The Oracle of Omaha just commented on the Chinese stock market in this year’s Berkshire’s annual meeting:

…Markets have a casino characteristic that has a lot of appeal to people, particularly when they see people getting rich around them. And those who haven’t been through cycles before are more prone to speculate than people who have experienced the outcome of wild speculation…. it will offer investors more opportunity if you have lots of speculation, if they keep their wits about them…

Yes, indeed. If investors can “keep their wits about them,” the Chinese market is a great place to potentially make speculative returns.

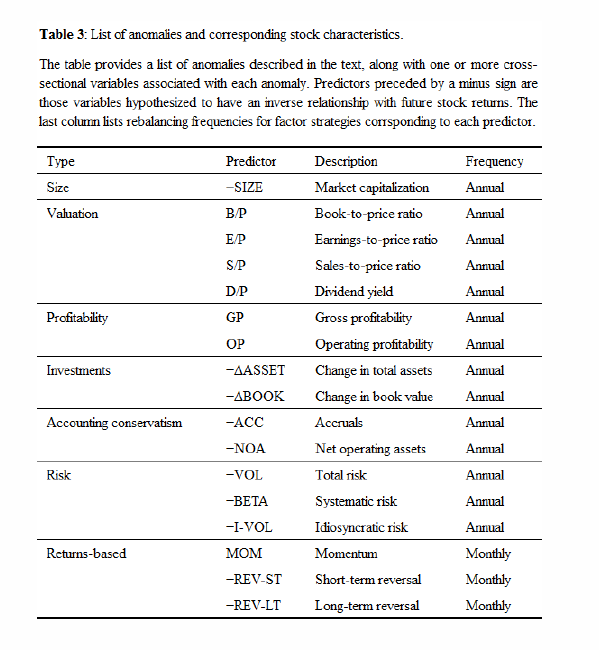

But is the Chinese stock market just a big gambling casino? Or can we assess some data and ascertain if there is some semblance of structure to how and why stock prices move in this market? As a quantitative minded investor, we enjoy research and empirical evidence over stories and narratives. In this piece we discuss a recent research paper that examines the classic “anomalies” in the Chinese stock market. The authors examine take aim at the following factors:

- Size

- Valuation

- Profitability

- Investments

- Accounting conservation

- Risk

- Return-based

Chinese (ie. Yang Xu) taking aim at various factors.

Chinese Stock Market Anomalies

There are only a handful papers discussing stock anomalies in China A shares (the NYSE and NASDAQ of China). “Anomalies in Chinese A-Shares,” by Hsu, Viswanathan, Wang and Wool, is one of the better papers in this space.(1) The authors examined US factors to Chinese A shares based on data between May 1995 to December 2016. The results are fascinating.

Seven core factor classes were examined: Size, Valuation, Profitability, investments, Accounting Conservatism, Risk and Returns-based. These classes were broken into 14 predictors.

The starting universe eliminates the smallest 20% of stocks based on market-cap and this universe is ranked by the predictors and assigned deciles. The returns-based predictors are monthly rebalanced and all other factors are annually rebalanced.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

How Have these Factors Performed?

