When Diversification Fails

- Sebastien Page and Robert Panariello

- Financial Analyst Journal, forthcoming

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The paper investigates the following research question:

- Are left-tail vs. right-tail correlations symmetric for the majority of risky assets (including size and styles)?

- Is left-tail vs. right-tail correlations between stocks and hedge funds styles symmetric?

- Is left-tail vs. right-tail correlations between stocks and private assets (direct real estate and private equity) symmetric?

- Is left-tail vs. right-tail correlations between stocks and risk premia symmetric?

What are the Academic Insights?

By analyzing a number of asset classes, style and risk premia, the authors find the following:

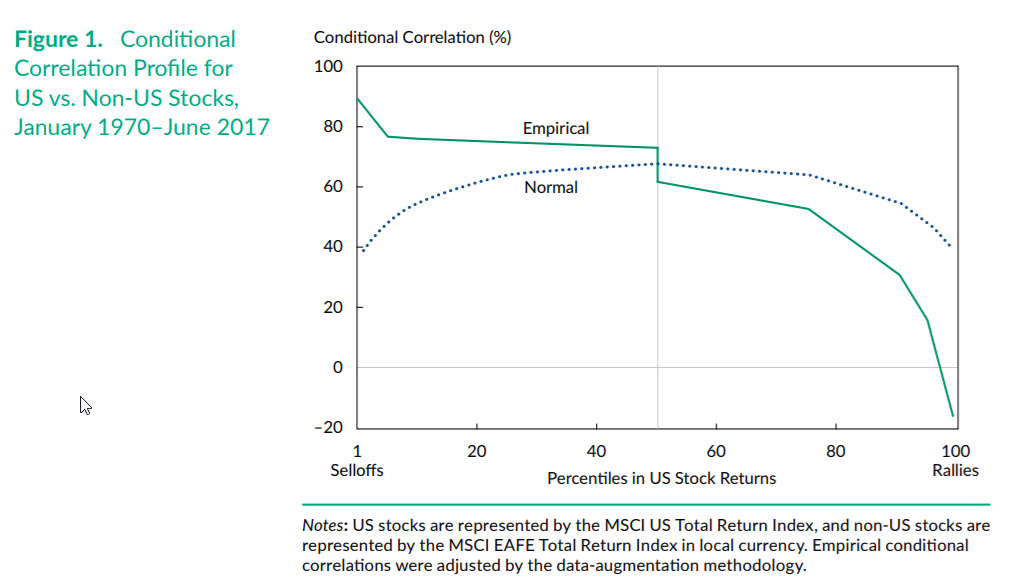

- NO-Across the board, left-tail correlations are much higher than right-tail correlations. Diversification fails across styles, sizes, geographies, and alternative assets. Essentially, all the return-seeking building blocks that asset allocators typically use for portfolio construction are affected.

- NO- All the styles, including the market-neutral funds, exhibit significantly higher left-tail than right-tail correlations.

- NO- Across the board, left-tail correlations are much higher than right-tail correlations (in particular, when looking at rolling annual data to correct for the smoothing bias).

- YES- Results show that several risk factors appear to be more immune to the failure of diversification than are other asset classes. It is important to point out that factors deliver better diversification than traditional asset classes simply because they allow short positions and often encompass a broader universe of assets.

Why does it matter?

This study is an important reminder that full-sample correlations are misleading. The authors propose a robust approach to measure left- and right-tail correlations, and document the extent of the failure of diversification on a large dataset of asset classes and risk factors. The good news is that tail risk–aware analytics, as well as hedging and dynamic strategies, are now widely available. To enhance risk management beyond naive diversification, investors should reoptimize portfolios with a focus on downside risk, consider dynamic strategies, and depending on aversion to losses, evaluate the value of downside protection as an alternative to asset class diversification.

The Most Important Chart from the Paper:

Abstract

One of the most vexing problems in investment management is that diversification seems to disappear when investors need it the most. We surmise that many investors still do not fully appreciate the impact of extreme correlations on portfolio efficiency—in particular, on exposure to loss. We take an in-depth look at what drives the stock-to-credit, stock-to–hedge fund, stock-to–private asset, stock-to–risk factors, and stock-to-bond correlations during tail events. We introduce a data-augmentation technique to improve the robustness of tail correlation estimates. Finally, we discuss implications for multi-asset investing.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.