Do short sellers exploit industry information?

- Zsuzsa R. Huszár, Ruth S.K. Tan, Weina Zhang

- Journal of Empirical Finance

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

- Does the industry concentration exhibited in short sellers’ holdings convey new material information about the industry?

- Are the excess returns obtained from industry shorting combined with firm-specific shorting strategies explained by risk?

- Is the industry shorting signal correlated with economic trends in the associated industry?

What are the Academic Insights?

- YES. The results reported here are consistent with previous studies. Heavily shorted industries consist of larger stocks with low transactions costs and larger book-to-market ratios with higher dispersion. Short sellers also focus on industries that are less concentrated with fewer dominant firms, but firms with greater informational complexity.

- NO. After adjusting for Fama-French risk factors, highly shorted stocks in industries that are also highly shorted in the aggregate, return 1.535% lower excess returns when compared to other highly shorted stocks. The largest excess returns, 6.745% over the following six months, were found in long positions in lightly shorted stocks were combined with short positions in highly shorted stocks that also exhibit the highest industry aggregated level of short sellers.

- YES. The “aggregated industry shorted value” is correlated with future changes in two economic variables: the value-weighted average sales and firm concentration for an industry. The industry measure predicts significant reductions in sales and increases in competition over the future one year period. The authors conclude that aggregate short selling produces economic and market efficiency at the industry level.

The authors conduct robustness tests to eliminate competing explanations or influences including removing stocks with extreme values, testing the sorting methods to construct long-short positions, and utilizing equal-weighting schemes.

Why does it matter?

It is well known that short sellers target different industries at different times. What is not known is why short sellers tend to herd into specific industries when their information advantage is thought to be at the firm-specific level. This study provides support that the concentration of short sellers within an industry conveys significant information about fundamental and ongoing changes within an industry.

The authors construct an industry measure of short selling, the “aggregate industry shorted value,” and report findings about industry concentration that are valuable to investors, traders and regulators. The industry measure reflects the concentration of informed short sellers within an industry by capturing the capital at risk of short sellers. The shorted value of each stock plus the number of stocks shorted in the industry is included in the calculation and is shown to accurately reflect ongoing, pivotal changes in the industry. This new variable is in contrast to the short interest measure traditionally used to capture the informational advantage of short sellers.

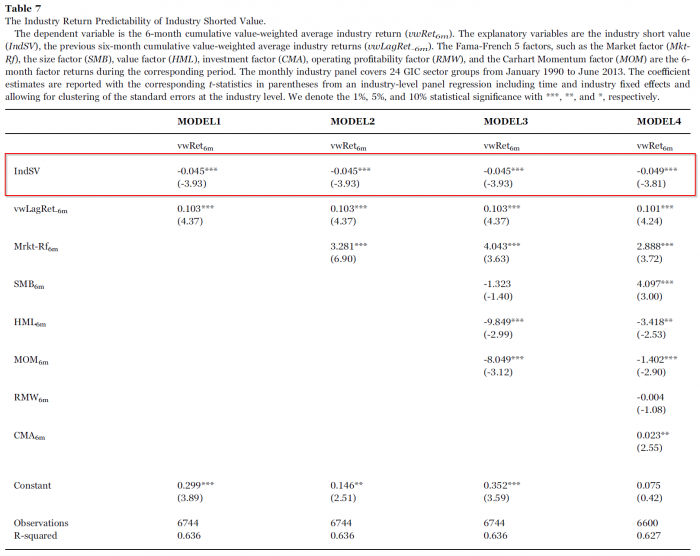

The most important chart from the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

This study provides new evidence about short sellers’ trading strategies by showing that short sellers exploit firm information in combination with industry information in their trades. In industries with the highest aggregate shorted values, the most-shorted stocks earn about 1.535% lower abnormal returns than other highly shorted stocks in less shorted industries over the next six months. These results are likely driven by short sellers’ preference for complex industries with the highest profit potential. We also show that the aggregate shorted value at the industry level is able to predict important industry shifts, such as declines in sales and increased competition. Overall, our results suggest that short sellers help to reduce information complexity and improve economic efficiency at the industry level.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.