- Title: ABUSING ETFs

- Authors: UTPAL BHATTACHARYA, BENJAMIN LOOS, STEFFEN MEYER, ANDREAS HACKETAL

- Publication: REVIEW OF FINANCE, VOL.21, 2017 (version here)

What are the research questions?

By studying the trading data (provided by a German brokerage house) of a large (6,949) group of individual self-directed investors over the period from 2005-2010, the authors attempt at answering:(1)

- Do ETFs provide performance benefits to individual investor portfolios?

- If not, what are the reasons?

- Does investors’ heterogeneity (specifically, overconfident investors and/or financially unsophisticated ones) impact the results?

What are the Academic Insights?

The authors look at both raw returns as well as risk adjusted returns (with up to 5 factors in the model). Additionally, they divide the sample into ETFs users (1,080, those who traded an ETF at least one time) and non-ETF users (5,869). Answering the questions above, they find:

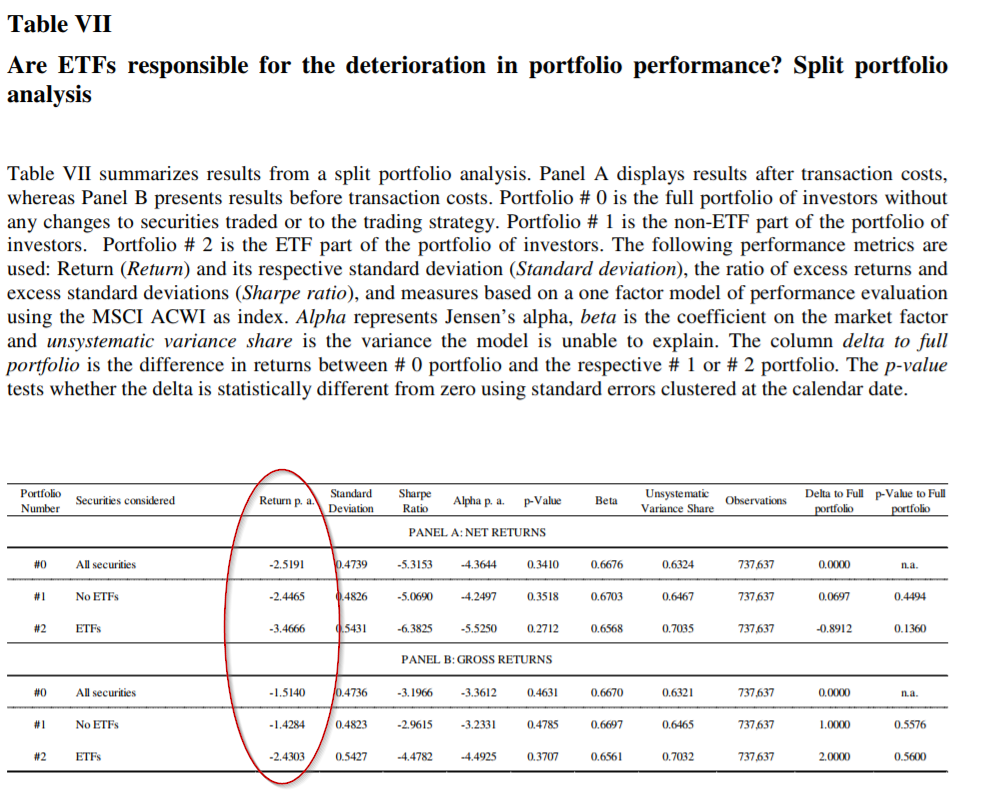

- NO – ETFs do not improve portfolio performance of ETF users rather, compared to the non-ETFs part of the portfolio, total performance decreases by -1.16% on average (however, investors using ETFs use all products sub-optimally-not just ETFs- see Tables IV and V in the paper)

- POOR “TIMING” and “SELECTION” abilities. By using counterfactual portfolio analysis, the authors turn off “timing” and “security selection” behaviors. They find that, out of the -1.16% drop in performance, 0.77% comes from poor timing abilities (and cannot be related to additional trading costs). Similarly, when they compared the results of the total average portfolio with a portfolio invested in a market portfolio buy & hold strategy (proxy for security selection), they find that the majority of underperformance comes from security selection behavior

- NO – The authors find that there is no distinct investor group that significantly benefits from ETF use or that experiences significant increase in diversification. Differently, they also find that no group will lose by investing in the right market ETF.

The analysis includes transaction costs.

Why does it matter?

Investing is difficult, especially timing the entry and exit points as well as the selection of the right instruments. Investors under this analysis emerge as buying and selling ETFs at the “wrong” time or trading the “wrong” ETFs. In the words of the authors: “Ironically, the growth in the number of ETFs that track single industries or countries seems to encourage this damaging behavior.” The suggestion from the authors for “Do it yourself” investors is to stick to a Buy&Hold strategy in a low-cost diversified market instrument.

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.