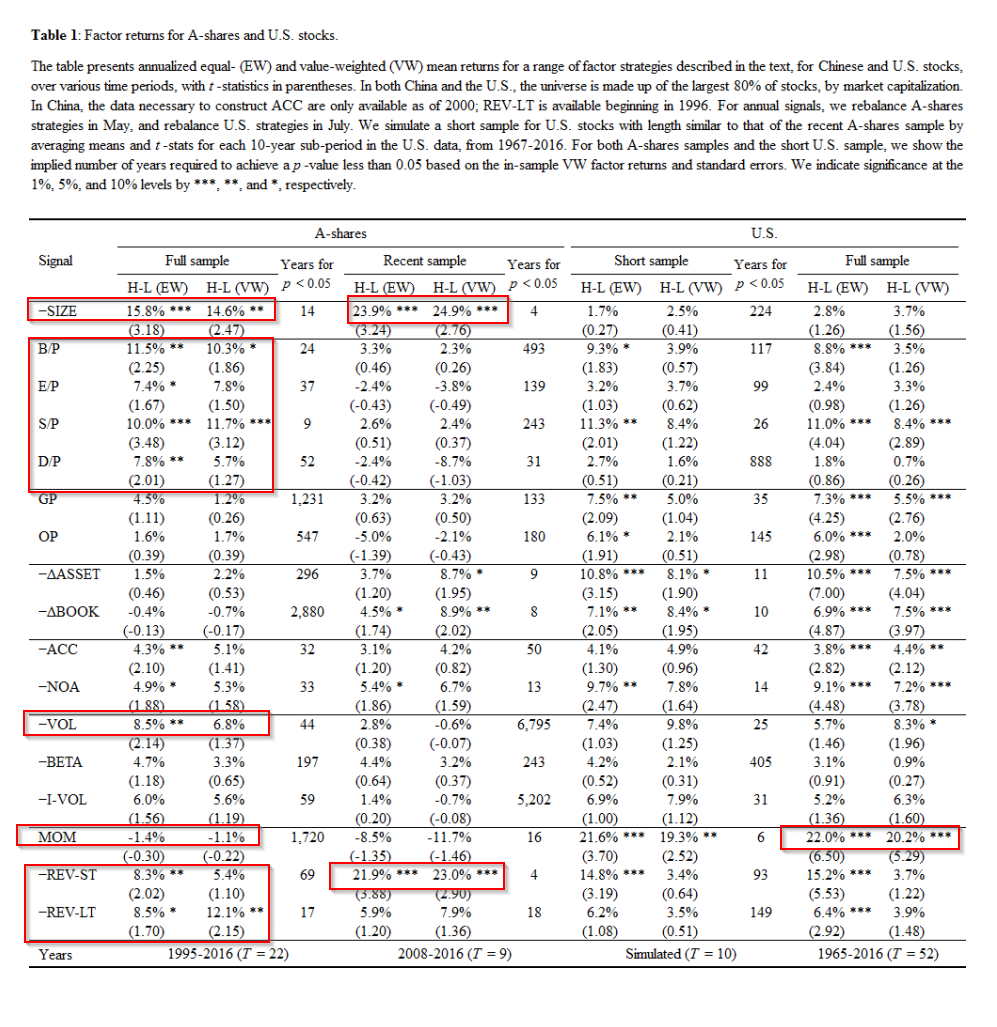

The authors compare the A-shares results next to the U.S. results, and within each market, they split the sample into two periods. The authors also present equal-weight and value-weight results, gross of fees.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Couple interesting findings in the Full Sample China A-shares (1995/05 – 2016-12):

- Size, size, size! EW Small cap outperformed large caps by 15.8% per annum, on average.

- Value works! B/P spread is 11.5% per annum for EW, and 10.3% for VW. Note that all the factors earned more than a 5% spread, though only S/P ‘s result is significant at the 1% level.

- Low volatility works. It earned on average 8.5% for EW and 6.8% for VW.

- Both short-term reversal and long-term reversal worked. On average, they returned between 5% and 12%.

- Momentum stinks. This all-star premium factor (~20%+ in the U.S. market) when applied on China A-shares earned NEGATIVE 1% return per annum.

Things have gotten more interesting in the Recent Sample (2008/05 – 2016-12):

- Size premium is even bigger: A record high 24% spread in both EW and VW portfolios.

- Value looks bad: B/P and S/P earned positive spreads, 3% and 2.5% respectively, but as only 30% as they had earned in the full sample. E/P and D/P spreads are all negative.

- Short-term reversal is a rock-star: it earned 21.9% in EW and 23% in VW portfolios.

- Momentum gets worse: Momentum’s spread is negative 8.5% for EW and negative 11.7% for VW!

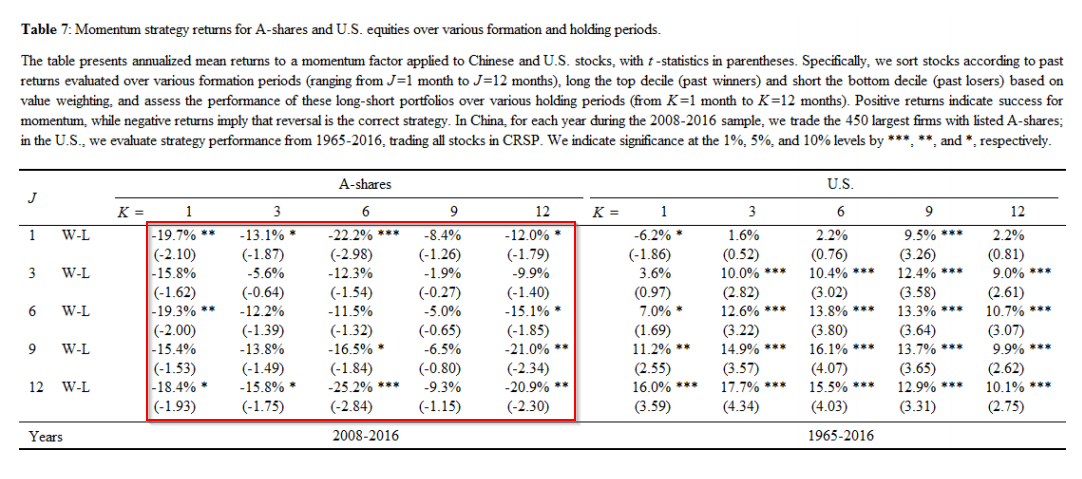

Here is a deep dive into momentum: the authors test the combination of different lookback periods and holding periods and found an astonishing result: all negative spreads!

