- Direxion — $12 Billion

- U.S. Commodity Funds (technically publicly traded, but a unicorn) — $4.2 Billion

The “Already Acquired By, or Started By, a Larger Wealth Management Firm” Division

- ALPS — $14.5 Billion

- Deutsche Bank — $13.8 Billion

- Northern Trust — $13.4 Billion

- PIMCO — $13 Billion

- UBS — $7 Billion

- Barclays Capital — $6.6 Billion

- Credit Suisse — $3.6 Billion

- ETF Securities (has one of the largest European ETF businesses) — $2.4 Billion

- IndexIQ (acquired by NY Life) — $2.4 Billion

- OppenheimerFunds (acquired RevenueShares) — $2 Billion

- Victory Capital Management (acquired Compass EMP — $1.3 Billion

(This division is interesting because you *could try to convince some of these firms* that a spin off of their ETF business would enable it to achieve its full value. We’re assuming that’s too complicated and these firms want to hold on.)

The “We Started Later, But Are Choosing To Go It Alone” Division

- Fidelity — $6.2 Billion

- JPMorgan — $5.3 Billion

- Goldman Sachs — $3.3 Billion

The “I’m Kinda Seeing Someone Already” Division

- Global X (partially owned by JPMorgan) — $4.7 Billion

The Exemptive Relief Division

- Exchange Traded Concepts — $2.6 Billion

- ETF Managers Group — $1.2 Billion

- AdvisorShares — $1.1 Billion

- Millington Securities — $1 Billion

The Wisdomtree Division

- Wisdomtree — $42 Billion

(Can they be bought? Yes. Will they be bought? They’re often thrown around as a target acquisition for one of the behemoth asset management firms, but likely too large and too expensive now.)

OK. That is every ETF company/product line that has over $1 billion in assets. None of them are really acquirable. Yes, there’s always a price, but any firm that can buy the firms above, it probably doesn’t make sense to, and any firm that would like to acquire the firms above, can’t.

Under $1 billion in AUM, we have some very large asset management firms that are either going it alone in building their ETF business line, or they bought a small ETF shop mainly as an acqui-hire (saying this because there was either a short track record for the ETF shop acquired, small AUM, or both).

Since the rush of 2014/2015 acquisitions, the options to acquire firms have become much slimmer. If you’re a firm that is looking to buy your way into the ETF space then, what are the best options from what’s left?

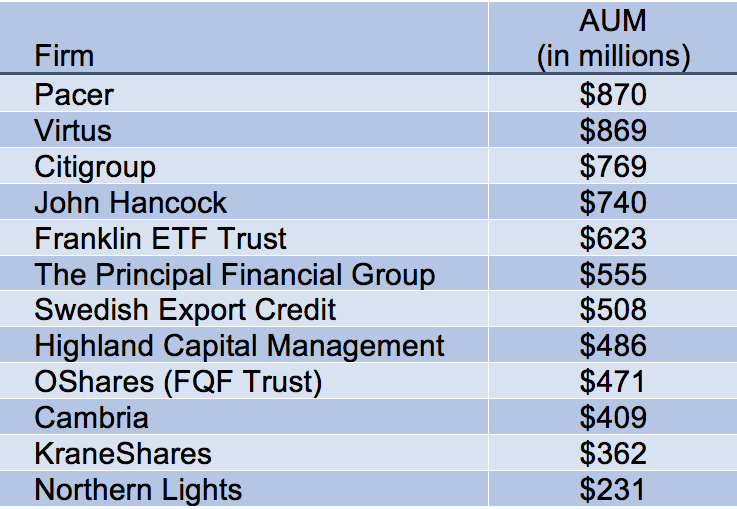

Here’s the list of firms under $1 Billion , but over $200 million in AUM (in millions):

This is a good range to focus on as these firms are large enough to be of interest to a larger firm, or soon could be.

Within those, there’s three independent ETF shops to keep an eye on:

- Pacer Financial

- O’Shares (FQF Trust)

- Cambria

Beyond falling in that AUM range, each of them has a product suite that achieves the following:

- Can handle a large capacity of assets due to how they’re structured

- Their products can be sold in major portfolio allocation segments

- They each have a product suite that has a theme to them that could be expanded upon by a larger firm for future product development.

Those are the key things to look for if you’re considering acquiring your way into the ETF business.

Sure, they each have some flaws in an acquisition scenario (Pacer’s Trendpilot products are more complicated to sell to the average client, O’Shares has a short track record, and Cambria just raised additional capital). But if they were perfect, they’d already be acquired!

