Evaluating Multi-Asset Strategies

- K. Stuart Peskin

- Journal of Portfolio Management, special issue

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the research questions?

- Is there ‘ONE’ correct way to evaluate multi-asset strategies?

- Which are the most appropriate metrics to evaluate multi-asset strategies?

What are the Academic Insights?

By using a case-study approach, the author suggests the following:

- NO- There is no ‘ONE’ correct way to evaluate the performance of a multi-asset portfolio. A range of measures is preferred. And by the way, correlation can be a misleading metric, if viewed in isolation.

- The author proposes different metrics based on both historical and predictive techniques.

HISTORICAL:

- Tail behavior to provide critical information of the strategy results during period of market turbulence ( including a comparison to what correlations would have predicted)

- Upside versus downside participation to observe the degree of market capture

- Attribution by asset class, for example, how much of the return was captured by equities

PREDICTIVE:

- Risk modeling, for instance by using an APT risk model (intro to these models here)

- Ex-ante tail behavior, the evaluation of portfolio under never-seen-before turbulence

Why does it matter?

This case study is a nice example of a complementary analysis to better understand multi-asset strategy and their potential role in a portfolio.

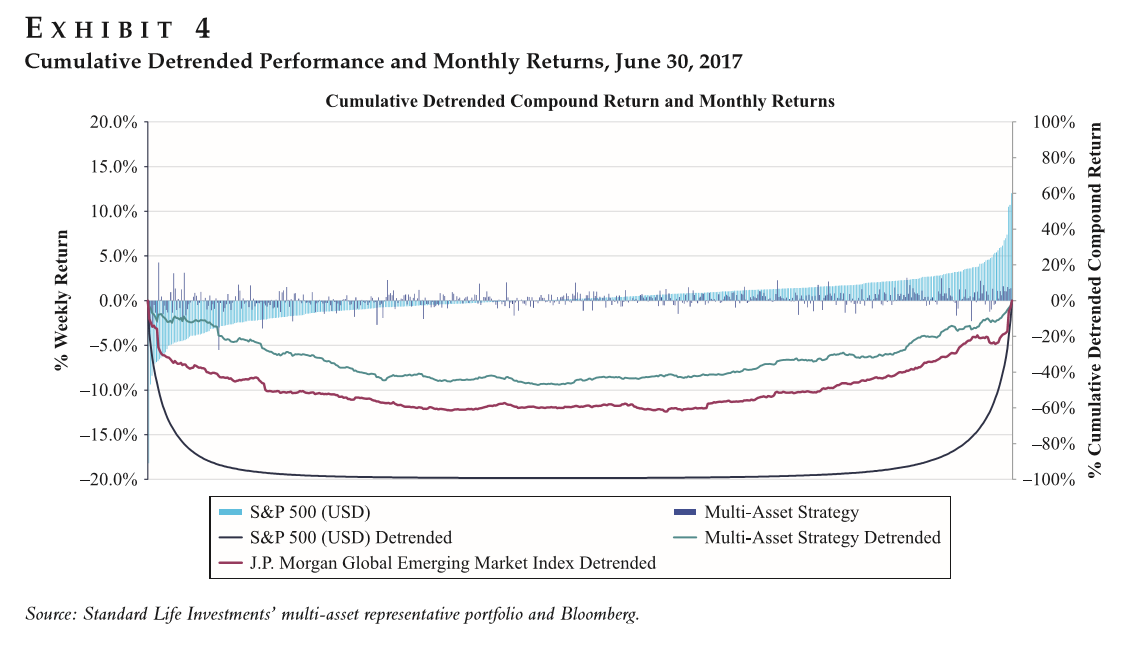

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

An increasing number of investors are recognizing the many benefits of a multi-asset approach, including the potential for improved diversity, greater liquidity, and reduced volatility. Also advantageous is their ability to fit readily alongside a variety of investment approaches and asset class categories. That said, multi-asset strategies come with challenges. This article addresses a particularly problematic area—how to evaluate multi-asset strategy outcomes. Relying on only one or two measures for evaluation can lead to misinterpretation of the historical investment results achieved. Instead, the author advises using a variety of evaluation techniques. One of these—correlation—is discussed in depth, because the author believes it is misunderstood in many dimensions of multi-asset investing. The author also examines some of the more useful performance and risk analytics, both historical and predictive, that can help to understand what drives multi-asset investment outcomes.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.