Financial Literacy and Portfolio Dynamics

- Milo Bianchi

- Journal of Finance, forthcoming

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the research questions?

They ask the following research questions:

- How does financial literacy relate to portfolio return?

- How does financial literacy relate to portfolio rebalancing choices?

What are the Academic Insights?

The following insights are derived from the study:

- Controlling for various measures of portfolio risk, more literate households in the sample experience approximately 0.4% higher yearly returns compared to the least literate.

- In terms of the relationship between financial literacy and portfolio choices, there are three main findings:

- The first result is that more financial literate households do not always take more risk but their risk exposures vary with market regimes ( for example, a 1% increase in the expected excess return of risky assets is associated with a 2% increase in the risky share for each unit of financial literacy).

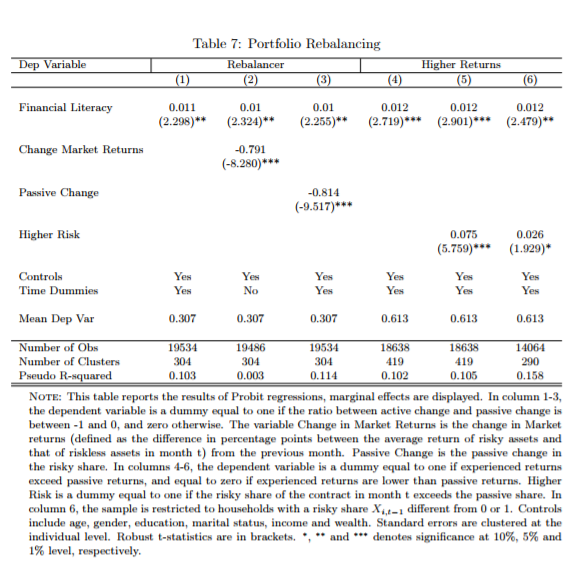

- The second result is that the least financial literate households passive rebalancing (based on market moves) is more important (64% of the total change in the risky share) compared to active rebalancing. Differently, for the most literate households passive rebalancing accounts for only 30%.

- The third result is that more literate households are more likely to act as contrarians (they tend to move allocations to funds that experienced lower returns in the past).

Why does it matter?

Another important study, which uncovers novel mechanisms that relate financial literacy to portfolio management dynamics and outcomes.

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

We match administrative panel data on portfolio choices with survey measures of financial literacy. When we control for portfolio risk, the most literate households experience 0.4% higher annual returns than the least literate households. Distinct portfolio dynamics are the key determinant of this difference. More literate households hold riskier positions when expected returns are higher, they more actively rebalance their portfolios and do so in a way that holds their risk exposure relatively constant over time, and they are more likely to buy assets that provide higher returns than the assets that they sell.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.