The Initial Plan–ETFs Will Deliver Cheap Beta

In part one, we looked at the state of the ETF industry from a business/acquisition perspective.

How did we get here though, and where are we headed next?

The ETF industry started in 1993 with the launch of SPY. This started the first wave for the industry: market capitalization weighting, or “cheap” beta. To most investors and asset managers, for the next eighteen years (until about 2013), market cap weighting equaled ETFs. ETFs were market cap weighed. They were one in the same. If an advisor wanted the chance at outperformance, they invested with mutual funds; if they wanted cheap beta, they bought an ETF.

The financial advisor was now becoming the active manager once again, helping clients decide among various active and passive offerings. Let me explain. For many of the more seasoned financial advisors in the business (i.e., those who have been around for at least 20 years), when these advisors started their careers, they woke up every morning diving through individual company information to find the best stocks they could purchase for their clients. And that was fun. That was the part of the business that got them excited. If they made the right call for their clients on a stock, it could make their career.

Throughout their careers though, it slowly became less of stock and bond picking, and more of assigning that active management role to the mutual fund industry. The advisor found a few mutual fund companies he (or she) trusted, he picked their funds across asset classes for diversification, put his clients’ money in them, and checked in on the funds occasionally to make sure they were performing to expectations.

The creation of market cap weighted ETFs began to change the financial advisors’ role back to their earlier days of the business. Once again, they had to make the call:

- Should I buy the Van Eck Egypt ETF ($EGPT), or maybe invest in India using the iShares India ETF (INDA)?

- Gold could protect my clients downside if we have another 2008, maybe I should buy some of State Street’s SPDR Gold Shares ETF ($GLD)?

- Yeah, but GLD owns U.S. Gold and the U.S. confiscated people’s Gold in 1933, I better buy ETFS Physical Swiss Gold Shares ETF ($SGOL) just to be safe…

Decisions, decisions, decisions.

ETFs empowered advisors (and individual investors) with decisions and took that power away from the mutual fund companies.

All of this happened on the back of a relatively small number of market-cap weighted ETFs. For example, in 2011, there were a “record” 304 exchange traded products listed on the New York Stock Exchange. Many people thought that everything that could be done with ETFs, had been done. Around that time, we crossed 1,000 ETFs listed in the U.S. The only thing left to do was launch the “Zimbabwe market cap weighted ETF,” or some other obscure location (or sector) that wasn’t already taken by iShares or State Street.

But the ETF industry was only starting to revolutionize the asset management industry. The industry moved from delivering cheap beta, to delivering so-called “smart” beta. The active mutual fund managers were already in trouble when advisors had more decision points and an ability to allocate to cheap market-cap weighted ETFs, but the introduction of products that would directly compete with mutual fund manager’s active products was extremely disruptive.

The New Plan–ETFs Will Deliver “Smart” Beta

From a product development standpoint, there wasn’t much left to be done in the market-cap weighted space. To twist a Yogi Berra quote, “No one builds market cap weighted ETFs anymore, they’re too crowded.” Plus, with expense ratios approaching zero, launching a market-cap weighted product only served as a loss leader or as a way to stay relevant in the minds of investors and advisors. In many respects, market-cap weighted ETFs serve as a utility for the asset management industry. Nothing fancy, but they deliver your electricity at low-cost.

Remarkably, these investment “utilities” were difficult to beat. The combination of rules based investing (removing behavioral biases), lower management fees, and the tax efficiency of the ETF wrapper, made it all but impossible for actively managed mutual funds to outperform market cap weighted ETFs over time.

The ETF industry was not satisfied with the status quo. As Jeff Bezos is quoted as saying, “Your profit margin is my opportunity.” ETF firms started seeing the juicy active mutual fund profit margin as an opportunity and decided it was time to compete — and win. Why couldn’t an ETF firm take the benefits of the ETF structure — rules-based, tax-efficient, and transparent — and turn that into a weapon against the active mutual fund managers? Rob Arnott of Research Affiliates (RAFI) figured he’d give it a chance with the advent of “smart beta.”

PowerShares launched the PowerShares FTSE RAFI US 1000 Portfolio ($PRF) on 12/19/2005. No one knew it at the time, but this was the biggest launch of the ETF industry since the launch of SPY in 1993. In contrast to SPY, and most of the ETFs that came before it, this fund removed price from the passive weighting equation of its constituents. They instead chose to weight their ETF holdings by a variety of “value factors,” in an attempt to provide outperformance.