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Implementation

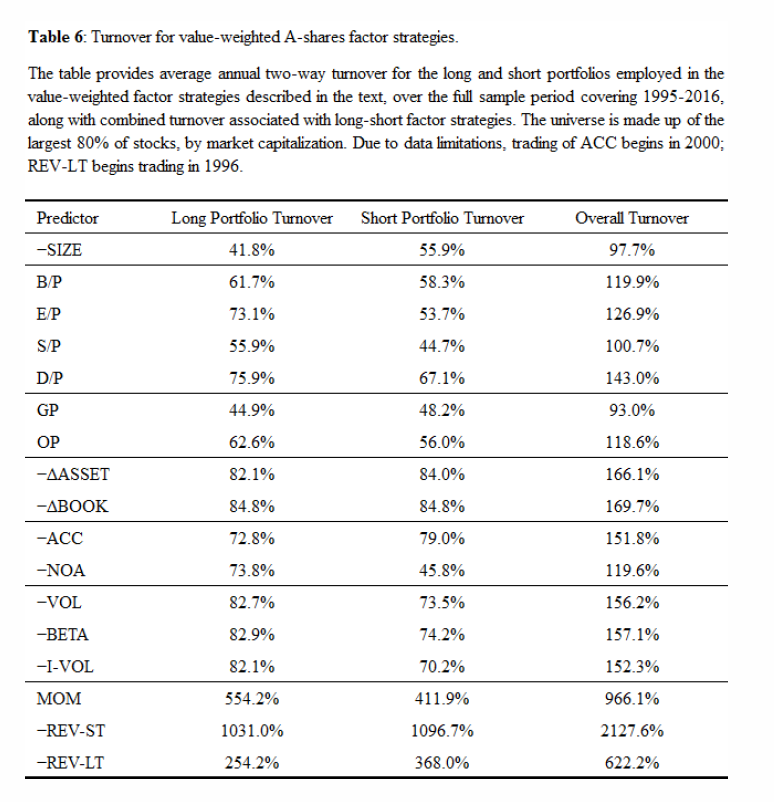

Realistically, can we earn such high returns in China A-shares by applying any of the factors above? We all love strategies with high returns — sounds cool, right? Short-term reversal fits the profile. But when it comes to implementation, execution costs can easily cut the realized returns in half. According to the paper, the short-term reversal strategy’s two-way annual turnover rate is 1031% for the long leg and 1096% for the short leg.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

One good thing about the Chinese stocks market (at least for Chinese investors) is that there is NO capital gain tax at all. No short-term, no long-term, no nothing. The stamp tax is 10bps when you sell stocks. When one adds up all other cost, such as commission, transfer agent fees and as on, we estimate the total trading costs — without considering market impact, borrowing cost and margin loan rate — is about 37bps.

When multiplying by the turnover rate, the trading cost is 3.76% for long leg and 4% for short leg, totaling 7.76%. This cuts down the EW and VW returns to about 14% and 15% respectively. When considering additional market impact, borrow cost and margin loan rate, the net return can easily go a lot lower.

Another obstacle of implementing higher frequency trading strategy in China is the T+0 constraint. If you short, you cannot cover your short on the same day. See this Bloomberg post. Although there are some ways to get around this, it creates more complexities and opens up space for large trading errors and implementation issues.

Conclusions

The paper is comprehensive and interesting. Some of the traditional factors look reasonable before costs. However, the Chinese stock market, has a short and highly volatile 22 years history, and is still a very young and emerging region. All the results presented should obviously be taken with a grain of salt, but at a minimum, the results are interesting.

What’s more, the Chinese market is controlled by the government to a large extent. For example, during the 2015 Chinese market collapse, the government suspended the shorting of index futures. Imagine what would happen in a market free-fall if you were implementing a long/short value strategy, and then the government essentially told you that you can’t do the strategy any longer? You’d had no choice but to liquidate the strategy. And imagine what might happen when all the long/short managers had to do this at the same time? Yikes!

We look forward to using our own data and conducting our own backtest of the factors in the Chinese stock market in the future.

Anomalies in Chinese A-Shares

- Jason Hsu, Vivek Viswanathan, Micheal Wang and Phillip Wool.

- A version of the paper can be found here.

Abstract:

We apply well-studied factor strategies from the U.S. equity anomalies literature to Chinese A-shares, demonstrating which factors have worked and which have not over the last two decades since the opening of China’s stock markets. We find while a number of traditional factors like value and size appear to work well in China, other factors are less effective, including A-shares momentum which works in the opposite direction. Our analysis reconciles conflicting results from the prior A-shares anomalies literature and explains differences in U.S. and Chinese factor investing experiences on the basis of unique features of China’s evolving investing landscape, including issues related to regulation, financial reporting standards, differences in market microstructure, and investor behavior. After reviewing evidence on the performance of specific factor strategies applied to A-shares, we demonstrate ways in which a deep institutional knowledge of China’s financial markets leads to more effective investment strategies through factor design and portfolio construction tailored to novel features of A-shares. Our findings will be of interest to researchers of equity anomalies and to those developing quantitative strategies for Chinese equities.

References[+]

| ↑1 | (Wes had some students review the core data earlier this year). |

|---|

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.