Are we misidentifying seasonal patterns as genuine earnings news?

- Tom Y. Change, Samuel M. Hartzmark, David H. Solomon, Eugene F. Soltes

- The Review of Financial Studies

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the research questions?

Changes in earnings are comprised of the expected earnings number plus any seasonal component of earnings. If the seasonal component is expected then it should not affect prices in an efficient market. However, unusual returns have been documented surrounding earnings announcements at the seasonal juncture in time. It is possible investors discount the complexity of seasonality even though it is a relatively straightforward concept.

-

Are higher returns associated with firms with high earnings seasonality relative to firms with low seasonality, surrounding the announcement of earnings at the seasonal peaks?

-

Do investors understate the importance of the information contained in earnings seasonality? Positive surprises may occur if investors do not incorporate the predictable tendency for earnings to be higher in specific quarters.

-

Are there other explanations that would explain an increase in risk around announcements of earnings during a seasonal peak?

What are the Academic Insights?

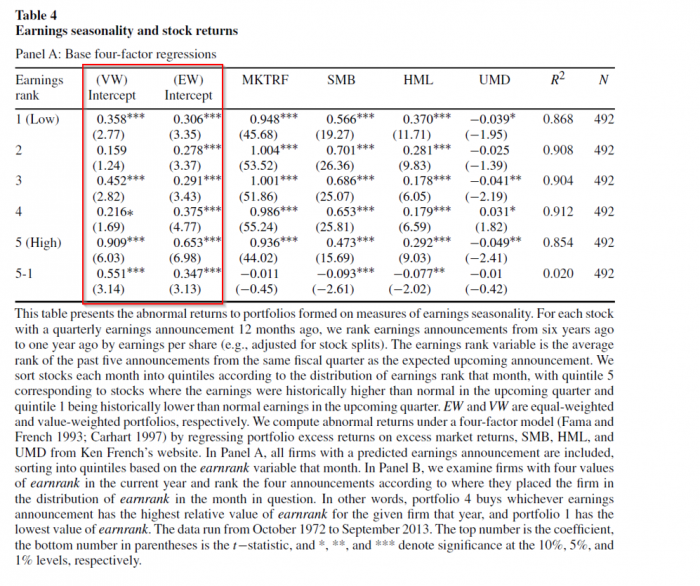

- YES. Using an equal weighting scheme, the excess return spread between the highest quintile when ranked on earnings seasonality (“earnrank”) was 34bps per month, larger than that of the lowest seasonality quintile, with a t-stat equal to 3.13. The low seasonality portfolio returned an excess of 31bps, equally weighted, with a t-stat equal to 3.35, when risk-adjusted. The high seasonality portfolio returned an excess 65bps with a t-stat equal to 6.98, over the four-factor model. When excess returns were value-weighted the excess return spread surprisingly increased to 55bps. Excess returns were calculated using the four-factor Fama-French/Carhart model. All results were significant at the 1% level.(1)

- YES. Controlling for risk and stock-specific news, higher returns occur during periods when stock are expected to exhibit larger earnings due to seasonal effects. Although analysts do take seasonality into account, a complete correction of the seasonality in earnings forecast is not made.On average, analysts forecast 93% of the seasonal change in earnings correctly, missing 7%.In addition: The seasonal effect is larger when earnings are lower in the three most recent periods (3, 6 and 9 months prior) than they are in the prior 12 months. If earnings are lower in the prior 12 months there is no difference in returns.

- NO. Although risk adjustments were made, it is still possible that sorting on earnings seasonality the results may be a function of other variables or anomalies associated with the seasonal excess returns. No empirical support was found for competing explanations including the following: Increases in trading volume and firm-specific risk; Time-varying factor exposures; Earnings management and other accounting variables; and other measures of earnings seasonality.

Why does it matter?

This study is interesting because it moves forward the discussion about behavioral biases that are tied to investor underreaction that ultimately impacts rational pricing. The evidence presented here supports the idea that investors focus on recent earnings events instead of paying adequate attention to predictable, long-term patterns in earnings.

What is the most important chart in the paper?

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

We present evidence consistent with markets failing to properly price information in seasonal earnings patterns. Firms with historically larger earnings in one quarter of the year (“positive seasonality quarters”) have higher returns when those earnings are usually announced. Analysts have more positive forecast errors in positive seasonality quarters, consistent with the returns being driven by mistaken earnings estimates. We show that investors appear to overweight recent lower earnings following positive seasonality quarters, leading to pessimistic forecasts in the subsequent positive seasonality quarter. The returns are not explained by risk-based explanations, firm-specific information, increased volume, or idiosyncratic volatility.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.