Six months later Wisdomtree, a former personal finance magazine company, launched their first ETFs in June 2006. WisdomTree also chose not to use price in the weighting of their ETFs. They chose to weight their funds using a dividend methodology.

One year after WisdomTree’s launch, in May 2007, First Trust launched their first Alphadex ETFs. The First Trust Alphadex ETFs, like PowerShares RAFI indexes, chose to use multiple factors to weight their ETFs holdings, and therefore exclude price from the equation.

At the time, these firms were small players in the ETF industry. Fast forward to March 2017 though, and these firms represent numbers four, six, and seven in ETF assets under management.

The era of market cap weighting product development ran from 1993 until 2013, when we saw the final player rush in. Smart Beta started in 2005 and had the two other dominant firms established two years later. It wasn’t until 2014 though that the term Smart Beta really began to take hold. By 2014, mostly everyone knew ETFs were real. Most knew you couldn’t launch market-cap weighted products because that battle was fought (and there was no money left to be made there). But firms thought they could compete on products that provided differentiated weighting schemes.

JPMorgan launched their first ETF in 2014 (a multifactor ETF). About a year after that, Goldman Sachs entered the ETF world with a suite of multifactor ETFs of their own. And Fidelity launched their own suite of smart beta funds in 2016. Though still relatively new players overall, as these firms were sooner to catch the second trend within ETFs, they’ve more rapidly gained assets in the space and now make up a reasonable percentage of the assets in this category.

Since the launch of PRF in 2005, iShares, State Street and many other firms entered the smart beta ETF weighting area as well. ETF product development started out as a race to fill the entire globe with straightforward strategies that would offer investors exposure to anything there was demand for (or not!). It moved on to attempting to offer exposure to those areas in a more intelligent (Smart!) way. That race is continuing, and there is still room for innovation there, but the price war has started here as well.

The Next Plan–ETF will Deliver ESG

With the first two ETF waves — cheap beta and smart beta — when the rush of product development came there was already a large amount of assets invested in those areas and those areas were continuing to grow rapidly. From a product development standpoint, there seems to be a third way emerging: ESG Investing.

There’s been a rush of asset managers launching ETFs in the ESG space, but assets are minimal (a few billion dollars). Legg Mason has filed for two new ESG ETFs. Nuveen launched a suite of ESG ETFs. Oppenheimer Funds launched two. iShares has the longest running ones ($KLD and $DSI). State Street successfully launched the SPDR SSGA Gender Diversity Index ETF ($SHE).

- The rush makes sense for a few reasons: If you’re a larger asset manager, you know from the first two trends that it can pay to be early.

- With market cap weighted ETFs being nearly free and smart beta ETFs beginning to experience the same pricing pressure (thanks a lot, Goldman), there could be money to be made here as the ETF issuers are setting higher expense ratios on these products.

- If ESG ETFs prove to be the third trend, it could give firms that missed the first two waves a shot at taking major, core allocation, placement in investors portfolios. All good reasons from a business standpoint to take the shot if you have the capital to be patient on waiting to see if the trend takes off.

That business reasoning is why we have the supply of ETFs ready to catch this trend. Let’s analyze the demand for ESG ETFs, and figure out why that isn’t there yet (low asset under management in the products) and if it makes sense that the demand will catch up to the supply.

What’s the real idea behind ESG investing?

The idea is investors want to make a difference with their investments.

(1)They want to invest in companies that, at least, aren’t damaging the world or, at best, are making the world a better place in a number of different ways (ESG stands for environmental, social, and governance after all). In doing so, the hope is to coerce companies into making better decisions.

Can investing in certain companies based off certain metrics cause change to be made by individual companies? Yes.

Inclusion in an index likely can change a company’s behavior if there’s enough assets pushing them one way or another. If we had an ETF that had a trillion dollars of AUM in it, and it only invested in the 100 largest companies that powered themselves with solar roofs, we’d see a lot more companies moving to power themselves with solar roofs.

From a financial advisor standpoint, I know there’s demand from clients as well. I had one financial advisor recently tell me after she added the phrase “Socially Responsible Investing Strategies” to her website, she received two unsolicited calls from individual investors telling them they called her instead of her competitors when looking for a financial advisor because she had that phrase listed on her website. (If you’re a financial advisor, I’d recommend you put that phrase on your website–you might get lucky!)

