The oversight role of regulators: evidence from SEC comment letters in the IPO process

- Bing Li and Zhenbin Liu

- Review of Accounting Studies

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

- Do firms engaged in the IPO process, that also receive CLs (vs. IPOs that do not receive CLs), revise their final offering prices one way or the other during the waiting period?

- Does the receipt of SEC CLs increase the likelihood that the firm will reduce it’s offer price?

- Is there a relationship between the number of CLs issued and the frequency of changes in the IPO disclosures, during the waiting period?

What are the Academic Insights?

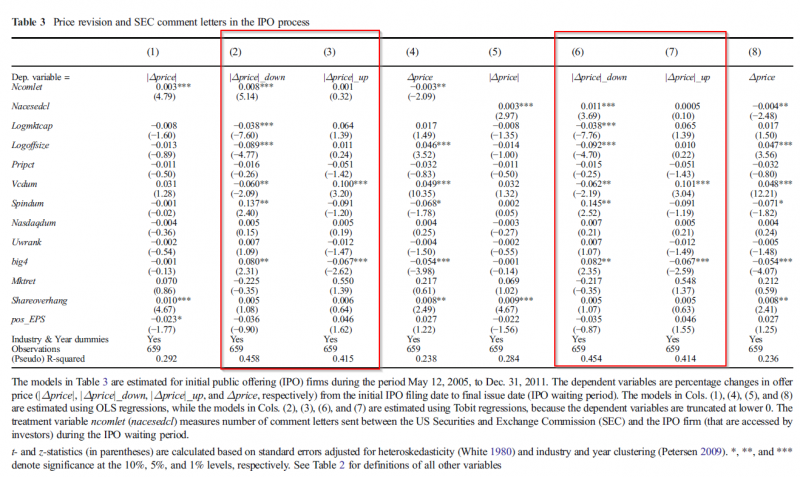

- YES. IPOs (S-1 and SB-2 filings) with available price data between May 2005 and December 2011 are more likely to make revisions in prices if they have received comment letters. We know from practical experience and from previously published research that IPOs tend to provide imprecise disclosures in order to keep proprietary information from competitors and reduce other agency costs. Combined with that research, the results presented here are consistent with the idea that SEC Comment Letters have an impact on the information asymmetry associated with initial offerings, thereby lessening corporate “hyping” that may occur during the IPO waiting period.

- YES. There is a negative and significant relationship between the sign of the price change and the receipt of Comment Letters. This result is consistent with the idea that new issuers have strong economic incentives to overestimate the selling price in the offer. The registration statement provides an opportunity for issuers to “manipulate” the information found in the filings. The SEC CLs in turn, provide a mitigating influence on the disclosures in the filing with an eye towards suppressing the incentive to hype the offering. The authors propose that the CLs in effect, lead to downward pressure on investor demand for the offering which in turn, leads the issuer to reduce the offer price.

- YES. Using a definition of “hyping” published previously, the authors equate the number of changes in disclosures to incentives to hype the offering price and calculate that value within a six month period around the offering. It appears that there is a more pronounced impact in decreasing the offer price with greater incentives to hype (i.e. more frequent changes in disclosures).

Why does it matter?

The authors conclude that the SEC’s role in oversight of the IPO process is an effective mechanism that reduces the over-hyping of the offering price set by issuers. If CLs are the mechanism, then mispricing at the final offer by issuers with more CLs should be no more or less than those with fewer CLs. However, the authors report that issuers with more CLs actually outperform those with fewer, over the long term. ONE CAVEAT: Perhaps that outperformance is more a result of an inordinate amount of negativity in the disclosures required by the CLs.

The most important chart from the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

This study investigates how regulatory oversight affects the price formation of initial public offerings (IPOs). We provide evidence on the oversight role of the US Securities and Exchange Commission (SEC) by examining the effects of comment letters issued by the SEC in the process through which companies are initially listed. We find that IPO issuers reduce their offer price if they receive comment letters. The reduction in price from the IPO filing date to the final issue date is greater when the IPO firm has more correspondence with the SEC. The pricing impact of SEC comment letters is more pronounced for IPO issuers with greater hyping incentives. Moreover, we find that IPO firms that receive more comment letters have similar levels of underpricing and outperform over the long run after the issue date, compared with IPOs with fewer comment letters.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.