The Impact of Market Conditions on Active Equity Management

- Harsh Parikh, Karen McQuiston, and Sujian Zhi

- Journal of Portfolio Management

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

Using eVestment, a source of data for asset managers, the authors evaluate U.S. fundamental and quantitative managers, specifically core, growth and value styles. Eighteen strategy types (six in each style) were identified and results calculated using averages for the median manager over the period including January 1996 to December 2016.

- Is the observed deterioration in excess returns for active managers, over the period studied, cyclical or structural in nature?

- Are market conditions (volatility, dispersion and level of market returns) important for active equity managers to succeed?

- Is there evidence that performance varies with the level of correlation between security returns?

What are the Academic Insights?

- BOTH. The authors observe and discuss cyclical factors related to the decline in manager returns.: volatility, dispersion and level of market performance. This focus on cyclical issues provides a useful context for investors (and managers) to better understand the relative significance of changing market conditions on investment performance. However, other structural issues are discussed that have raised the bar for active managers, including the impact of improved accessibility to information, advances in data processing and dissemination, increased transparency, and the effects of large scale trend- investing, ETFs, and the trend towards self-management.

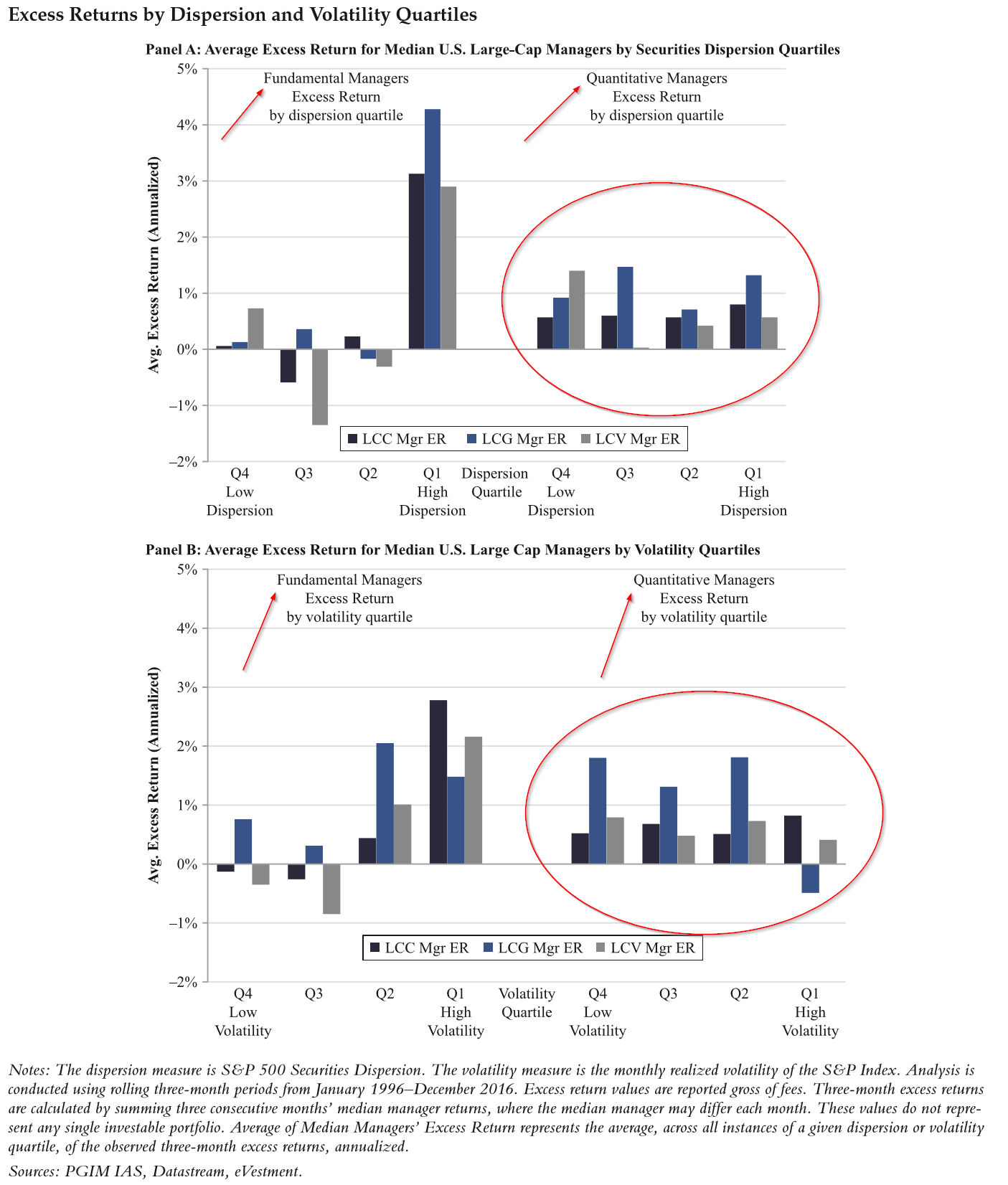

- YES. All three cyclical factors including volatility, dispersion and level of market performance differentially affect the performance of quantitative vs. fundamental managers. Although returns have been generally disappointing, there is a strong and clear inverse relationship between the performance of active managers and the level of market performance. In Q1 high markets, the average excess return was very low or negative. In Q4 lowest markets, the average excess returns were the highest. Quantitative managers were less sensitive to the level of market returns than fundamental managers. This was also true for varying conditions of dispersion and volatility. Quant managers were neutral to dispersion and only somewhat sensitive to volatility. Fundamental managers exhibited a starkly different profile to these two factors: in high dispersion and high volatility fundamental managers displayed a significant increase in average excess returns. In low dispersion and low volatility conditions, they displayed very low to negative results.

- YES, but only for quantitative managers. Their excess returns have a distinct inverse relationship to correlations among securities. Quant managers do especially well when correlations are low. There was no relationship observed for fundamental managers.

One or two caveats: The data is self-reported and may not cover the universe of U.S. managers. Returns are calculated gross of fees and calculated using rolling 3-month median manager returns as opposed to individual managers.

Why does it matter?

Although high excess returns are generally achieved by high active risk/fundamental managers only during low return scenarios, we have not seen those conditions for a number of years. However, market conditions may eventually cycle into a scenarios conducive to the fundamental approach and such an orientation would be advantageous positioning for the investor. However, the high level of consistency exhibited by quantitative managers across market conditions suggests that a combination of quantitative strategies across style should be the optimal approach given that market conditions are notoriously difficult, if not impossible, to predict.

The most important chart from the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

Since the financial crisis, investors have enjoyed generally benign conditions, with subdued volatility and strong markets-but active equity managers have remained under pressure. Yet this should not be surprising; history has shown a strong pattern of counter-cyclicality in manager excess returns relative to the equity market. In this study, the authors take a close look at the relationship between equity market conditions (defined by market returns, volatility, and dispersion) and active equity manager results. Focusing on the U.S. large cap space, they analyze over 20 years of manager and market data to determine which set of conditions are associated with more or less favorable results for active equity managers.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.