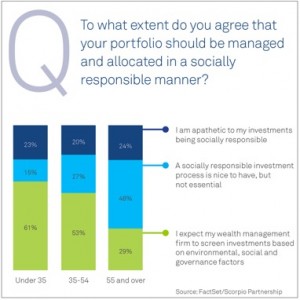

OK. We’re pretty sure we can change companies’ behavior based off of rules for investing in them (or not investing in them), and we’re pretty sure there’s at least some clients out there asking for it. But there’s still no real assets in the space yet on the ETF side. So why are ETF companies rushing to get into the space? The leading reason thrown around for that future demand (and AUM) to come: Millennials. The holders of the future assets.

ETF firms are predicting that based off studies like the one above (full data here), Millennials will be providing a rush of assets into socially responsible funds as they become the wealthiest generation with the Baby Boomer generation aging. The phrasing of these types of questions is highly misleading though. Ask young people from any generation that question, and I bet you’d see similar answers. Let’s flip the question: Do you want to invest in a socially irresponsible manner? You’d likely get 99% saying no, from every generation.

Millennials want their money invested soundly. Companies are changing to make themselves more socially responsible, more environmentally friendly, and have better social governance as the pressure of society forces them to do so. In 2011, under 20% of companies within the S&P 500 reported a sustainability report. By 2015 81% of companies did. The corporate change ESG investing is meant to drive, is occurring already. ETFs are not a missing tool needed to force that change. They are the needed tool in forcing the other changes we are seeing across the financial world (lower cost and more transparency).

ESG investing makes sense from a business standpoint, but it won’t be moving beyond a niche in the ETF world.

The Next Big Idea? Helping Investors and Advisors Pick ETFs

Financial advisors started off in the drivers seat, picking stocks, driving asset allocation, and really being engaged in the asset management piece of their client portfolios. Then mutual funds came around and advisors took a backseat as they simply allocated assets to a few mutual fund families and called it a day. But the demise of mutual funds and the rise of ETFs have shifted portfolio decisions back to financial advisors.

Advisors are now faced with the question of which ETFs to buy and how to set asset allocation. They need help and tools to accomplish their new mission. The next wave of ETF services will revolve around helping financial advisors make sense of it all (a good example is the visual active share tool just released by Alpha Architect). With almost 2000 ETFs, and 10,000 mutual funds out there, the ETF firms that excel in the future are going to be the ones that can provide advisors and investors with the knowledge and tools to confidently construct ETF portfolios and make good use of those 12,000 products. As with the other trends, some firms were early to this trend. Many of the leading ETF issuers provide tools on their websites for clients to build their own models, some are providing pre-built ETF models for free on their websites, and their sales forces are working with financial advisors in a truly consultative way to construct customized ETF models.

Financial advisors are drowning in emails and phone calls from ETF wholesalers looking to pitch them on their products. The last thing a financial advisor needs is one more salesperson walking in to tell them they have the best product for them. Some of them are even right, they do have the best product. But how does the product fit into their portfolio? Financial advisors need holistic advice. Below are some example questions an ETF wholesaler should explore with future advisors:

- What is the overlap of the ETF we’re discussing and the rest of my portfolio?

- Does it increase my diversification in an intelligent way, or is it more ownership in assets I already own?

- What does it do for the cost of my portfolio?

- Cost isn’t everything, but I better be getting something additional for that cost. ETF exposures are getting cheaper and cheaper!

- What does this do for the valuation of my portfolio?

- What matters is the historical average valuation of a product. Products can become overcrowded. The SPDR Utilities Select Sector SPDR ($XLU) is always (we hope) going to trade at a lower valuation than the Purefunds ISE Cyber Security ETF ($HACK), but if XLU is trading at a 30 P/E, its probably not the right time to add to it…

- What’s the best way to achieve my desired exposure?

- As an example, if I’m a value and growth investor, what’s the best way to get my exposure to value and growth?

- What are the tax concerns (if any) with this type of product?

- What is the current liquidity profile of this product, and can that change? Or, can I get my money out as easily as I can get it in?

- Some products can move in and out of more liquid and less liquid assets as they rebalance. This can rapidly change the liquidity profile of the ETF.

- In a liquidity crisis, almost everything becomes illiquid.

- Wes has a good piece on this subject: (How ETFs trade in the Secondary Market)

If you can help an advisor address the questions above, your ETF firm stands a good chance to pick up assets. If you cannot, you’ve got a 1 in 12,000 shot — ugly!

Constructing lower cost, transparent, tax-efficient ETF portfolios is a trend that hasn’t peaked, but now, more than ever, investor education is critical to success.

Follow me on Twitter @RyanPKirlin or on Medium for more ETF updates.

References[+]

| ↑1 | Although, this is arguably questionable based on Aaron Brask’s recent piece. |

|---|

About the Author: Ryan Kirlin

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.